Get the free FCPA Prevention of Bribery Policy - Colliers Benefits

Show details

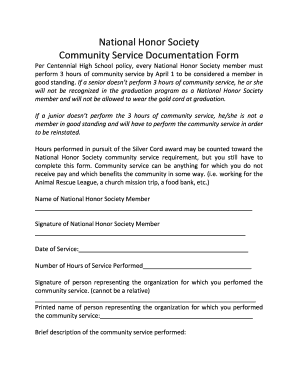

CPA Prevention of Bribery Policy Colliers International (the Company) and its employees, independent contractors and agents (Supervised Person) are required to comply with all applicable antibribery

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fcpa prevention of bribery

Edit your fcpa prevention of bribery form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fcpa prevention of bribery form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fcpa prevention of bribery online

Follow the steps down below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit fcpa prevention of bribery. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fcpa prevention of bribery

How to fill out FCPA prevention of bribery:

01

Understand the FCPA regulations: Familiarize yourself with the Foreign Corrupt Practices Act (FCPA) and its provisions to ensure that you grasp the requirements for preventing bribery.

02

Implement a comprehensive anti-bribery policy: Develop and implement a clear and detailed anti-bribery policy that addresses the specific risks faced by your organization. The policy should cover both domestic and international operations.

03

Conduct risk assessments: Identify potential areas where bribery may occur within your organization or during business dealings with third parties. Assess the level of risk associated with each area and prioritize your prevention efforts accordingly.

04

Establish internal controls and procedures: Implement effective internal controls and procedures to minimize the risk of bribery. This may include implementing strong financial controls, conducting due diligence on business partners, and implementing monitoring systems.

05

Provide training and communication: Educate employees and key stakeholders about the FCPA, your anti-bribery policy, and their roles and responsibilities in preventing bribery. Regularly communicate updates and reinforce the importance of adherence to anti-bribery measures.

06

Conduct due diligence: Thoroughly screen and assess potential business partners, vendors, and agents to ensure they have a reputation for integrity and compliance with anti-bribery laws.

07

Maintain accurate records: Keep clear and accurate records of all transactions, payments, and interactions related to business dealings. These records can serve as evidence of compliance and help in detecting and investigating any potential bribery incidents.

08

Monitor and audit: Continuously monitor and audit your anti-bribery program to identify any weaknesses or areas for improvement. Regularly review and assess the effectiveness of your prevention efforts and adjust as needed.

09

Encourage reporting and establish a whistleblower hotline: Create a culture that encourages employees to report any suspected violations or unethical behavior. Establish a confidential whistleblower hotline or other mechanisms to facilitate the reporting of potential bribery incidents.

10

Seek legal advice if needed: If you have concerns or questions about filling out the FCPA prevention of bribery or need legal advice specifically tailored to your organization, consult with legal professionals who specialize in anti-corruption compliance.

Who needs FCPA prevention of bribery?

01

Organizations with international operations: Companies that engage in international business transactions, especially those operating in countries with a higher risk of corruption, need to ensure compliance with the FCPA.

02

Executives and management teams: Leaders within organizations need to understand the FCPA requirements to establish a culture of compliance and ensure that anti-bribery policies are properly implemented and followed.

03

Employees involved in international business dealings: Individuals responsible for negotiating contracts, interacting with foreign officials, or handling financial transactions should be well-versed in FCPA prevention of bribery to mitigate compliance risks.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is fcpa prevention of bribery?

FCPA (Foreign Corrupt Practices Act) prevention of bribery is a set of regulations designed to prohibit the bribery of foreign officials by companies and individuals under the jurisdiction of the United States.

Who is required to file fcpa prevention of bribery?

Any company or individual that falls under the jurisdiction of the United States and conducts business internationally is required to file FCPA prevention of bribery.

How to fill out fcpa prevention of bribery?

FCPA prevention of bribery filings can be completed online through the designated government portal. The form requires detailed information about the nature of the transaction, parties involved, and compliance measures in place.

What is the purpose of fcpa prevention of bribery?

The purpose of FCPA prevention of bribery is to promote transparency, integrity, and fair competition in international business transactions by prohibiting bribery of foreign officials.

What information must be reported on fcpa prevention of bribery?

Information such as the date and parties involved in the transaction, the amount of payment or benefit exchanged, and any compliance measures in place must be reported on FCPA prevention of bribery.

How can I send fcpa prevention of bribery to be eSigned by others?

fcpa prevention of bribery is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I sign the fcpa prevention of bribery electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your fcpa prevention of bribery in seconds.

Can I create an eSignature for the fcpa prevention of bribery in Gmail?

Create your eSignature using pdfFiller and then eSign your fcpa prevention of bribery immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

Fill out your fcpa prevention of bribery online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fcpa Prevention Of Bribery is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.