Get the free Index Annuity Application

Show details

This document serves as an application for purchasing an index annuity from Standard Insurance Company, detailing required personal and financial information, beneficiary designations, and declarations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign index annuity application

Edit your index annuity application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your index annuity application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit index annuity application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit index annuity application. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out index annuity application

How to fill out Index Annuity Application

01

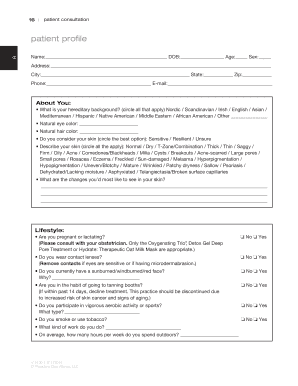

Begin by entering the applicant's personal information, including their full name, address, and contact details.

02

Fill out the financial information section, providing details on income, assets, and investment experience.

03

Select the type of index annuity being applied for, and indicate any specific features or riders desired.

04

Complete the section regarding the beneficiary information, specifying who will receive benefits in the event of the applicant's death.

05

Review all entries for accuracy and completeness before signing the application.

06

Submit the application along with any required documentation or initial premium payment to the insurance provider.

Who needs Index Annuity Application?

01

Individuals looking to secure their retirement income with a fixed or indexed return.

02

People wanting to protect their principal investment from market losses while still gaining market-linked returns.

03

Those interested in tax-deferred growth on their investment.

04

Investors seeking a long-term financial product that can provide lifetime income options.

Fill

form

: Try Risk Free

People Also Ask about

Who has the best fixed-indexed annuity?

10 Best Fixed Index Annuity Companies of 2024 AIG Companies (American General Life Insurance) Nationwide Life Insurance Company. American Equity Investment Life. Lincoln Financial Group (LFG) Jackson National. Global Atlantic Financial Group. Pacific Life. Great American Life Insurance Company.

What is the highest rated annuity company?

MassMutual, New York Life and Allianz are among our top picks for annuities. Annuities have seen major growth as more Americans look for ways to ensure they don't outlive their retirement savings: Total annuity sales hit a record $432.4 billion in 2024, ing to the industry research association LIMRA.

What company has the best fixed index annuity?

0:00 14:43 And so this guy's this guy wants a commission you need to run. I can't believe you just said thatMoreAnd so this guy's this guy wants a commission you need to run. I can't believe you just said that come on Dave now with all due respect when it comes to other investments.

How much does a $100,000 fixed annuity pay per month?

For example, a $100,000 immediate annuity purchased at age 65 might pay around $500 to $700 per month for life. Rates vary by provider, interest rates and optional features like survivor benefits or inflation protection.

What are the best fixed annuity rates right now?

Best Annuity Rates This Week Year. 6.00% Global Atlantic. Years. 5.25% Mountain Life Insurance Company. Years. 6.00% Mountain Life Insurance Company. Years. 5.30% Americo Financial Life and Annuity Insurance Company. Years. 6.15% Wichita National Life Insurance. Years. 5.50% Years. 5.80% Years. 5.40%

What is the downside of indexed annuities?

It's possible to lose money with a fixed index annuity, but if you do, it's likely because you have withdrawn too much or too early, and as a result, paid withdrawal charges and penalty taxes. If you leave the funds in place, your premium contributions are typically protected from losing value.

How much does a $100,000 annuity pay per month?

Best annuity companies Best for investment options: Allianz Life. Best for fixed annuities: Athene. Best for immediate income: MassMutual. Best for low-risk annuities: Gainbridge. Best for earning dividends: New York Life. Best for death benefits: Nationwide. Best for teachers: TIAA.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

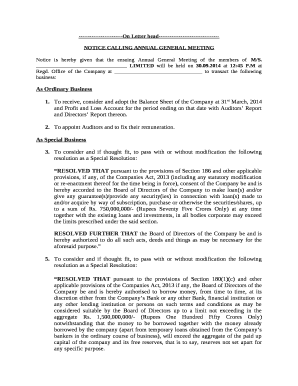

What is Index Annuity Application?

An Index Annuity Application is a financial document used to apply for an index annuity, which is a type of annuity linked to a stock market index that provides growth potential while offering some level of principal protection.

Who is required to file Index Annuity Application?

Individuals who wish to purchase an index annuity must file an Index Annuity Application, including both the annuity purchaser and any joint owners or beneficiaries.

How to fill out Index Annuity Application?

To fill out an Index Annuity Application, the applicant should provide personal information such as name, address, date of birth, financial information, and investment objectives, ensuring accuracy and completeness in all sections.

What is the purpose of Index Annuity Application?

The purpose of the Index Annuity Application is to provide the issuer with the necessary information to evaluate the applicant's eligibility for the annuity, assess suitability, and initiate the contract process.

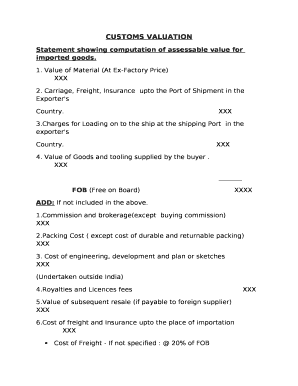

What information must be reported on Index Annuity Application?

The Index Annuity Application must report information including personal identification, financial situation, investment objectives, risk tolerance, and any existing insurance or annuity products.

Fill out your index annuity application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Index Annuity Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.