Get the free 2011 DONOR FORM - stlouiscityrecorder

Show details

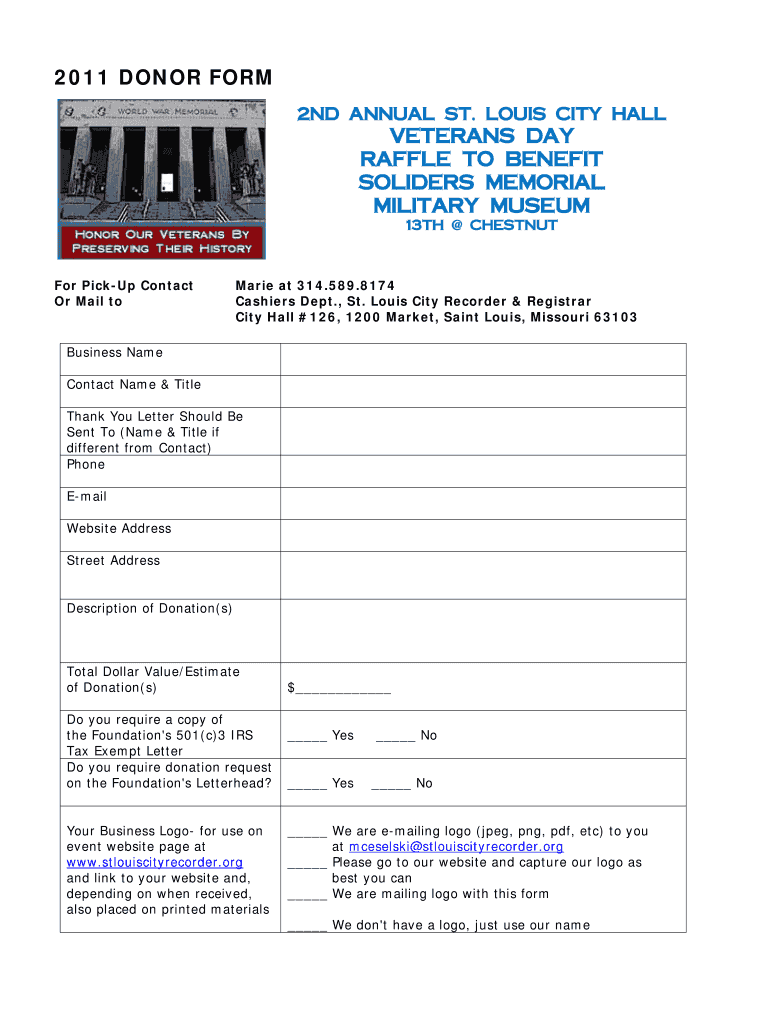

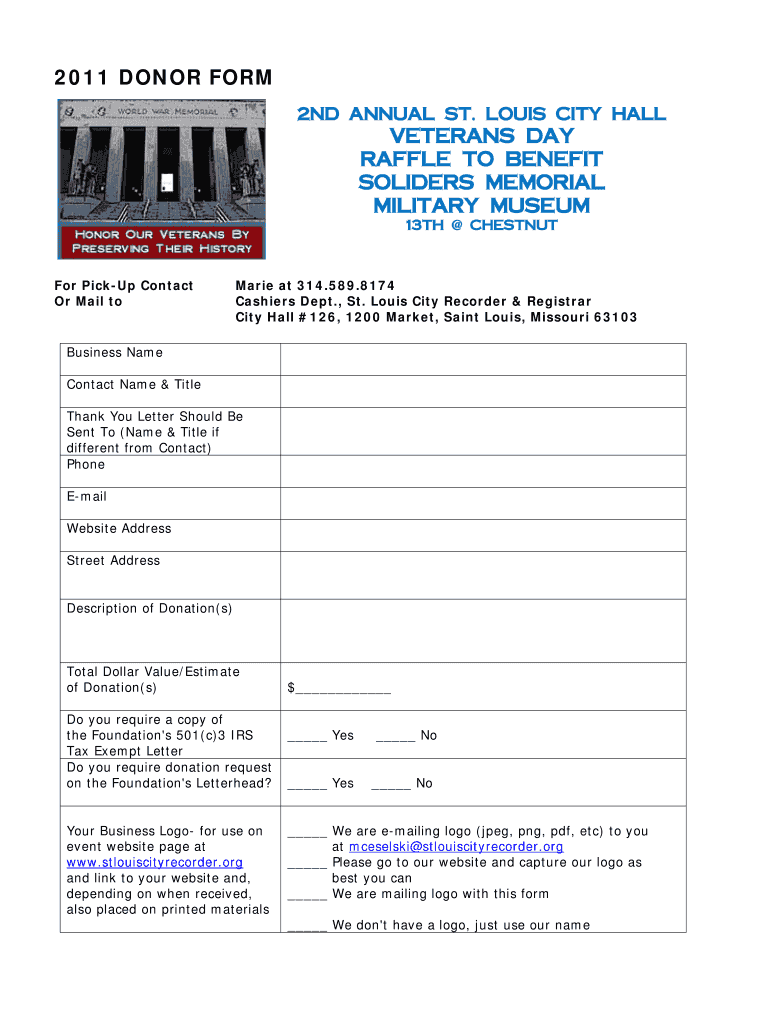

Form for businesses to contribute donations for the Veterans Day Raffle to benefit the Soldiers Memorial Military Museum.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2011 donor form

Edit your 2011 donor form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2011 donor form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2011 donor form online

Follow the steps down below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 2011 donor form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2011 donor form

How to fill out 2011 DONOR FORM

01

Obtain the 2011 DONOR FORM from the relevant organization or website.

02

Read the instructions carefully before starting to fill out the form.

03

Fill in your personal information, including name, address, and contact details.

04

Provide any donor identification numbers if applicable.

05

Specify the type of donation and the amount, if required.

06

Sign and date the form in the designated section.

07

Double-check all information for accuracy before submission.

08

Submit the completed form to the organization as directed.

Who needs 2011 DONOR FORM?

01

Individuals or organizations wishing to make a donation.

02

Entities seeking tax deductions for charitable contributions.

03

Non-profit organizations requesting donor information for their records.

04

Individuals participating in fundraising campaigns that require donor documentation.

Fill

form

: Try Risk Free

People Also Ask about

What is a donor registry?

During DBD, organs undergo cold perfusion before organ retrieval and thus warm ischaemia is minimal. However, DCD by definition will incur some degree of warm ischaemia as there will be an interval after asystole where organs are not being perfused and have not yet been cooled.

What is the National donor Registry?

By registering your decision to be an organ, eye and tissue donor in the National Donate Life Registry, you are helping to save lives and give hope to the more than 100,000 people in the United States currently waiting for lifesaving organ transplants.

What is a donor form?

A donor information form is a document used by non-profit organizations to collect information about their donors. Whether you're a small charity or an international non-profit, use this customizable donor information form template to collect contact details and other relevant information from your contributors.

Which organ cannot be donated after death?

There are two methods which the FDA has adopted. A deferred donor subsequently may be found to be eligible as a donor of blood or blood components by a requalification method or process found acceptable for such purposes by FDA. Such a donor is considered no longer deferred.

What is the difference between DBD and dcd?

For example, if someone passes away from a heart attack, they are not going to be able to donate their heart but they may be able to donate their kidneys and liver. Likewise, if a person has diabetes, they might not be able to donate their pancreas but may be able to donate their heart or lungs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2011 DONOR FORM?

The 2011 DONOR FORM is a specific document used to report donations made to eligible charitable organizations and track donor information for tax purposes.

Who is required to file 2011 DONOR FORM?

Individuals or entities that make charitable donations subject to reporting requirements are generally required to file the 2011 DONOR FORM, especially if the total donations exceed certain thresholds.

How to fill out 2011 DONOR FORM?

To fill out the 2011 DONOR FORM, one must provide personal identification information, details about the charitable organizations, and specifics about the donations made, ensuring all required fields are completed accurately.

What is the purpose of 2011 DONOR FORM?

The purpose of the 2011 DONOR FORM is to facilitate the reporting of charitable contributions for tax deductions, enable organizations to verify donations, and maintain transparency in charitable activities.

What information must be reported on 2011 DONOR FORM?

The information that must be reported on the 2011 DONOR FORM includes the donor's name, contact information, the amount donated, the date of the donation, and the name and address of the charitable organization.

Fill out your 2011 donor form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2011 Donor Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.