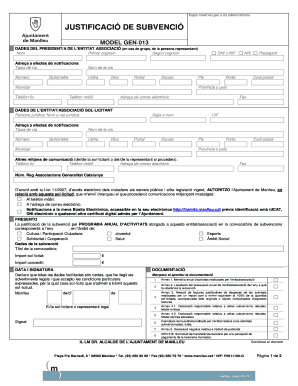

Get the free Index Annuity Application

Show details

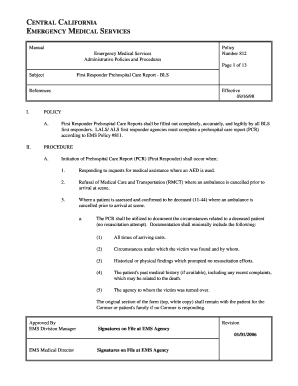

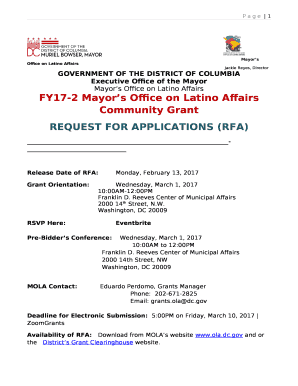

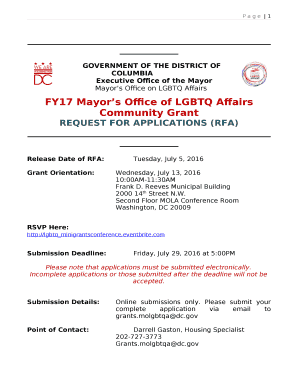

This document is an application form for purchasing an Index Annuity from Standard Insurance Company. It collects personal information from potential owners and annuitants to process their application

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign index annuity application

Edit your index annuity application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your index annuity application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing index annuity application online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit index annuity application. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out index annuity application

How to fill out Index Annuity Application

01

Begin by gathering all necessary personal information, including your name, address, date of birth, and Social Security number.

02

Identify the type of index annuity you are applying for and ensure you understand its terms and benefits.

03

Fill out the application form with your personal details accurately, following the instructions provided on the form.

04

Indicate your financial goals and risk tolerance to help the insurer assess your suitability for the product.

05

Provide information about your income, assets, and existing financial products, if required.

06

Review the disclosures and terms of the annuity carefully before signing the application.

07

Submit the completed application to the insurance company, along with any required documentation.

Who needs Index Annuity Application?

01

Individuals looking to secure their retirement income with a fixed, predictable payout.

02

Those who want a chance for growth tied to a specific market index without the risk of losing principal.

03

Investors seeking to diversify their portfolios with low-risk financial products.

Fill

form

: Try Risk Free

People Also Ask about

Who has the best fixed-indexed annuity?

10 Best Fixed Index Annuity Companies of 2024 AIG Companies (American General Life Insurance) Nationwide Life Insurance Company. American Equity Investment Life. Lincoln Financial Group (LFG) Jackson National. Global Atlantic Financial Group. Pacific Life. Great American Life Insurance Company.

What is the highest rated annuity company?

MassMutual, New York Life and Allianz are among our top picks for annuities. Annuities have seen major growth as more Americans look for ways to ensure they don't outlive their retirement savings: Total annuity sales hit a record $432.4 billion in 2024, ing to the industry research association LIMRA.

What company has the best fixed index annuity?

0:00 14:43 And so this guy's this guy wants a commission you need to run. I can't believe you just said thatMoreAnd so this guy's this guy wants a commission you need to run. I can't believe you just said that come on Dave now with all due respect when it comes to other investments.

How much does a $100,000 fixed annuity pay per month?

For example, a $100,000 immediate annuity purchased at age 65 might pay around $500 to $700 per month for life. Rates vary by provider, interest rates and optional features like survivor benefits or inflation protection.

What are the best fixed annuity rates right now?

Best Annuity Rates This Week Year. 6.00% Global Atlantic. Years. 5.25% Mountain Life Insurance Company. Years. 6.00% Mountain Life Insurance Company. Years. 5.30% Americo Financial Life and Annuity Insurance Company. Years. 6.15% Wichita National Life Insurance. Years. 5.50% Years. 5.80% Years. 5.40%

What is the downside of indexed annuities?

It's possible to lose money with a fixed index annuity, but if you do, it's likely because you have withdrawn too much or too early, and as a result, paid withdrawal charges and penalty taxes. If you leave the funds in place, your premium contributions are typically protected from losing value.

How much does a $100,000 annuity pay per month?

Best annuity companies Best for investment options: Allianz Life. Best for fixed annuities: Athene. Best for immediate income: MassMutual. Best for low-risk annuities: Gainbridge. Best for earning dividends: New York Life. Best for death benefits: Nationwide. Best for teachers: TIAA.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Index Annuity Application?

An Index Annuity Application is a form used to apply for an index-linked annuity product, which provides a combination of growth potential through market indices and a degree of principal protection.

Who is required to file Index Annuity Application?

Typically, the individual applying for the index annuity must file the application. This includes consumers seeking to invest in such financial products.

How to fill out Index Annuity Application?

To fill out an Index Annuity Application, you must provide personal information such as your name, address, financial goals, and investment history, as well as any necessary signatures and disclosures required by the financial institution.

What is the purpose of Index Annuity Application?

The purpose of the Index Annuity Application is to formalize the request to purchase an index annuity, allowing the insurance company to gather necessary information to assess eligibility and tailor products to the applicant's needs.

What information must be reported on Index Annuity Application?

The application typically requires personal identification details, financial status, investment preferences, risk tolerance, and any other relevant financial information that helps insurers determine suitability.

Fill out your index annuity application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Index Annuity Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.