Get the free Inherited Beneficialdoc

Show details

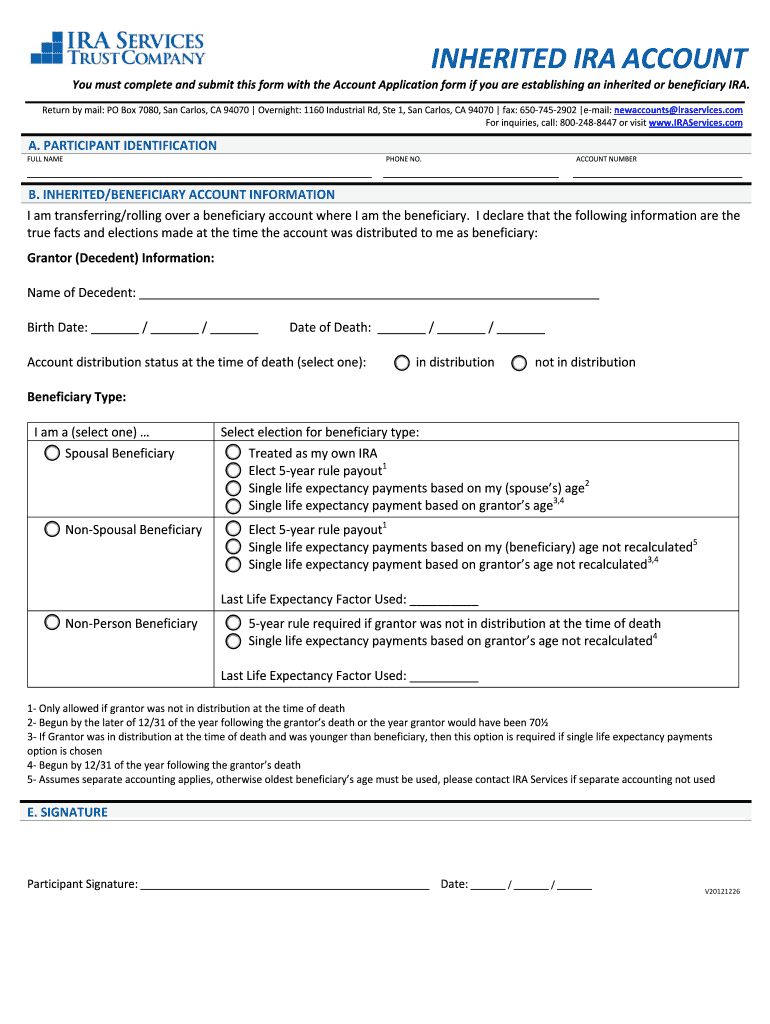

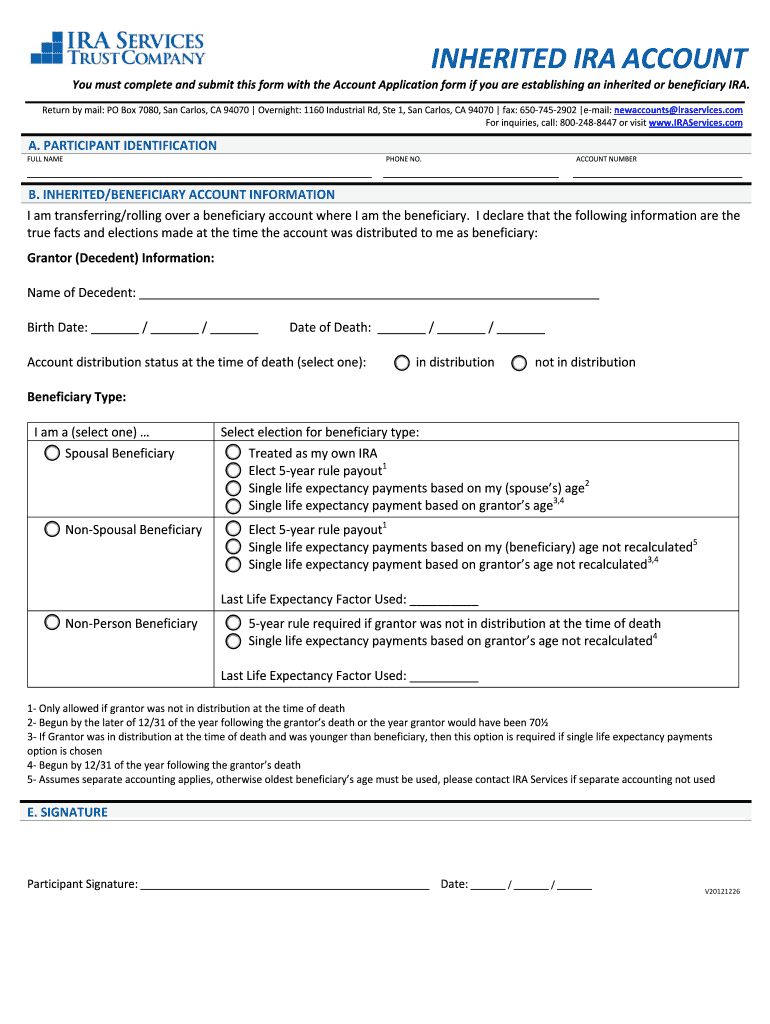

INHERITED IRA ACCOUNT YoumustcompleteandsubmitthisformwiththeAccountApplicationformifyouareestablishinganinheritedorbeneficiaryIRA. Returnbymail:POBox7080,San Carlos,CA94070 Overnight:1160IndustrialRd,Ste1,San

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign inherited beneficialdoc

Edit your inherited beneficialdoc form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your inherited beneficialdoc form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit inherited beneficialdoc online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit inherited beneficialdoc. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out inherited beneficialdoc

How to fill out inherited beneficialdoc?

01

Start by gathering all the necessary documents related to the inherited assets or beneficiaries. This may include wills, trust documents, death certificates, and any other relevant paperwork.

02

Review the instructions provided with the inherited beneficialdoc to understand the specific requirements and steps involved in filling it out. Make sure to follow them carefully to ensure accuracy and avoid any potential legal issues.

03

Begin by entering your personal information in the designated fields of the inherited beneficialdoc. This may include your full name, address, contact information, and any other pertinent details.

04

Next, provide details about the inherited assets or beneficiaries. This can include information such as the name of the deceased, the date of their passing, and a description of the assets being inherited.

05

If required, indicate any specific instructions or conditions outlined in the will or trust documents that need to be carried out during the distribution of the assets. This could involve setting up a trust fund, transferring ownership of properties, or allocating funds to specific individuals or organizations.

06

Carefully review all the information you have entered in the inherited beneficialdoc to ensure its accuracy and completeness. Double-check spellings, dates, and any numerical figures that may be involved.

07

Once you are confident that all the necessary information has been provided, sign and date the inherited beneficialdoc. If required, have it witnessed or notarized according to the legal requirements of your jurisdiction.

08

Make copies of the filled-out inherited beneficialdoc for your records and distribute them to any relevant parties, such as the executor of the will, trustees, or legal representatives involved in the administration of the estate.

Who needs inherited beneficialdoc?

01

Executors: Executors are typically responsible for managing the estate of a deceased person. They may need the inherited beneficialdoc to fulfill their duties and ensure the proper distribution of assets to beneficiaries.

02

Beneficiaries: Beneficiaries are the individuals or organizations entitled to receive assets or benefits from a person who has passed away. They may need the inherited beneficialdoc to understand their rights and responsibilities and to provide the necessary information for the distribution of the inherited assets.

03

Legal Representatives: Lawyers or legal professionals involved in handling the estate administration may require the inherited beneficialdoc to properly execute the deceased person's wishes and manage any legal issues that may arise during the process.

04

Financial Institutions: Banks or financial institutions holding the assets of the deceased person may request the inherited beneficialdoc to verify the authority of individuals or entities seeking access or control over the inherited assets.

05

Government Agencies: In some cases, government agencies may require the inherited beneficialdoc to determine the tax liabilities of the deceased person's estate and to process any necessary paperwork related to the inheritance.

Overall, anyone involved in the administration, distribution, or management of the assets of a deceased person may need the inherited beneficialdoc to ensure a smooth and legally compliant process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get inherited beneficialdoc?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific inherited beneficialdoc and other forms. Find the template you need and change it using powerful tools.

How do I complete inherited beneficialdoc online?

pdfFiller makes it easy to finish and sign inherited beneficialdoc online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I fill out inherited beneficialdoc on an Android device?

Complete inherited beneficialdoc and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is inherited beneficialdoc?

Inherited beneficialdoc is a document that outlines the beneficiaries who have inherited assets from a deceased individual.

Who is required to file inherited beneficialdoc?

The beneficiaries who have inherited assets from a deceased individual are required to file inherited beneficialdoc.

How to fill out inherited beneficialdoc?

Inherited beneficialdoc can be filled out by providing information about the deceased individual, the beneficiaries, and the inherited assets.

What is the purpose of inherited beneficialdoc?

The purpose of inherited beneficialdoc is to ensure transparency and accuracy in reporting inherited assets for tax and legal purposes.

What information must be reported on inherited beneficialdoc?

The information reported on inherited beneficialdoc includes details about the deceased individual, the beneficiaries, and the assets that have been inherited.

Fill out your inherited beneficialdoc online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Inherited Beneficialdoc is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.