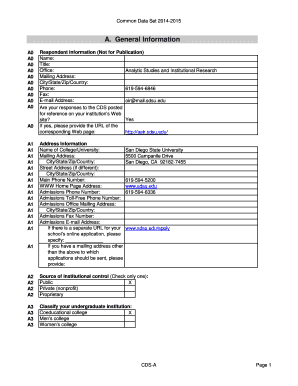

Get the free FORM E-1

Show details

This return must be filed in conjunction with Form E to cover the preceding three-month period, and is to include ONLY cancellations which have been previously reported and taxes paid on the reported

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form e-1

Edit your form e-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form e-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form e-1 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form e-1. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

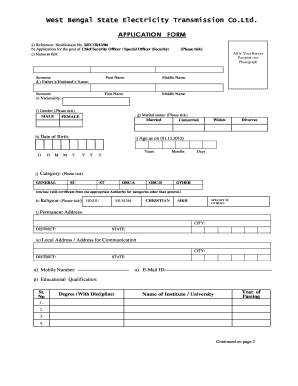

How to fill out form e-1

How to fill out FORM E-1

01

Begin with personal information: Enter your full name, address, and contact details in the designated sections.

02

Provide information about your income: Fill in your total income for the last financial year as per the instructions.

03

Fill out deductions: List any applicable deductions you are eligible for based on the guidelines provided.

04

Complete the tax calculation section: Calculate your total taxable income and taxes owed using the provided formulas.

05

Review: Double-check all information for accuracy before submission.

06

Sign and date the form: Ensure that you provide your signature and the date at the end of the form.

Who needs FORM E-1?

01

Individuals who need to report their yearly income for tax purposes.

02

Self-employed persons who need to declare their income and deductions.

03

Those who receive income from multiple sources and need to consolidate their tax obligations.

Fill

form

: Try Risk Free

People Also Ask about

What is an E-1 form?

Form E-1 is a tax return used by a resident individual taxpayer, regardless of the location of their employer, or a non-resident working in the City of St. Louis to file and pay the earnings tax of 1% due and not withheld by the employer.

What is the form E in English?

Form E, also known as Borang E in Malay, is an annual report that employers in Malaysia must submit to the Inland Revenue Board of Malaysia (LHDN). This form provides a comprehensive summary of employment information, including employee salaries, bonuses, and deductions for the previous year.

What is the E1 form?

Form E1: Financial statement for a financial remedy (other than a financial order or financial relief after an overseas divorce or dissolution etc) in the family court or High Court.

What is form E in customs?

The Customs Authority of the importing Party shall accept a Certificate of Origin (Form E) in cases where the sales invoice is issued either by a company located in a third country or by an ACFTA exporter for the account of the said company, provided that the product meets the requirements of the Rules of Origin for

What is the form e for?

A form E is required for the court to determine a fair settlement. If parties are mutually agreeing financial settlement without financial disclosure, then financial form is not compulsory. It is however advisable to exchange Form E's. This highlights all the elements to be considered before reaching an agreement.

What is the e form used for?

Electronic forms (eforms) provide a series of fields where data is collected, often using a Web browser. They take the place of paper forms and are designed to capture, validate, and submit data to a recipient for forms processing in a more efficient manner.

What tax form do I use for a non-resident in Missouri?

Filing Form MO-CR or Form MO-NRI Missouri residents with income from another state, nonresidents, and part-year residents need to file Form MO-CR or Form MO-NRI with Form MO-1040 (long form).

What happens if you don't fill in form E?

If you, or your partner, opt not to fill in and submit Form E following a court order, you could face serious consequences. Initially, you may receive a fine. However, the longer you avoid completing and submitting the form, the more serious the penalty becomes to the extent that you may face prison.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FORM E-1?

FORM E-1 is a specific form used for reporting certain types of financial information as required by regulatory authorities.

Who is required to file FORM E-1?

Entities or individuals that meet specific criteria set by the regulatory authority, such as businesses involved in specific industries or activities, are required to file FORM E-1.

How to fill out FORM E-1?

To fill out FORM E-1, one should gather the necessary financial information, follow the provided instructions detailed on the form, and ensure all required fields are completed accurately before submission.

What is the purpose of FORM E-1?

The purpose of FORM E-1 is to collect essential financial data to ensure compliance with regulatory standards and to provide transparency in financial practices.

What information must be reported on FORM E-1?

Information required on FORM E-1 typically includes financial statements, transaction details, and any relevant disclosures as mandated by the regulatory authority.

Fill out your form e-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form E-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.