Get the free TaxRelief - Country: Denmark

Show details

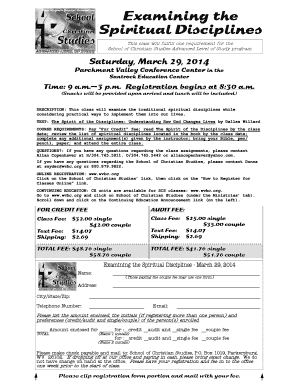

This document provides information regarding tax refunds related to the dividends for Danisco A/S and outlines the necessary documentation for participants to claim the refunds based on eligibility.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign taxrelief - country denmark

Edit your taxrelief - country denmark form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your taxrelief - country denmark form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit taxrelief - country denmark online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit taxrelief - country denmark. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out taxrelief - country denmark

How to fill out TaxRelief - Country: Denmark

01

Gather your necessary tax documents, including income statements and deduction records.

02

Visit the official website of the Danish tax authority (SKAT).

03

Log in to your tax account using your NemID or another identification method.

04

Navigate to the Tax Relief application section.

05

Fill out the required forms accurately, providing details of your income and any applicable deductions.

06

Double-check all entered information for accuracy before submitting the forms.

07

Submit the application electronically through the SKAT portal.

Who needs TaxRelief - Country: Denmark?

01

Danish residents who have incurred expenses that may qualify for tax deductions.

02

Individuals who have experienced significant life changes affecting their income or tax situation.

03

Self-employed individuals seeking to reduce their taxable income through allowable deductions.

04

Anyone who has paid substantial medical or educational expenses during the tax year.

Fill

form

: Try Risk Free

People Also Ask about

Is there an exit tax for 7 years in Denmark?

Shares that you can sell tax-free must also be included. These rules normally only apply if you have been liable to pay tax in Denmark on capital gains on shares for a total of minimum seven years before leaving Denmark or if you were subrogated to the transferor's tax position when you acquired the shares.

What is the Denmark expat tax scheme 2026?

From the 1st of January 2026, the Danish Expat Tax Regime will become even more accessible, with the minimum salary threshold dropping to DKK 60,100. This change opens up the scheme to a broader pool of talent and gives businesses a valuable tool for global recruitment.

What is the tax break for expats in Denmark?

Special expatriate scheme According to the special expatriate tax regime, expatriates who are employed in Denmark and scientists assigned to Denmark may be able to apply for a flat tax rate of 27% on their gross salary for up to 84 months.

What are the tax advantages of Denmark?

Key advantages of Danish corporate taxation rules: Corporate tax is 22 %. Special expat tax scheme of 27% for key employees and researchers. Expats living and working in Denmark also benefit from the Danish welfare system. No capital duty, share transfer duty or wealth taxes.

What is the most tax-friendly country for expats?

Key Features of Tax-Friendly Countries: Panama: No Tax on Foreign Income. Key Facts: Portugal: Attractive NHR Tax Program. Costa Rica: Low Taxes and Affordable Living. Thailand: Expat-Friendly Tax Policies. Malaysia: No Tax on Foreign Pensions. Mexico: Tax Benefits and Proximity to the US. Belize: Simple Tax System for Expats.

What is the expat tax relief in Denmark?

Special expatriate scheme According to the special expatriate tax regime, expatriates who are employed in Denmark and scientists assigned to Denmark may be able to apply for a flat tax rate of 27% on their gross salary for up to 84 months.

What is the 27 rule in Denmark?

Denmark offers a special tax regime to highly paid inbound expatriates and researchers recruited from abroad. Employees may elect to be taxed at a rate of 27 % on employment income and other cash allowances, for up to 84 months.

How much tax do you get back in Denmark?

If you have purchased goods in Denmark before arriving at Copenhagen Airport, you can get a VAT refund of between 10% and 19% of the total price of the goods, depending on how much you have spent on the goods and the VAT refund operator.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is TaxRelief - Country: Denmark?

TaxRelief in Denmark refers to various tax deductions and credits available to taxpayers, aimed at reducing the overall tax burden.

Who is required to file TaxRelief - Country: Denmark?

Individuals in Denmark who have incurred deductible expenses or are eligible for tax credits are required to file for TaxRelief.

How to fill out TaxRelief - Country: Denmark?

To fill out TaxRelief in Denmark, taxpayers must complete the relevant forms provided by the Danish Tax Agency, including details of deductions or credits claimed.

What is the purpose of TaxRelief - Country: Denmark?

The purpose of TaxRelief in Denmark is to provide financial support to taxpayers by reducing their taxable income and providing incentives for certain expenditures.

What information must be reported on TaxRelief - Country: Denmark?

Taxpayers must report information regarding their eligible expenses, income sources, and any other relevant financial data that supports their claim for tax relief.

Fill out your taxrelief - country denmark online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Taxrelief - Country Denmark is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.