Get the free Broker Insurance Bond

Show details

This document serves as a surety bond for insurance brokers in North Carolina, ensuring accountability in handling premiums and insurance for clients. It outlines the obligations of the principal

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign broker insurance bond

Edit your broker insurance bond form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your broker insurance bond form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing broker insurance bond online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit broker insurance bond. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out broker insurance bond

How to fill out Broker Insurance Bond

01

Gather required personal and business information.

02

Determine the amount of the bond required by your state or licensing authority.

03

Choose a reputable surety bond company or broker.

04

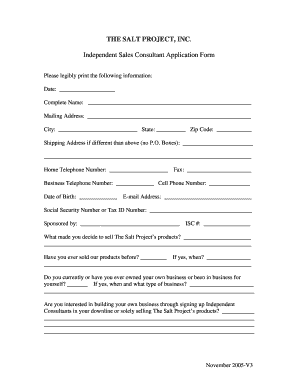

Complete the bond application form with accurate information.

05

Provide any necessary financial documents or credit information.

06

Review the bond terms and conditions carefully.

07

Sign the bond agreement and make payment for the bond premium.

08

Receive the bond certificate and ensure it is filed with the appropriate regulatory agency.

Who needs Broker Insurance Bond?

01

Real estate brokers and agents.

02

Insurance brokers.

03

Mortgage brokers.

04

Business brokers.

Fill

form

: Try Risk Free

People Also Ask about

Who buys insurance bonds?

The principal: The party that purchases the bond as a guarantee that they'll finish the project or task set by the obligee. The obligee: The party that requires the principal to obtain a surety bond.

Why do brokers need to be bonded?

Deterring Fraudulent Practices: The existence of a bond and the financial accountability it represents discourage brokers from engaging in deceitful behavior. Enhancing Industry Trust: When all brokers are required to be bonded, it creates a safer and more trustworthy environment for both shippers and carriers.

What is a broker in terms of insurance?

An insurance broker is an intermediary who sells, solicits, or negotiates insurance on behalf of a client for compensation.

Why would a person need to be bonded?

The required bonds are a type of insurance agreement which guarantees reimbursement to the union for any financial losses caused by fraudulent or dishonest acts by officers or employees, such as theft, embezzlement, or forgery.

What is the purpose of a bond?

A bond is a debt security, like an IOU. Borrowers issue bonds to raise money from investors willing to lend them money for a certain amount of time. When you buy a bond, you are lending to the issuer, which may be a government, municipality, or corporation.

What is a surety bond example?

Examples of Surety Bonds Includes bid or proposal bonds, performance bonds, payment or labor and material bonds, maintenance bonds and supply bonds. These bonds are required by state or federal law for most public construction projects or by a private developer.

What does a bond do in insurance?

An insurance bond is also a promise to pay but it has a different purpose – to protect against financial loss or to guarantee compliance. The condition for payment is not the passage of time but rather, whether and when a specific negative situation occurs.

Is a bond the same as an insurance policy?

Insurance pays on behalf of you; surety bonds are just a guarantee of payment to another party. The primary difference between a surety bond and insurance is that insurance will pay for losses in a claim, whereas a bonding company will guarantee your obligations are fulfilled.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

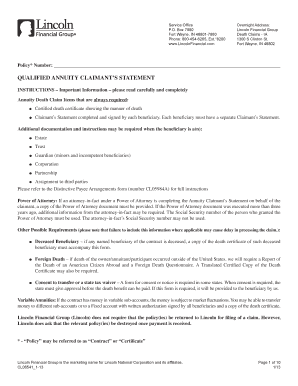

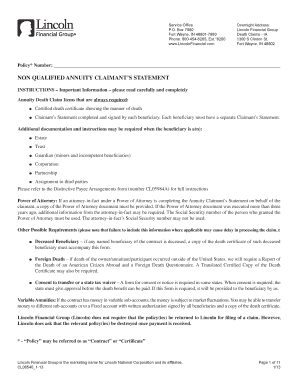

What is Broker Insurance Bond?

A Broker Insurance Bond is a type of surety bond that insurance brokers must obtain to ensure compliance with state regulations and protect clients against potential financial losses due to negligence or misconduct.

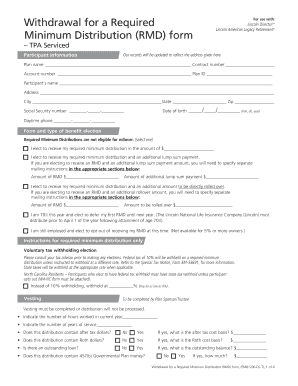

Who is required to file Broker Insurance Bond?

Insurance brokers and agents operating in specific states are typically required to file a Broker Insurance Bond as part of the licensing process to ensure they meet regulatory requirements.

How to fill out Broker Insurance Bond?

Filling out a Broker Insurance Bond typically involves providing details such as the broker's name, address, the bond amount, and the names of the surety and insurance regulatory agency. It may require signatures from the broker and the surety company.

What is the purpose of Broker Insurance Bond?

The purpose of a Broker Insurance Bond is to protect clients and the public from any financial harm caused by the broker's failure to adhere to industry regulations or professional standards.

What information must be reported on Broker Insurance Bond?

Information reported on a Broker Insurance Bond usually includes the names and addresses of the broker and surety company, the bond amount, a description of the bond's purpose, and any relevant state regulatory information.

Fill out your broker insurance bond online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Broker Insurance Bond is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.