Get the free FIDUCIARY BOND

Show details

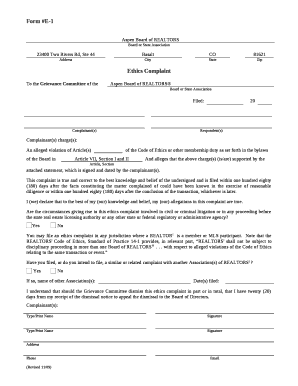

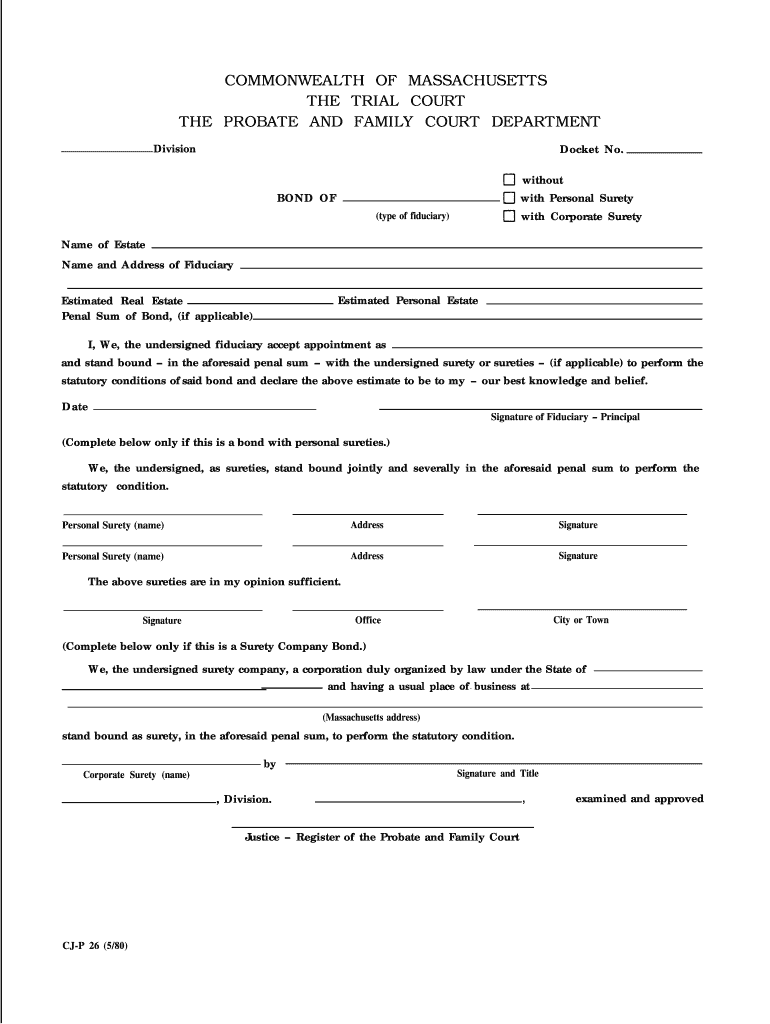

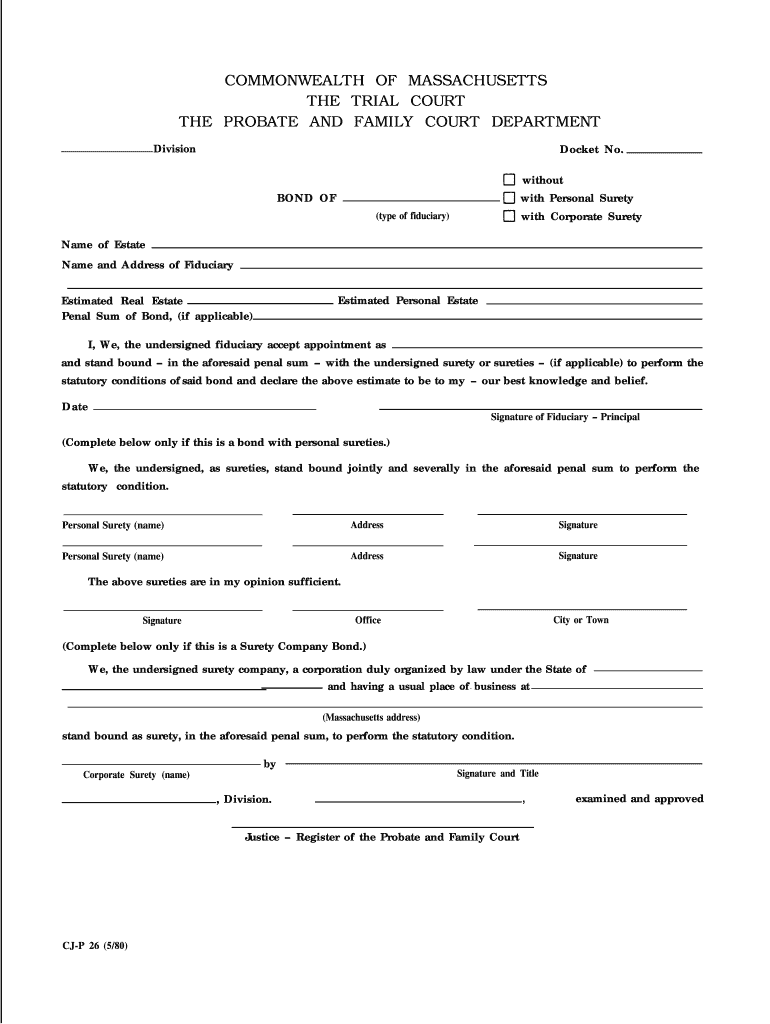

This document is a Fiduciary Bond used in the Probate and Family Court of Massachusetts, illustrating the acceptance of appointment by a fiduciary and the sureties involved in performing the statutory

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fiduciary bond

Edit your fiduciary bond form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fiduciary bond form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fiduciary bond online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit fiduciary bond. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fiduciary bond

How to fill out FIDUCIARY BOND

01

Obtain the FIDUCIARY BOND form from the relevant authority or online.

02

Provide your full name and contact information in the designated sections.

03

Indicate the capacity in which you are acting as a fiduciary (e.g., executor, trustee, guardian).

04

Specify the bond amount as required by the court or governing body.

05

Review the bond terms and conditions carefully.

06

Sign the bond in the presence of a notary public, if required.

07

Submit the completed bond form along with any necessary supporting documents to the appropriate authority.

Who needs FIDUCIARY BOND?

01

Individuals acting as executors or administrators of estates.

02

Trustees managing trust assets.

03

Guardians appointed for minors or incapacitated individuals.

04

Any person who handles someone else's financial matters or estate.

Fill

form

: Try Risk Free

People Also Ask about

What is a fiduciary bond?

A fiduciary bond is court-ordered protection, a form of insurance. It is not protection for the guardian but it is protection for the person who needs a guardian. By issuing a bond the bonding agency agrees to repay the ward any money that might be lost because of the guardian's actions or mistakes.

What is a fiduciary in English?

A fiduciary is someone who manages money or property for someone else. When you're named a fiduciary and accept the role, you must – by law – manage the person's money and property for their benefit, not yours.

What does fiduciary duty mean in English?

A fiduciary duty is the legal responsibility to act solely in the best interest of another party. “Fiduciary” means trust, and a person with a fiduciary duty has a legal obligation to maintain that trust. For example, lawyers have a fiduciary duty to act in the best interest of their clients.

What is the difference between a fiduciary and a surety?

A fiduciary acts to benefit the beneficiary of the relationship; indemnitors are not beneficiaries of any obligations under the indemnity agreement. Instead, the surety is the beneficiary of the indemnity agreement, which imposes duties exclusively on the indemnitors in favor of the surety.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FIDUCIARY BOND?

A fiduciary bond is a type of surety bond that protects the interests of beneficiaries in the event that a fiduciary, such as an executor, administrator, or trustee, fails to perform their duties honestly and in accordance with the law.

Who is required to file FIDUCIARY BOND?

Individuals who serve as fiduciaries, such as executors of estates, trustees of trusts, or guardians of minors, may be required to file a fiduciary bond to ensure the faithful performance of their duties.

How to fill out FIDUCIARY BOND?

To fill out a fiduciary bond, the fiduciary must provide personal information, details about the estate or trust involved, and the bond amount. The bond must be signed by the fiduciary and a surety company, and may need to be submitted to a court or relevant authority.

What is the purpose of FIDUCIARY BOND?

The purpose of a fiduciary bond is to protect beneficiaries from potential mismanagement, fraud, or negligence by the fiduciary, ensuring that they fulfill their legal and ethical obligations.

What information must be reported on FIDUCIARY BOND?

The fiduciary bond must include information such as the name and address of the fiduciary, the bond amount, details about the estate or trust, and identification of the surety company providing the bond.

Fill out your fiduciary bond online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fiduciary Bond is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.