Get the free Student Technology Fee Income - FY12 - it iastate

Show details

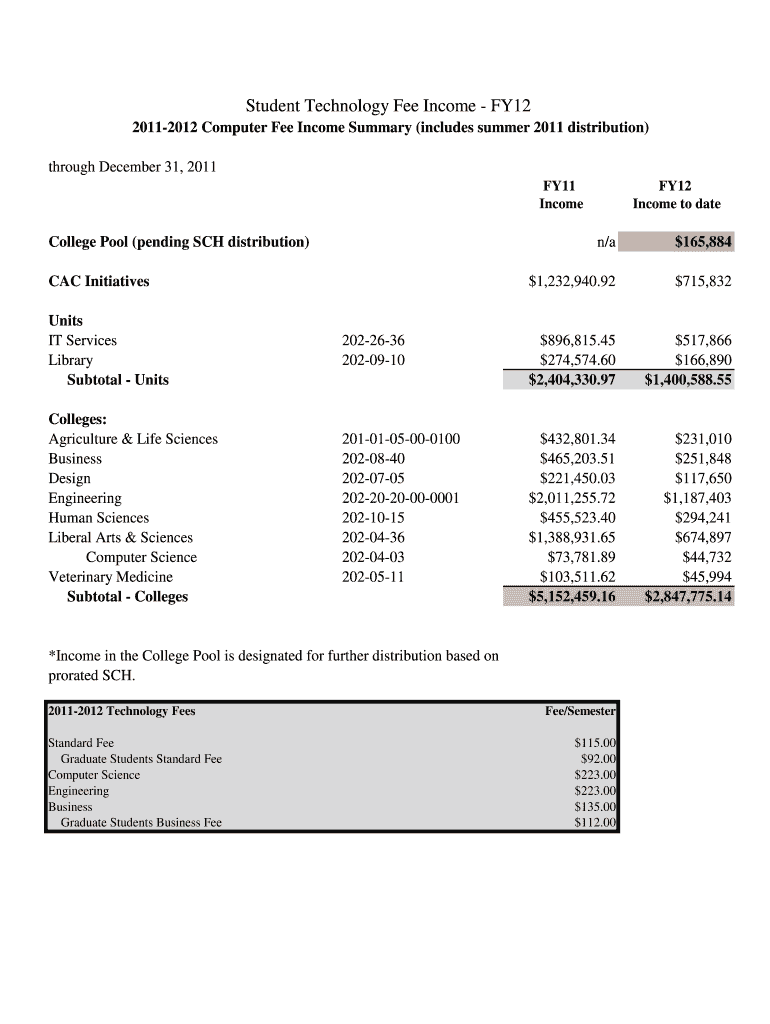

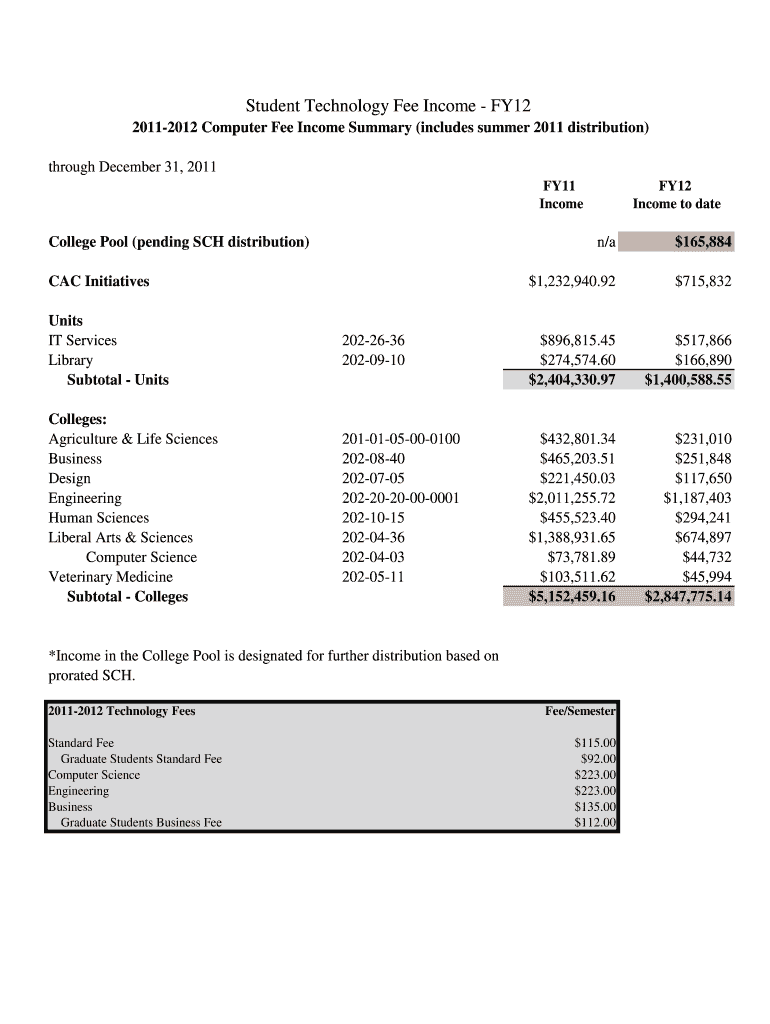

Student Technology Fee Income FY12 20112012 Computer Fee Income Summary (includes summer 2011 distribution) through December 31, 2011 FY11 Income College Pool (pending SCH distribution) FY12 Income

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign student technology fee income

Edit your student technology fee income form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your student technology fee income form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing student technology fee income online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit student technology fee income. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out student technology fee income

How to fill out student technology fee income:

Gather the necessary documents and information:

01

Identify the specific form or application required to fill out for the student technology fee income. This could be obtained from the educational institution or relevant department.

02

Collect any supporting documentation or receipts related to technology expenses that may qualify for reimbursement or financial assistance.

Read the instructions carefully:

01

Understand the guidelines and requirements provided with the form or application.

02

Pay attention to any specific deadlines or submission procedures.

Provide personal information:

Fill in your full name, contact details, student ID number, and other necessary identification information as requested.

Detail your technology expenses:

List your technology-related expenses for which you seek income or reimbursement. This may include items such as computer hardware, software, educational subscriptions, or any other technology-related costs.

Calculate the total income requested:

Determine the total amount of income you are requesting for the student technology fee. This amount should be based on the eligible expenses for which you are seeking reimbursement or financial assistance.

Attach supporting documentation:

Include all relevant receipts, invoices, or any other supporting documentation that validates your technology expenses. Make sure to follow any specified guidelines regarding the format or organization of these documents.

Review and double-check:

Carefully review the filled-out form to ensure accuracy and completeness. Verify that all required fields have been filled, and all necessary supporting documents are attached.

Who needs student technology fee income?

Students pursuing higher education:

Students enrolled in colleges, universities, or other educational institutions may need student technology fee income to help cover the costs of necessary technology for their studies.

Students with limited financial resources:

Students who come from low-income backgrounds or face financial constraints may require student technology fee income to access essential technology resources and support their educational journey.

Those with technology-related expenses:

Individuals who incur costs for technology-related items, such as computer equipment, software, internet services, or educational subscriptions, may benefit from student technology fee income to receive financial assistance or reimbursement for these expenses.

In summary, anyone pursuing higher education, facing financial challenges, and incurring technology expenses may require and be eligible for student technology fee income.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit student technology fee income online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your student technology fee income to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I edit student technology fee income on an iOS device?

Create, modify, and share student technology fee income using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

Can I edit student technology fee income on an Android device?

You can make any changes to PDF files, like student technology fee income, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is student technology fee income?

Student technology fee income is the revenue generated from fees charged to students specifically for technology-related resources and services.

Who is required to file student technology fee income?

Educational institutions and organizations that charge students for technology fees are required to file student technology fee income.

How to fill out student technology fee income?

Student technology fee income can be filled out by providing details of the revenue generated from technology fees charged to students.

What is the purpose of student technology fee income?

The purpose of student technology fee income is to fund and support technology resources and services for students.

What information must be reported on student technology fee income?

Information that must be reported on student technology fee income includes the total revenue generated from technology fees and how it was allocated to support technology resources.

Fill out your student technology fee income online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Student Technology Fee Income is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.