Get the free Fixed Annuity Application Mail to PO Box 79905 Des

Show details

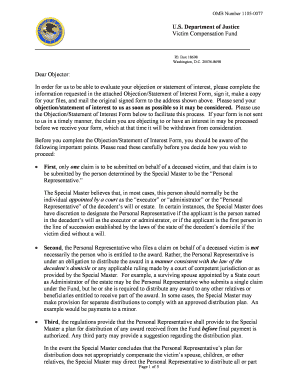

CLEAR FORM Fixed Annuity Application Mail to: P.O. Box 79905, Des Moines, IA 503250905 Overnight to: 4350 Weston Pkwy, West Des Moines, IA 50266 Annuitant Gender U.S. Citizen Male Female Yes No First

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fixed annuity application mail

Edit your fixed annuity application mail form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fixed annuity application mail form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fixed annuity application mail online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit fixed annuity application mail. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fixed annuity application mail

How to fill out a fixed annuity application mail:

01

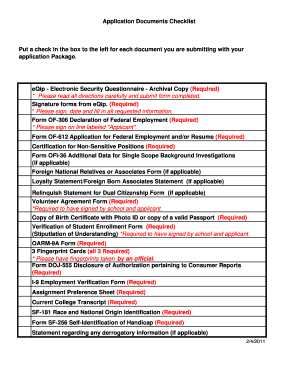

Gather all necessary documents: Before starting the application, make sure you have all the required documents ready. This may include your identification proof, financial statements, and any relevant forms provided by the annuity provider.

02

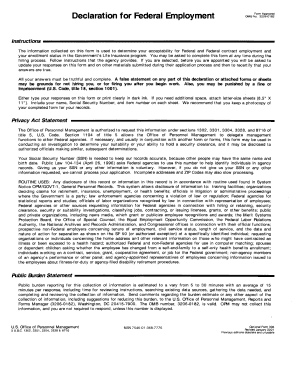

Provide personal information: Start by filling out your personal details accurately. This typically includes your full name, date of birth, social security number, and contact information. Make sure to double-check for any errors.

03

Choose the annuity type: Select the type of fixed annuity you wish to apply for. This could be a single premium annuity or a flexible premium annuity. Consider your financial goals and risk tolerance before making a decision.

04

Enter beneficiary information: Indicate who will receive the annuity benefits in case of your death. Provide the beneficiary's full name, relationship to you, and contact details. It's advisable to have a primary beneficiary and a contingent beneficiary.

05

Specify the investment amount: State the amount you wish to invest in the fixed annuity. Ensure that the amount meets the minimum investment requirement set by the annuity provider.

06

Choose the payment frequency: Decide how often you want to receive annuity payments, whether it's monthly, quarterly, annually, or in a lump sum.

07

Provide additional information: Some annuity applications may require additional information regarding your financial situation, investment objectives, and risk tolerance. Fill out these sections accurately and truthfully.

08

Read the terms and conditions: Thoroughly read the terms and conditions of the fixed annuity application. Pay attention to any fees, surrender charges, and withdrawal restrictions that may apply. Seek clarification from the annuity provider if needed.

09

Review and sign the application: Once you have completed all the necessary fields, review the application form for any errors or missing information. Sign and date the application as required.

10

Submission: Send the completed fixed annuity application mail to the designated address provided by the annuity provider. Consider sending it through certified mail or any other reliable method to ensure secure delivery.

Who needs fixed annuity application mail?

01

Individuals seeking a reliable retirement income stream: Fixed annuities are commonly used by individuals who want to secure a steady income during their retirement years. They provide a guaranteed, fixed rate of return and can be an attractive option for those who prioritize income stability.

02

Investors looking for tax-deferred growth: Fixed annuities offer tax-deferred growth, meaning you won't pay taxes on your earnings until you start withdrawing. This feature makes them appealing to individuals who want to minimize their tax liability while accumulating funds for the future.

03

Individuals wanting to diversify their investment portfolio: Fixed annuities can serve as a way to diversify an investment portfolio that may be heavily focused on stocks and bonds. By adding a fixed annuity, investors can mitigate risk and potentially enhance their overall investment strategy.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit fixed annuity application mail from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including fixed annuity application mail, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I edit fixed annuity application mail on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing fixed annuity application mail.

Can I edit fixed annuity application mail on an Android device?

You can edit, sign, and distribute fixed annuity application mail on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is fixed annuity application mail?

Fixed annuity application mail is a form used to apply for a fixed annuity investment product.

Who is required to file fixed annuity application mail?

Individuals seeking to invest in a fixed annuity are required to file the application mail.

How to fill out fixed annuity application mail?

To fill out the fixed annuity application mail, individuals must provide personal information, investment amount, and beneficiaries.

What is the purpose of fixed annuity application mail?

The purpose of fixed annuity application mail is to apply for a fixed annuity investment product.

What information must be reported on fixed annuity application mail?

Information such as personal details, investment amount, beneficiaries, and signature must be reported on the fixed annuity application mail.

Fill out your fixed annuity application mail online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fixed Annuity Application Mail is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.