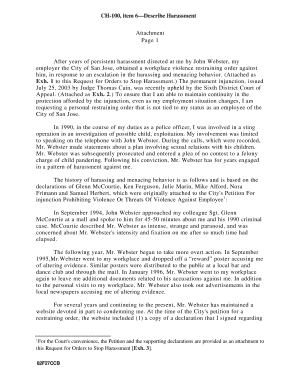

Get the free New To Budgeting? Why You Should Try The 50-20-30 Rule - Forbes

Show details

Customer servicesGetting on

top of your

finances. Feeling financially

sorted starts here.

This guide aims to point you in the direction of better money

management. You'll find practical advice on

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign new to budgeting why

Edit your new to budgeting why form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new to budgeting why form via URL. You can also download, print, or export forms to your preferred cloud storage service.

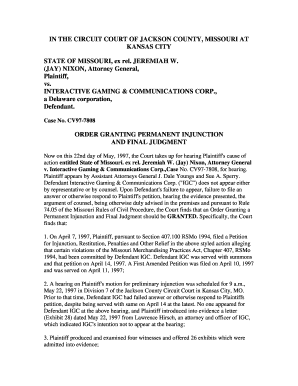

How to edit new to budgeting why online

Follow the steps below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit new to budgeting why. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

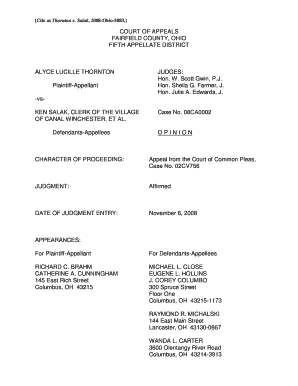

How to fill out new to budgeting why

How to fill out new to budgeting why?

01

Start by understanding your financial goals: Before creating a budget, it's important to identify your financial goals. Whether it's saving for a specific expense, paying off debt, or building an emergency fund, understanding your goals will help you prioritize your spending and make better financial decisions.

02

Track your income and expenses: Begin by tracking your income and all your expenses for a month. This will give you a clear picture of where your money is currently going and help you identify any areas where you may be overspending or can cut back.

03

Categorize your expenses: Once you have an accurate record of your expenses, categorize them into different groups such as groceries, transportation, housing, entertainment, and so on. This will help you better understand your spending patterns and identify areas where you may need to make adjustments.

04

Set realistic and achievable budgeting goals: Based on your financial goals and spending patterns, set realistic and achievable budgeting goals. These goals should include targets for savings, debt repayment, and any other financial objectives you may have.

05

Allocate your income: Determine how much of your income will go towards each category. Start with your fixed expenses such as rent, utilities, and loan payments. Then allocate a portion of your income towards savings and debt repayments. Finally, assign amounts to discretionary categories such as entertainment and dining out.

06

Monitor and adjust your budget regularly: Your budget should be flexible and adaptable. Monitor your progress regularly and make adjustments as needed. If you notice that you're consistently overspending in a certain category, evaluate your expenses and find ways to cut back.

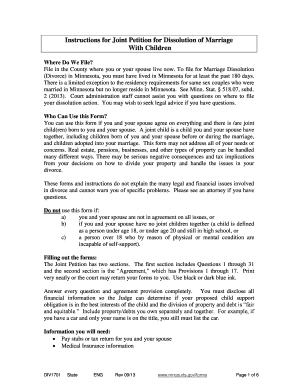

Who needs new to budgeting why?

01

Individuals with unstable financial situations: Budgeting is crucial for individuals who have unstable financial situations. It helps them regain control over their finances, prioritize expenses, and work towards stabilizing their financial position.

02

People looking to save money or pay off debt: Budgeting is essential for individuals who have specific financial goals such as saving for a down payment, paying off student loans, or becoming debt-free. It allows them to allocate their income efficiently towards these goals and track their progress.

03

Individuals experiencing lifestyle changes: Major life changes such as marriage, having children, or buying a new home can significantly impact your finances. Budgeting helps individuals navigate these changes by adjusting spending habits and ensuring they can afford these new responsibilities.

Overall, anyone who wants to gain a better understanding of their finances, set financial goals, and make informed financial decisions can benefit from learning how to budget effectively. It is a fundamental skill that helps individuals build a strong financial foundation and achieve their long-term financial aspirations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit new to budgeting why on an iOS device?

You certainly can. You can quickly edit, distribute, and sign new to budgeting why on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How can I fill out new to budgeting why on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your new to budgeting why, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

Can I edit new to budgeting why on an Android device?

You can make any changes to PDF files, like new to budgeting why, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is new to budgeting why?

New to budgeting is the practice of creating a new budget for a specific period of time in order to plan and track financial resources.

Who is required to file new to budgeting why?

Anyone who wants to effectively manage their finances or business operations is required to create and follow a budget.

How to fill out new to budgeting why?

To fill out a new budget, one must gather information on income, expenses, and financial goals, then allocate resources accordingly.

What is the purpose of new to budgeting why?

The purpose of new to budgeting is to ensure that financial resources are allocated efficiently and effectively to meet financial goals.

What information must be reported on new to budgeting why?

Information such as income sources, expenses, savings goals, and financial projections must be reported on a new budget.

Fill out your new to budgeting why online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New To Budgeting Why is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.