Get the free Resident Debt Management Handbook 2016 - University of bb - urmc rochester

Show details

University Of Rochester Medical Center RESIDENT DEBT MANAGEMENT HANDBOOK 2016 Financial Aid Office University of Rochester School of Medicine & Dentistry 601 Elmwood Avenue Box 601 Rochester, New

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign resident debt management handbook

Edit your resident debt management handbook form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your resident debt management handbook form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing resident debt management handbook online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit resident debt management handbook. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out resident debt management handbook

How to Fill Out Resident Debt Management Handbook:

01

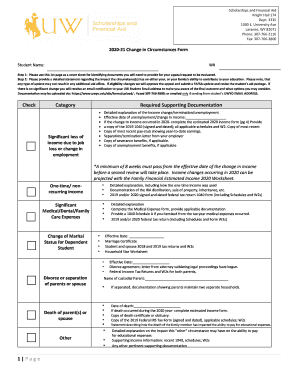

Start by gathering all the necessary financial information, such as credit card statements, loan documents, and any other outstanding debts you may have. This will help you have a clear understanding of your current financial situation.

02

Read through the handbook carefully to familiarize yourself with its contents. Pay attention to any instructions or guidelines provided.

03

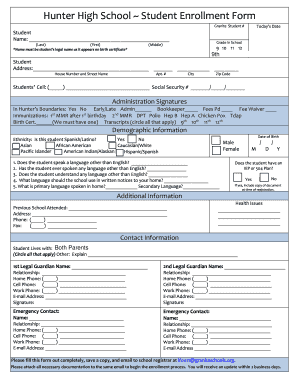

Begin filling out the handbook by inputting your personal information, such as your name, contact details, and social security number. This information will ensure proper identification and organization of your debt management plan.

04

Move on to the section where you list all your debts. Provide accurate and complete information about each debt, including the creditor's name, account number, outstanding balance, and interest rate. Be thorough in this step to ensure all your debts are accounted for.

05

Evaluate your financial status and determine how much you can afford to pay towards your debts each month. This will help you establish a realistic budget and repayment plan. Fill this information into the appropriate section of the handbook.

06

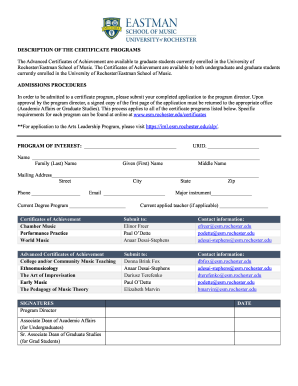

Review the available debt management strategies outlined in the handbook. Choose the one that best suits your financial goals and capabilities. It might involve debt consolidation, negotiating with creditors, or seeking professional assistance.

07

Once you have selected your preferred debt management strategy, follow the instructions provided in the handbook to implement it effectively. This may involve creating a repayment schedule, contacting creditors, or seeking assistance from a debt management agency.

Who Needs Resident Debt Management Handbook?

01

Individuals struggling with excessive debt and are seeking guidance on how to manage and overcome it.

02

Residents who wish to improve their financial literacy and take control of their debts, ultimately leading to a more secure financial future.

03

Residents who feel overwhelmed by their current debts and are unsure of the best course of action to alleviate their financial burden.

In summary, filling out a resident debt management handbook requires gathering financial information, carefully reading and following instructions, inputting personal and debt-related details accurately, evaluating your financial status and choosing a suitable debt management strategy. The handbook is beneficial for individuals struggling with excessive debt, those seeking financial literacy, and those feeling overwhelmed by their debts.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit resident debt management handbook from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including resident debt management handbook, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Can I edit resident debt management handbook on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign resident debt management handbook. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How do I fill out resident debt management handbook on an Android device?

Use the pdfFiller mobile app to complete your resident debt management handbook on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is resident debt management handbook?

The resident debt management handbook provides guidelines and procedures for managing debts within a community.

Who is required to file resident debt management handbook?

Residential property managers and landlords are required to file the resident debt management handbook.

How to fill out resident debt management handbook?

The handbook can be filled out online or by using a paper form provided by the relevant authorities.

What is the purpose of resident debt management handbook?

The purpose of the resident debt management handbook is to ensure proper management and collection of debts within residential communities.

What information must be reported on resident debt management handbook?

Information such as outstanding debts, payment plans, and debt collection procedures must be reported on the resident debt management handbook.

Fill out your resident debt management handbook online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Resident Debt Management Handbook is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.