Get the free Record Retention Guidelines for Business

Show details

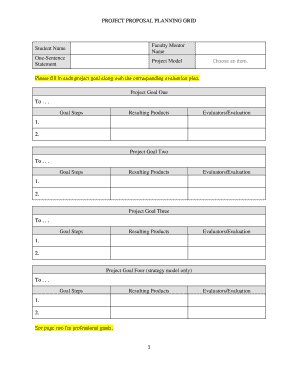

Record Retention Guidelines for Business Accounting RecordsLegal DocumentsAuditors report & annual financial statements.... Permanently Bank statements and deposit slips.....7 years Cancelled checks:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign record retention guidelines for

Edit your record retention guidelines for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your record retention guidelines for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing record retention guidelines for online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit record retention guidelines for. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out record retention guidelines for

How to fill out record retention guidelines for:

01

Begin by identifying the specific types of records that need to be retained. This could include financial documents, employee records, customer information, etc.

02

Determine the appropriate retention periods for each type of record. Consult legal and regulatory requirements, industry standards, and any internal policies or guidelines.

03

Create a document or spreadsheet to outline the retention guidelines. Include columns for the record type, retention period, and any additional notes or instructions.

04

Clearly specify how the records should be stored and organized. This may involve labeling files or folders, using a specific naming convention, or utilizing electronic document management systems.

05

Consider the format in which records will be stored. Some records may be exclusively paper-based, while others may be digital. Ensure that necessary measures are in place to protect and preserve the integrity of both physical and electronic records.

06

Establish protocols for record destruction or disposal once the retention period has expired. This may involve shredding paper documents or securely deleting electronic files.

07

Review the completed record retention guidelines with relevant stakeholders, such as legal counsel, compliance officers, or department heads, to ensure accuracy and compliance.

08

Periodically review and update the guidelines as laws, regulations, or business needs change.

Who needs record retention guidelines for:

01

Businesses of all sizes and industries need record retention guidelines to ensure legal compliance, mitigate risks, and maintain organized documentation.

02

Government agencies are required to follow specific record retention guidelines to preserve public records and facilitate transparency.

03

Non-profit organizations need record retention guidelines to ensure proper documentation of donations, financial records, and board meeting minutes, among others.

04

Educational institutions should establish record retention guidelines to manage student records, employee records, research data, and historical documents.

05

Healthcare organizations must adhere to strict record retention guidelines due to the sensitive nature of patient information and compliance with medical regulations.

06

Legal firms and professionals need record retention guidelines to maintain accurate case files, client records, and legal documents.

07

Financial institutions are subject to stringent record retention guidelines to maintain transaction records, account information, and regulatory compliance.

08

Human resources departments in all organizations require record retention guidelines to manage employee files, performance records, and relevant HR documentation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send record retention guidelines for for eSignature?

When you're ready to share your record retention guidelines for, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I make edits in record retention guidelines for without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing record retention guidelines for and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I sign the record retention guidelines for electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your record retention guidelines for and you'll be done in minutes.

What is record retention guidelines for?

Record retention guidelines are used to establish how long various types of records should be maintained by an organization before they can be destroyed or archived.

Who is required to file record retention guidelines for?

All organizations are required to have record retention guidelines, regardless of their size or industry.

How to fill out record retention guidelines for?

Record retention guidelines can be filled out by determining the required retention periods for different types of records based on legal, regulatory, and business requirements.

What is the purpose of record retention guidelines for?

The purpose of record retention guidelines is to ensure that organizations maintain records for the appropriate amount of time to meet legal and regulatory obligations, as well as business needs.

What information must be reported on record retention guidelines for?

Record retention guidelines typically include the types of records to be retained, retention periods, responsible personnel, and storage locations.

Fill out your record retention guidelines for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Record Retention Guidelines For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.