Get the free Supplemental Farmland

Show details

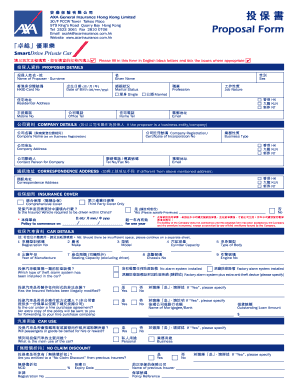

This document is a supplemental farmland activity income form that requires detailed completion for farmland tax purposes, including information about acreage, crop activities, and owner details.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign supplemental farmland

Edit your supplemental farmland form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your supplemental farmland form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit supplemental farmland online

Follow the steps below to use a professional PDF editor:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit supplemental farmland. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out supplemental farmland

How to fill out Supplemental Farmland

01

Obtain the Supplemental Farmland application form from your local agricultural office or website.

02

Fill in your personal information including name, address, and contact details.

03

Provide details about the land, including its location, size, and current usage.

04

Attach any required documentation such as land ownership proof or current lease agreements.

05

Specify the type of supplemental support you are seeking and justify your request.

06

Review the application for completeness and accuracy.

07

Submit the application to the appropriate authority before the specified deadline.

Who needs Supplemental Farmland?

01

Farmers looking for additional resources or support for their farmland.

02

Landowners wishing to enhance productivity on their agricultural land.

03

Individuals or organizations involved in sustainable farming practices.

04

Anyone needing financial assistance or incentives to maintain or improve their farmland.

Fill

form

: Try Risk Free

People Also Ask about

Which of the following are required to qualify for NJ farm assessment rates of property tax?

Eligibility Requirements Applicant must own the land. Owner must apply for Farmland Assessment on Form FA-1 with municipal tax assessor annually on or before August 1 of the year immediately preceding the tax year. Land must be devoted to agricultural or horticultural uses for at least two years prior to the tax year.

What qualifies as a farm in New Jersey?

A farm is a commercial farm if it meets the following conditions: The farm is no less than 5 acres, The farm produces agricultural or horticultural products worth $2,500 or more annually, and. The farm receives Farmland Assessment or satisfies the eligibility criteria for Farmland Assessment.

What is the farmland assessment in New Jersey?

Farmland assessment allows land actively devoted to an agricultural or horticultural use to be taxed on its farm value instead of its development value. All land qualifying for farmland assessment must meet a minimum income threshold from the sale of the agricultural output of the farm.

What is the Farmland Preservation Act in New Jersey?

The Agriculture Retention and Development Act (Act) is the framework for New Jersey's Farmland Preservation Program. The Farmland Preservation Program is designed to strengthen the agricultural industry and preserve important farmland to enhance the economy and quality of life in the Garden State.

How does farm assessment work in NJ?

All land qualifying for farmland assessment must meet a minimum income threshold from the sale of the agricultural output of the farm. The threshold begins at $1000 for the first five acres for cropland and $500 for the first five acres for woodland.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Supplemental Farmland?

Supplemental Farmland refers to additional land assessed for agricultural use, typically included in tax assessments or reporting to help determine eligibility for certain agricultural programs.

Who is required to file Supplemental Farmland?

Farmers or landowners who own or operate farmland that qualifies for supplemental assessment must file Supplemental Farmland.

How to fill out Supplemental Farmland?

To fill out Supplemental Farmland, landowners must provide detailed information about their land, including acreage, type of crops, and use of the land, often using a standardized form provided by local government or agricultural agencies.

What is the purpose of Supplemental Farmland?

The purpose of Supplemental Farmland is to ensure proper assessment of agricultural land for taxation, qualification for subsidies, and monitoring of land use for conservation and regulatory compliance.

What information must be reported on Supplemental Farmland?

Information reported typically includes the total acreage, type of crops grown, land usage, ownership details, and any conservation practices employed, which aids in accurate assessment and program eligibility.

Fill out your supplemental farmland online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Supplemental Farmland is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.