Get the free EXCISE DUTY

Show details

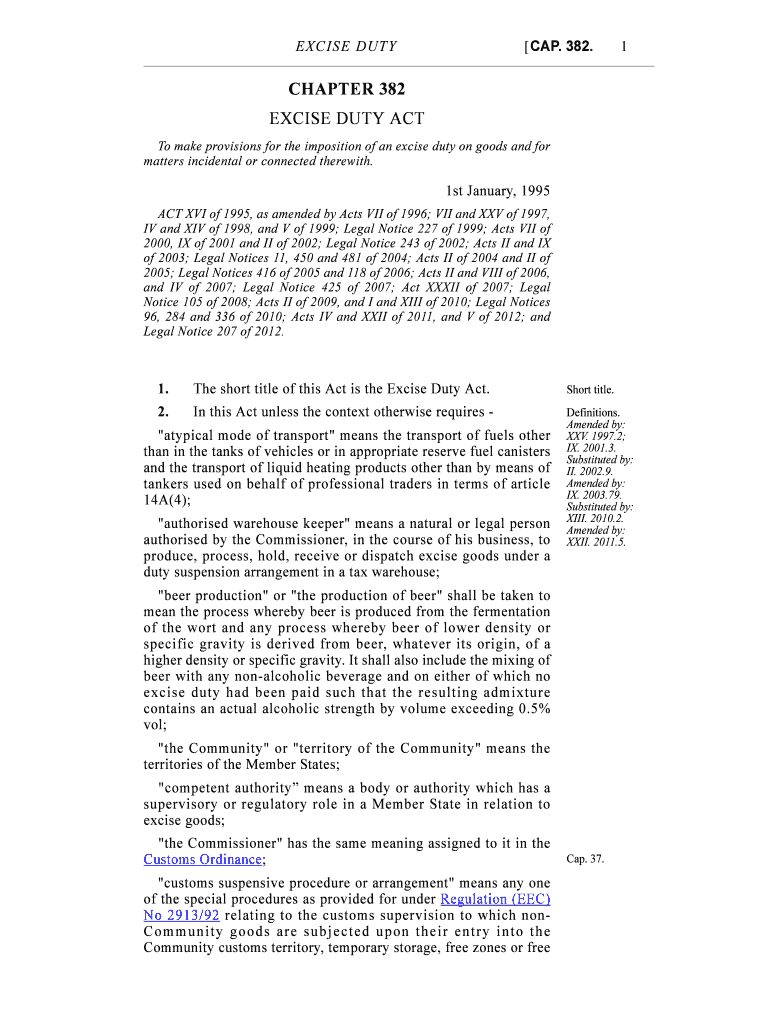

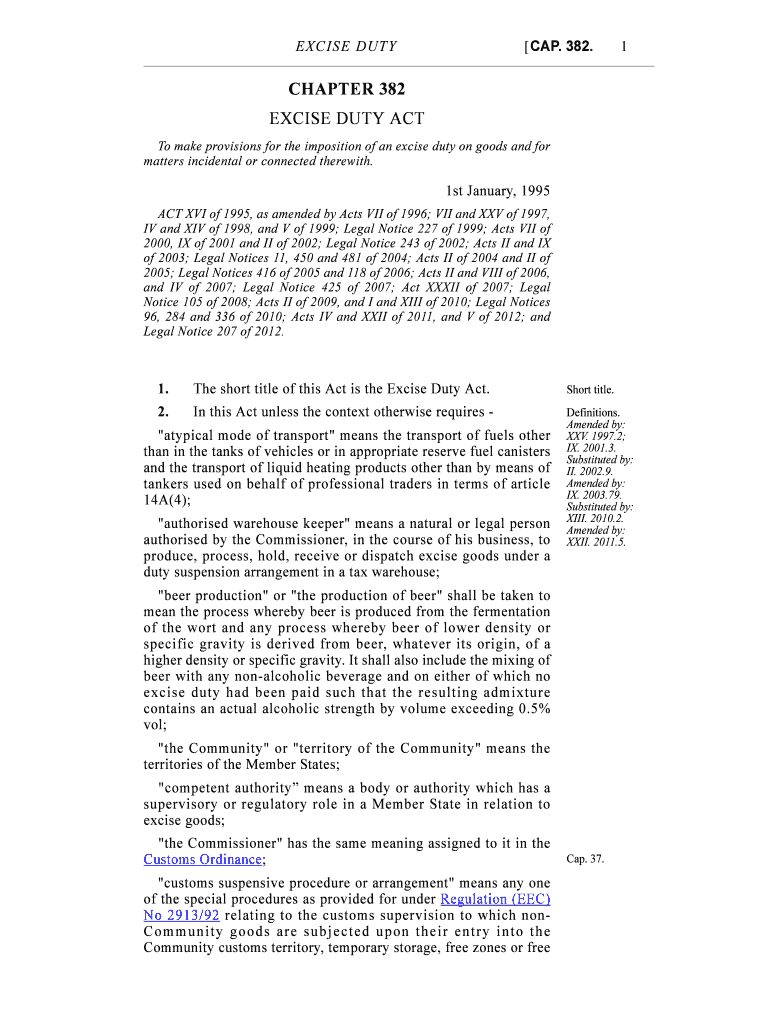

CAP. 382. EXCISE DUTY 1 CHAPTER 382 EXCISE DUTY ACT To make provisions for the imposition of an excise duty on goods and for matters incidental or connected therewith. 1st January 1995 ACT XVI of

We are not affiliated with any brand or entity on this form

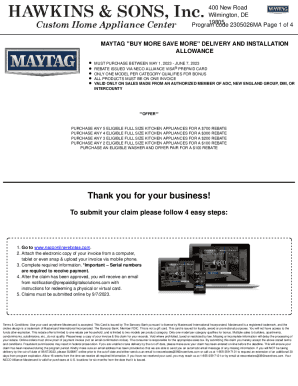

Get, Create, Make and Sign excise duty

Edit your excise duty form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your excise duty form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit excise duty online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit excise duty. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out excise duty

How to fill out excise duty:

01

Identify the type of product or activity that requires the payment of excise duty. Excise duty is usually imposed on goods such as alcohol, tobacco, fuel, and luxury items.

02

Understand the regulations and guidelines pertaining to excise duty in your jurisdiction. Familiarize yourself with the specific forms and documents that need to be filled out in order to report and pay the duty.

03

Collect all the necessary information and documentation required for the excise duty declaration. This may include details about the quantity or volume of the goods, their value, and any applicable exemptions or reliefs.

04

Fill out the excise duty declaration form accurately and completely. Provide the requested information, such as your business details, the type and quantity of goods subject to duty, the applicable tax rates, and any supporting documents.

05

Calculate the excise duty payable based on the information provided and the applicable tax rates. Ensure that you accurately calculate the duty to avoid any potential penalties or additional taxes.

06

Submit the completed excise duty declaration form along with any supporting documents to the relevant tax authority or customs office. Follow the prescribed submission procedures and deadlines to ensure timely compliance.

Who needs excise duty:

01

Manufacturers: Manufacturers of excisable goods such as alcoholic beverages, tobacco products, and petroleum products are generally required to pay excise duty on their production.

02

Importers: Importers of excisable goods are typically liable for paying excise duty when bringing these goods into a jurisdiction, either for their own use or for subsequent sale.

03

Retailers: Some jurisdictions impose excise duty on retailers or sellers of excisable goods. These businesses may need to include the duty in the sale price and remit it to the tax authority.

04

Consumers: While consumers do not directly pay excise duty, they indirectly bear the burden of this tax through increased prices on excisable goods.

Overall, excise duty is applicable to various entities involved in the production, import, sale, or consumption of excisable goods, depending on the specific regulations of each jurisdiction.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my excise duty in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your excise duty along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

Can I sign the excise duty electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your excise duty.

Can I create an eSignature for the excise duty in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your excise duty and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is excise duty?

Excise duty is a type of indirect tax that is levied on goods produced or manufactured within a country.

Who is required to file excise duty?

Businesses involved in the production or manufacture of goods that are subject to excise duty are required to file and pay the tax.

How to fill out excise duty?

Excise duty is typically filled out using a specific form provided by the tax authority, where details of the goods produced or manufactured, the quantity, and the tax rate are reported.

What is the purpose of excise duty?

The purpose of excise duty is to generate revenue for the government and to control the consumption of certain goods.

What information must be reported on excise duty?

Information such as the type of goods produced, quantity produced, applicable tax rate, and the total amount of excise duty payable must be reported.

Fill out your excise duty online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Excise Duty is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.