Get the free Fixed Index Annuity Allocation Form

Show details

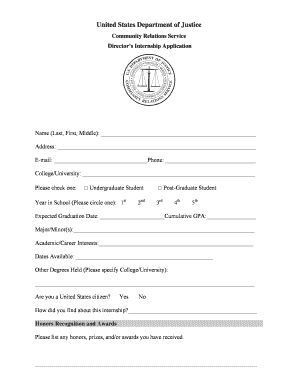

CLEAR FORM Fixed Index Annuity Allocation Form North American Precision Series, North American Charter, Freedom Choice, North American Ten, Prize Plus, and Performance Choice Mail to: P.O. Box 79905,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fixed index annuity allocation

Edit your fixed index annuity allocation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fixed index annuity allocation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fixed index annuity allocation online

Follow the steps below to take advantage of the professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit fixed index annuity allocation. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fixed index annuity allocation

How to fill out fixed index annuity allocation:

01

Begin by thoroughly understanding what a fixed index annuity (FIA) is and how it works. This will help you make informed decisions about your allocation.

02

Evaluate your financial goals and risk tolerance. Determine what percentage of your portfolio you want to allocate to FIAs based on your long-term objectives and comfort level with market volatility.

03

Consult with a financial advisor or insurance professional who specializes in FIAs. They can guide you through the process, explain different allocation strategies, and provide recommendations based on your unique circumstances.

04

Consider the different types of FIAs available and their respective features, such as indexing methods, participation rates, and caps. These factors will influence how you allocate your funds.

05

Assess your time horizon. FIAs are often used as long-term retirement savings vehicles, so your allocation strategy may differ depending on whether you have several decades until retirement or if you are closer to your target date.

06

Diversify your FIA allocation. Consider spreading your funds across multiple FIAs or other investment vehicles to mitigate risk and potentially enhance returns.

07

Review and adjust your allocation periodically. As market conditions change and your financial goals evolve, it's important to reassess and rebalance your FIA allocation accordingly.

Who needs fixed index annuity allocation:

01

Individuals who desire steady and reliable income during retirement. FIAs can provide a guaranteed stream of income, making them suitable for those who want to supplement their Social Security benefits or traditional pension plans.

02

Risk-averse investors who are cautious about market volatility but still want some potential for growth. FIAs offer a downside protection feature while allowing participation in market index gains.

03

Those looking for tax benefits. Unlike other investment vehicles, the interest earned in an FIA is tax-deferred until withdrawals are made, potentially resulting in greater growth over time.

04

Pre-retirees and retirees who want to preserve their principal while still generating returns. FIAs provide a level of protection against market downturns, giving peace of mind to those concerned about market fluctuations affecting their retirement savings.

Note: It is crucial to consult with a qualified financial advisor or insurance professional to determine whether an FIA allocation is suitable for your individual needs and circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send fixed index annuity allocation for eSignature?

When you're ready to share your fixed index annuity allocation, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How can I get fixed index annuity allocation?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the fixed index annuity allocation in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I edit fixed index annuity allocation straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing fixed index annuity allocation right away.

What is fixed index annuity allocation?

Fixed index annuity allocation refers to the specific percentage or proportion of your investment portfolio that is allocated towards a fixed index annuity.

Who is required to file fixed index annuity allocation?

Individuals or entities who hold fixed index annuities as part of their investment portfolio are required to report the allocation of these annuities.

How to fill out fixed index annuity allocation?

To fill out fixed index annuity allocation, you need to provide details on the percentage of your investment portfolio that is allocated towards fixed index annuities.

What is the purpose of fixed index annuity allocation?

The purpose of fixed index annuity allocation is to track and manage the portion of your investment portfolio that is invested in fixed index annuities, allowing you to monitor performance and make informed investment decisions.

What information must be reported on fixed index annuity allocation?

The information that must be reported on fixed index annuity allocation includes the percentage of the investment portfolio allocated towards fixed index annuities, the names of the annuities, and any changes in allocation over time.

Fill out your fixed index annuity allocation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fixed Index Annuity Allocation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.