Get the free IRA LLC VALUATION

Show details

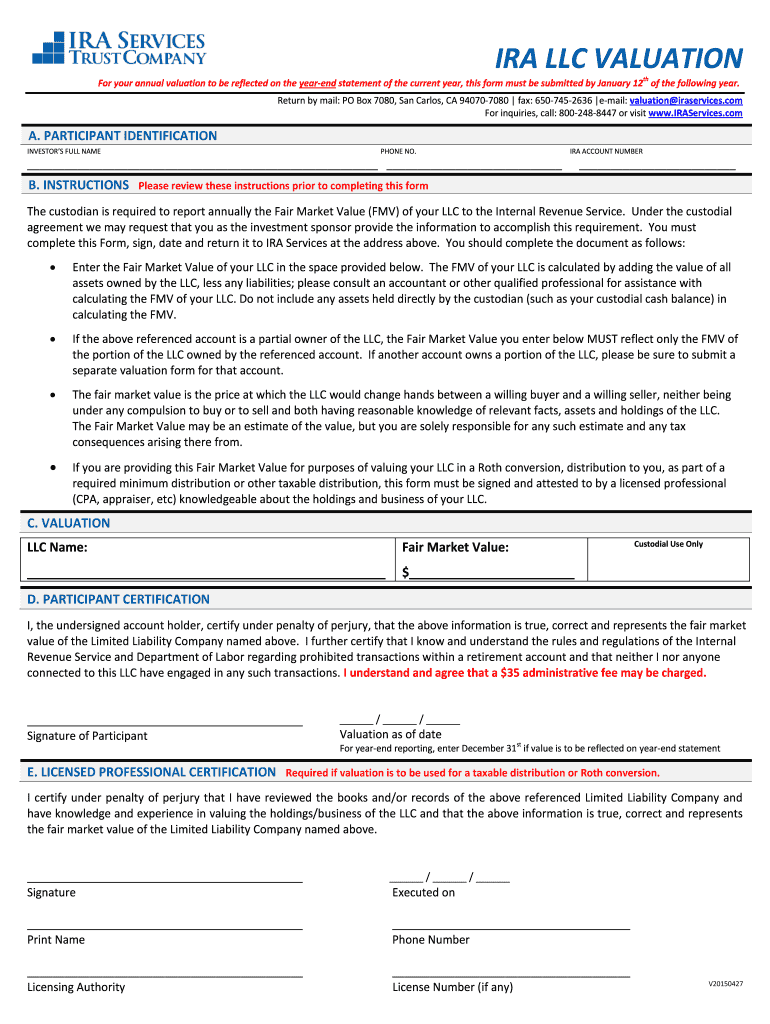

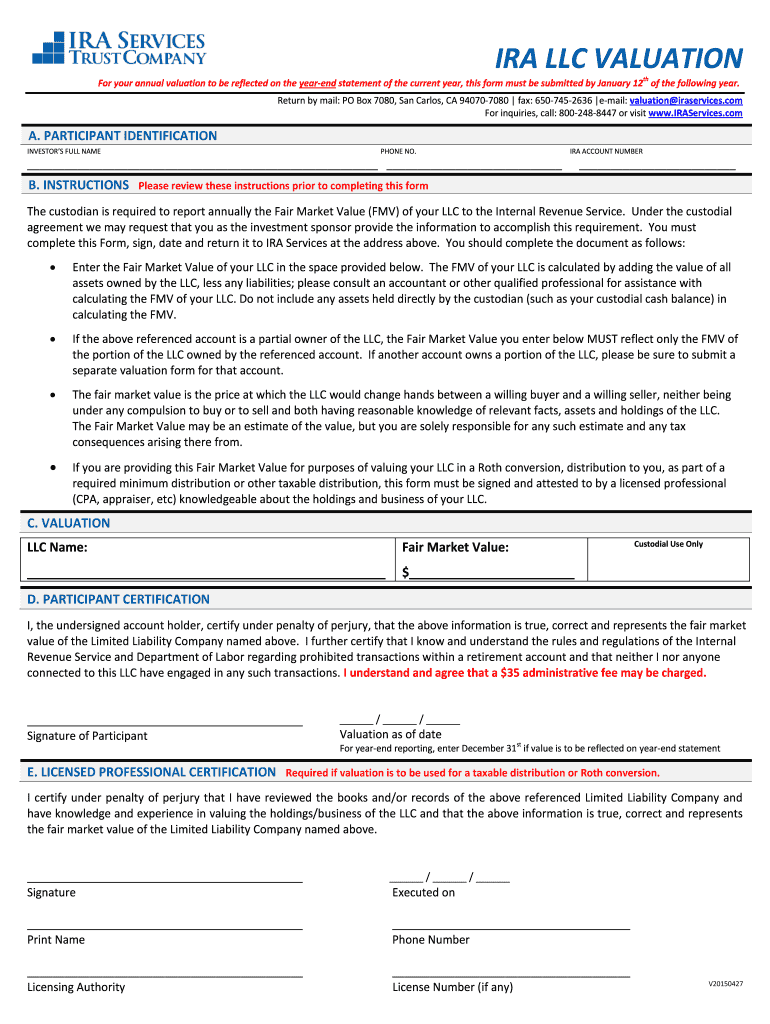

IRA LLC VALUATION For your annual valuation to be reflected on the yearend statement of the current year, this form must be submitted by January 12th of the following year. Return by mail: PO Box

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ira llc valuation

Edit your ira llc valuation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ira llc valuation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ira llc valuation online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ira llc valuation. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ira llc valuation

How to fill out IRA LLC Valuation:

01

Start by gathering all relevant financial information related to your IRA LLC. This includes details of any assets owned by the LLC, such as real estate properties, stocks, bonds, or any other investment holdings.

02

Determine the fair market value of these assets. This can be done by obtaining professional appraisals or using reputable market sources to estimate the value.

03

Calculate the percentage of ownership for each member of the LLC. This is important in determining the individual's share of the valuation.

04

Use the fair market value of the assets and the ownership percentages to calculate the overall value of the IRA LLC. This can be done by multiplying the asset value by the ownership percentage for each member and then summing up the values.

05

Ensure that the valuation process complies with the guidelines set by the IRS. It is important to follow the rules and regulations to avoid any penalties or audits.

Who needs IRA LLC Valuation:

01

Individuals who have a self-directed IRA and have invested in an LLC. These individuals may need to provide a valuation of their IRA LLC for various reasons such as tax reporting or asset allocation.

02

Individuals considering converting their traditional IRA or 401(k) into a self-directed IRA LLC. It is important to have a proper valuation in order to accurately transfer the funds and assets into the LLC.

03

Those who plan to distribute or transfer assets from their IRA LLC to the IRA account owner or any other beneficiary. A valuation may be required to determine the fair market value of the assets being distributed.

04

Individuals seeking to comply with IRS reporting requirements for their IRA LLC. Certain forms, such as the Form 5500-EZ, may require a valuation of the IRA LLC.

05

Investors who are considering the sale or purchase of a portion or the entire IRA LLC. Having a valuation can help in negotiating a fair price for the transaction and ensuring accurate financial decision-making.

It is always recommended to consult with a financial advisor or tax professional to ensure that the IRA LLC valuation is done correctly and in accordance with the applicable rules and regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my ira llc valuation in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your ira llc valuation and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I send ira llc valuation for eSignature?

When you're ready to share your ira llc valuation, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I edit ira llc valuation straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing ira llc valuation, you need to install and log in to the app.

What is ira llc valuation?

IRA LLC valuation is the process of determining the value of assets held within a self-directed IRA that is structured as a limited liability company.

Who is required to file ira llc valuation?

The owner of the self-directed IRA structured as a LLC is required to file the valuation.

How to fill out ira llc valuation?

IRA LLC valuation can be filled out by gathering all necessary financial information and using it to determine the value of the assets held within the LLC.

What is the purpose of ira llc valuation?

The purpose of IRA LLC valuation is to ensure that the assets within the self-directed IRA are accurately valued for reporting and tax purposes.

What information must be reported on ira llc valuation?

The IRA LLC valuation must include details of all assets held within the self-directed IRA LLC, along with their corresponding values.

Fill out your ira llc valuation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ira Llc Valuation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.