Get the free Anti-dumping and Countervailing Duty Customs and Border - lacbffa

Show details

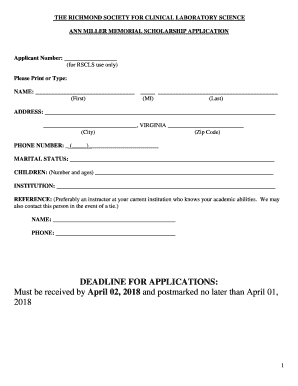

Los Angeles Customs Brokers & Freight Forwarders Assn. P.O. Box 4250, Sun land, CA 91041 Phone: 818.951.2841 Fax: 818.353.5976 Email: la. Coffey Verizon.net Join us for our February 11 workshop 2.5

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign anti-dumping and countervailing duty

Edit your anti-dumping and countervailing duty form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your anti-dumping and countervailing duty form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit anti-dumping and countervailing duty online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit anti-dumping and countervailing duty. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out anti-dumping and countervailing duty

How to Fill Out Anti-Dumping and Countervailing Duty:

01

Gather necessary information: Start by collecting all the relevant information required to complete the anti-dumping and countervailing duty form. This may include details about the imported goods, their origin, the exporting country, and any supporting documentation.

02

Understand the regulations: Familiarize yourself with the specific regulations and guidelines governing the anti-dumping and countervailing duty process in your country. These regulations may differ, so it is crucial to have a clear understanding of the requirements applicable to your situation.

03

Determine the appropriate form: Identify the specific form that needs to be filled out for filing anti-dumping and countervailing duty. This form may vary depending on your jurisdiction, so consult the relevant government agency or customs authority to obtain the correct document.

04

Provide accurate information: Fill out the form with precise and complete details. This may include the description of the imported goods, applicable tariff classifications, the value of the goods, and any relevant supporting information to establish the presence of anti-dumping or countervailing activities.

05

Include supporting documents: Attach any supporting documentation necessary to substantiate your claims regarding anti-dumping or countervailing activities. This may include invoices, sales contracts, pricing information, and any evidence demonstrating unfair trade practices.

06

Review and submit: Thoroughly review the completed form to ensure all information is accurate and complete. Any inaccuracies may result in delays or complications in the processing of your anti-dumping and countervailing duty claim. Once reviewed, submit the form to the designated government agency responsible for handling such matters.

Who Needs Anti-Dumping and Countervailing Duty?

01

Importers and exporters: Individuals or companies involved in importing or exporting goods are typically required to be aware of and comply with anti-dumping and countervailing duty regulations. This helps promote fair trade practices and protects domestic industries from unfair competition.

02

Governments and trade authorities: Governments and trade authorities implement and enforce anti-dumping and countervailing duty measures to safeguard their domestic industries. They work to prevent unfair trade practices that may harm their economies and ensure a level playing field for domestic producers.

03

Trade organizations and associations: Trade organizations and associations play a vital role in advocating for fair trade practices and supporting their member companies in navigating the complex landscape of anti-dumping and countervailing duty regulations. They provide guidance, resources, and representation to their members in these matters.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is anti-dumping and countervailing duty?

Anti-dumping duty is a tariff imposed on goods imported into the country at less than their fair market value, to protect domestic producers. Countervailing duty is a tariff imposed on subsidized goods to offset the benefit of the subsidy.

Who is required to file anti-dumping and countervailing duty?

Importers of goods subject to anti-dumping and countervailing duties are required to file.

How to fill out anti-dumping and countervailing duty?

Fill out the necessary forms provided by the customs authorities and submit all required documentation accurately.

What is the purpose of anti-dumping and countervailing duty?

The purpose is to protect domestic industries from unfair trade practices and ensure a level playing field for producers.

What information must be reported on anti-dumping and countervailing duty?

Information such as the importer of record, country of origin, value of goods, and relevant financial information must be reported.

How can I edit anti-dumping and countervailing duty from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including anti-dumping and countervailing duty, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I edit anti-dumping and countervailing duty on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing anti-dumping and countervailing duty.

How do I fill out anti-dumping and countervailing duty on an Android device?

Use the pdfFiller Android app to finish your anti-dumping and countervailing duty and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

Fill out your anti-dumping and countervailing duty online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Anti-Dumping And Countervailing Duty is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.