Get the free SHAREHOLDER RIGHTS PLAN AGREEMENT

Show details

This document is an agreement dated May 19, 2011, between Eastern Platinum Limited and Computershare Investor Services Inc., outlining the terms of a shareholder rights plan designed to protect the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign shareholder rights plan agreement

Edit your shareholder rights plan agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your shareholder rights plan agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit shareholder rights plan agreement online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit shareholder rights plan agreement. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

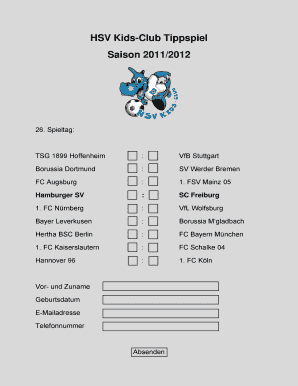

How to fill out shareholder rights plan agreement

How to fill out SHAREHOLDER RIGHTS PLAN AGREEMENT

01

Start with the title: 'SHAREHOLDER RIGHTS PLAN AGREEMENT'.

02

Define the parties involved: identify the corporation and the shareholders.

03

Specify the effective date of the agreement.

04

Outline the purpose of the shareholder rights plan.

05

Define the key terms used in the agreement, such as 'Rights', 'Shares', and 'Trigger Event'.

06

Detail the rights granted to shareholders under the agreement.

07

Specify the conditions under which the rights will be activated.

08

Include provisions for the expiration of rights.

09

Describe the procedures for amending the agreement.

10

Provide signatures for the authorized representatives of the corporation.

Who needs SHAREHOLDER RIGHTS PLAN AGREEMENT?

01

Corporations aiming to protect against hostile takeovers.

02

Shareholders seeking to ensure their rights in case of substantial changes in ownership.

03

Companies looking to enhance their governance procedures.

Fill

form

: Try Risk Free

People Also Ask about

Does a shareholder agreement need to be notarized?

No, a shareholder agreement does not typically need to be notarized to be legally binding. However, having the agreement notarized can provide an additional layer of authenticity and help prevent future disputes about the document's legitimacy.

What is a shareholders rights agreement?

Key Takeaways. A shareholders' agreement is an arrangement among a company's shareholders that describes how the company should be operated and outlines shareholders' rights and obligations. The shareholders' agreement is intended to make sure that shareholders are treated fairly and that their rights are protected.

What makes a shareholders agreement legally binding?

A shareholders agreement should be legally binding once it has been signed, provided it complies with the typical aspects of a contract, including offer, acceptance, consideration, and an intention to create legal relations.

What are the three rights of shareholders?

The three basic shareholder rights are: the right to vote, the right to receive dividends, and the right to the corporation's remaining assets upon dissolution or winding-up. Where a corporation only has one class of shares, the three basic rights must attach to that class.

Can you write your own shareholder agreement?

It might seem like a good idea to draft your own shareholders' agreement to save money but drafting your own shareholder agreement can mean that you may miss out vital clauses, which may burden your business in the future. A shareholders' agreement is a contract between the owners of a business.

Can I write my own shareholder agreement?

You're a busy entrepreneur, we understand. You may rarely have a moment to yourself. It might seem like a good idea to draft your own shareholders' agreement to save money but drafting your own shareholder agreement can mean that you may miss out vital clauses, which may burden your business in the future.

How to create a shareholder agreement?

What to Think about When You Begin Writing a Shareholder Agreement. Name Your Shareholders. Specify the Responsibilities of Shareholders. The Voting Rights of Your Shareholders. Decisions Your Corporation Might Face. Changing the Original Shareholder Agreement. Determine How Stock can be Sold or Transferred.

What is the Shareholder Rights Plan?

The goal of a shareholder rights plan is to force a bidder to negotiate with the target's board and not directly with the shareholders. The effects are twofold: It gives management time to find competing offers that maximize the selling price.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SHAREHOLDER RIGHTS PLAN AGREEMENT?

A Shareholder Rights Plan Agreement, also known as a 'poison pill,' is a strategy used by companies to prevent or discourage hostile takeovers by making their stock less attractive to potential acquirers.

Who is required to file SHAREHOLDER RIGHTS PLAN AGREEMENT?

Companies typically required to file a Shareholder Rights Plan Agreement are publicly traded corporations that wish to adopt such a plan to protect themselves from unsolicited takeover bids.

How to fill out SHAREHOLDER RIGHTS PLAN AGREEMENT?

Filling out a Shareholder Rights Plan Agreement involves drafting the agreement according to legal standards, specifying terms such as rights for shareholders, triggers for activation, and any conditions for distribution of rights.

What is the purpose of SHAREHOLDER RIGHTS PLAN AGREEMENT?

The purpose of a Shareholder Rights Plan Agreement is to protect the company from unwanted takeovers by giving existing shareholders certain rights that can dilute the ownership stakes of the acquirer.

What information must be reported on SHAREHOLDER RIGHTS PLAN AGREEMENT?

The Shareholder Rights Plan Agreement must report information such as the terms of the rights issued, the conditions triggering the rights, the rights expiration date, and details regarding shareholders’ eligibility.

Fill out your shareholder rights plan agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Shareholder Rights Plan Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.