Get the free Deed of Indemnity

Show details

This document serves as a Deed of Indemnity from a company to AXIS Bank regarding the provision of mobile banking facilities and the responsibilities associated with SMS alerts sent to authorized

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign deed of indemnity

Edit your deed of indemnity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your deed of indemnity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing deed of indemnity online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit deed of indemnity. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

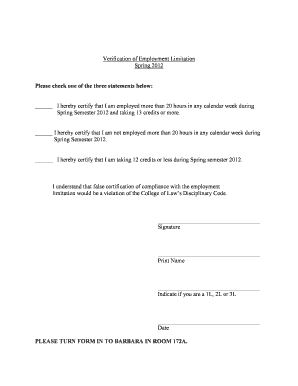

How to fill out deed of indemnity

How to fill out Deed of Indemnity

01

Begin by downloading the Deed of Indemnity form from a trusted legal resource or obtain a physical copy from a lawyer.

02

Fill in the date at the top of the document.

03

Identify the parties involved in the indemnity: the indemnitor (the party providing the indemnity) and the indemnitee (the party receiving the indemnity).

04

Clearly outline the circumstances under which the indemnity applies, detailing any specific events or situations.

05

Specify the scope of the indemnity, including what liabilities or claims are covered.

06

Include any necessary definitions and terms that clarify the agreement between the parties.

07

Have both parties review the document and agree on the terms, making any necessary amendments.

08

Obtain signatures from both parties, ensuring that the document is dated.

09

Consider having the document notarized to add an extra layer of validity.

10

Keep a copy of the signed Deed of Indemnity for your records.

Who needs Deed of Indemnity?

01

Individuals or businesses that require protection against potential legal claims or liabilities related to specific actions or events.

02

Contractors needing to protect themselves from third-party claims when working with clients.

03

Companies entering joint ventures that need assurance against risks associated with collaboration.

04

Landlords and property owners wanting to safeguard against tenant-related disputes.

05

Professionals in fields like finance or real estate who may face indemnity needs during transactions.

Fill

form

: Try Risk Free

People Also Ask about

What is the purpose of an indemnity?

Indemnity insurance compensates the beneficiaries of the policies for their actual economic losses, up to the limiting amount of the insurance policy. It generally requires the insured to prove the amount of its loss before it can recover.

What is the meaning of deed of guarantee and indemnity?

The Deed of Guarantee and Indemnity that Party B has signed means that Party B has agreed to ensure Party A repays the loan, or otherwise Party B will be responsible for it and any incidental costs associated with Party A breaching its obligations. Needless to say, Party A defaults on the loan repayments.

What is the purpose of an indemnity agreement?

Indemnity agreements, also known as indemnity clauses, play an integral role in contracts. That's because they are designed to punish the nonperforming party and reassure the damaged one they will be reimbursed for losses caused by the errant entity.

How to fill a deed of indemnity?

The Indemnity Bond is to be signed by Magistrate/Notary and affixed with stamp. Whereas Shri/Smt………………………………………….. (Name of surety) son/daughter/wife of Shri…………………….…………….. resident of ……………………………………………………

What is the purpose of the deed of indemnity?

An indemnity deed is a type of agreement, which can be used in lieu of the sale or exchange of property. The deed makes the grantor liable for any damages caused by certain types of accidents on the property. This deed will also protect someone who might buy it from some liability.

What is the meaning of indemnity in property?

Indemnity refers to a legal principle where one party agrees to compensate another for the loss or damage incurred due to actions, inactions, or incidents related to a property transaction or ownership.

What is the meaning of deed of indemnity?

A deed of indemnity is a legal agreement between a company and its directors, ensuring the company covers certain costs and liabilities the directors may incur while performing their duties.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Deed of Indemnity?

A Deed of Indemnity is a legal document that provides a guarantee that one party will compensate another for certain damages or losses that may arise from a specific situation or transaction.

Who is required to file Deed of Indemnity?

Typically, parties that are entering into a contract or agreement, where one party wishes to protect themselves from potential liabilities or claims from the other party, are required to file a Deed of Indemnity.

How to fill out Deed of Indemnity?

To fill out a Deed of Indemnity, the parties involved should provide their names and addresses, detail the circumstances requiring indemnity, specify the extent of indemnity, and include any conditions or limitations. It should be signed and dated by the parties.

What is the purpose of Deed of Indemnity?

The purpose of a Deed of Indemnity is to protect one party from financial loss or legal liability that may arise due to the actions of another party or due to specific risks associated with a transaction.

What information must be reported on Deed of Indemnity?

The Deed of Indemnity must include the names of the indemnifier and indemnity holder, the nature of the liability being indemnified, a description of the events that may trigger indemnity, and any limitations or conditions on the indemnity.

Fill out your deed of indemnity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deed Of Indemnity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.