Get the free BUYING A HOME - LESSON 17 D None of the above 2 A real - schools ccps k12 va

Show details

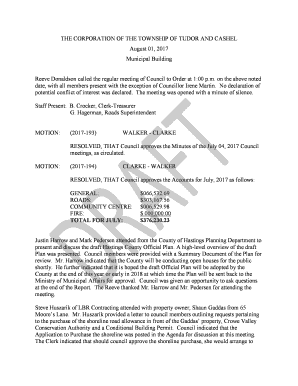

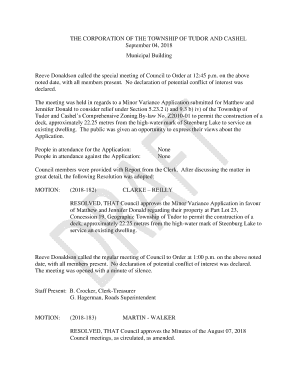

Student Name: Class: Date: BUYING A HOME LESSON 17 1. A simple formula for finding your equity in your home is: A. B. C. D. Purchase price of your home minus outstanding loan balance Down payment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign buying a home

Edit your buying a home form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your buying a home form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit buying a home online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit buying a home. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out buying a home

Question: How to fill out buying a home? Who needs buying a home?

How to fill out buying a home:

01

Start by determining your budget: Assess your financial situation and establish a budget that includes not only the purchase price of the home but also other costs like closing costs, property taxes, and maintenance fees.

02

Research and select a mortgage lender: Shop around and compare mortgage lenders to find the one that offers the best terms and interest rates. Consult with lenders to get pre-approved for a mortgage to know your borrowing capacity.

03

Find a real estate agent: Seek the assistance of a reputable real estate agent who specializes in the area where you want to buy a home. They can help you find suitable properties, negotiate offers, and navigate through the home buying process.

04

Start house hunting: Work with your real estate agent to identify potential properties that match your criteria and schedule visits to physically inspect them. Consider factors like location, size, amenities, and proximity to schools, shopping centers, and transportation.

05

Make an offer: When you find a home you want to purchase, submit a written offer to the seller. Include the proposed purchase price, any contingencies, and the desired closing date. Your agent will negotiate with the seller on your behalf.

06

Conduct inspections and appraisals: Hire a professional home inspector to thoroughly assess the condition of the property and any potential issues. Arrange for an appraisal to ensure the home's value aligns with the proposed purchase price.

07

Secure financing: Finalize your mortgage application with the lender you selected earlier. Provide all necessary documentation and complete any additional steps required to secure the loan.

08

Review and sign legal documents: Work closely with your real estate agent and attorney to review and sign all the necessary legal documents, including the purchase agreement, mortgage documents, and disclosures.

09

Perform a final walkthrough: Before closing, conduct a final walkthrough of the property to ensure that everything is in order and any agreed-upon repairs or changes have been made.

10

Close the deal: Attend the closing meeting, where you will sign the final paperwork and officially transfer ownership of the property. Pay any required closing costs and receive the keys to your new home.

Who needs buying a home:

01

Individuals or families looking for stability and long-term residence: Buying a home is an ideal option for those seeking a stable living situation and a place to call their own for an extended period.

02

Renters aiming to build equity: Owning a home allows individuals to build equity over time as they pay down their mortgage, unlike renting where monthly payments do not contribute to ownership.

03

Investors seeking potential financial gains: Purchasing a home can be a lucrative investment opportunity, especially in areas with appreciating property values. Real estate can provide both rental income and potential profits through property appreciation.

04

Those desiring customization and control: Owning a home allows individuals to personalize and modify their living space according to their preferences. It also offers more control over factors like home improvements, renovations, and landscaping.

05

Individuals seeking tax benefits: Homeowners may benefit from tax deductions such as mortgage interest, property taxes, and certain home-related expenses, potentially leading to reduced tax liability.

Note: The content provided is for informational purposes only and should not be considered as financial, legal, or real estate advice. It is always recommended to consult with professionals in these fields before making any significant financial decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is buying a home?

Buying a home is the process of purchasing a residential property to own and live in.

Who is required to file buying a home?

Individuals or families who are looking to purchase a home are required to file for buying a home.

How to fill out buying a home?

To fill out buying a home, individuals must provide details about the property, purchase price, financing information, and personal information.

What is the purpose of buying a home?

The purpose of buying a home is to have a place to live and call your own, as well as to potentially build equity and financial stability.

What information must be reported on buying a home?

Information such as the property address, purchase price, financing details, and personal information of the buyer must be reported on buying a home.

How do I complete buying a home online?

Filling out and eSigning buying a home is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I fill out buying a home using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign buying a home and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I edit buying a home on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign buying a home on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Fill out your buying a home online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Buying A Home is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.