Get the free Request for Tax Residency Certificate

Show details

This document serves as a formal request to the tax/government authority for the issuance of a Tax Residency Certificate, detailing personal information and overseas income for tax purposes.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign request for tax residency

Edit your request for tax residency form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your request for tax residency form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing request for tax residency online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit request for tax residency. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

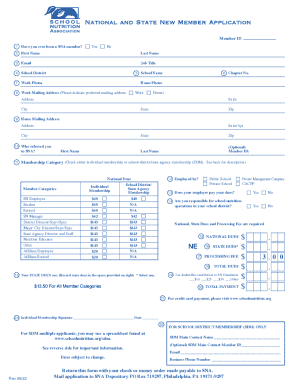

How to fill out request for tax residency

How to fill out Request for Tax Residency Certificate

01

Obtain the Request for Tax Residency Certificate form from your tax authority's website or office.

02

Fill in your personal information, including your name, address, and tax identification number.

03

Provide details about your residency status and the country you are requesting residency for.

04

Specify the purpose for which you need the Tax Residency Certificate.

05

Attach any required documentation that supports your claim, such as proof of residency.

06

Review all information for accuracy and completeness.

07

Sign and date the form before submission.

08

Submit the completed form to the relevant tax authority via mail, email, or in person as directed.

Who needs Request for Tax Residency Certificate?

01

Individuals or entities who are residents of a country and need to prove their residency for tax purposes.

02

Taxpayers who intend to benefit from tax treaties between countries.

03

People seeking to avoid double taxation on their income.

Fill

form

: Try Risk Free

People Also Ask about

How to obtain a tax residency certificate in Spain?

The application for a tax residence certificate is available online from the "All procedures", "Certificates", "Census" section. You can identify yourself with Cl@ve or with certificate or electronic DNI . Enter the requested data in the form.

What is proof of residency in Brazil?

Required Documents for a Residence Permit Valid passport; Criminal background certificates; Proof of address in Brazil; Documents supporting the reason for residence (e.g., work contract, marriage certificate, school enrollment);

How long does a U.S. residency certificate take?

Total Time: The entire process, from submission to receiving the certificate, typically takes around 45 days, provided there are no delays. Contact Information: For any questions regarding the application, applicants can call the IRS at 267-941-1000 and select the U.S. residency option.

How to obtain a U.S. tax residency certificate?

To obtain Form 6166, taxpayers must file Form 8802 (Application for U.S. Residency Certification) with the IRS. Form 8802 is used to request the Form 6166 to show certification of U.S. tax residency. Only authorized representatives can sign Form 8802.

How to get a US tax residency certificate?

To obtain Form 6166, a letter of U.S. Residency Certification, you must submit a completed Form 8802, Application for United States Residency Certification. A user fee is charged to process all Forms 8802.

What is the certificate of residence in the United States?

To obtain Form 6166, a letter of U.S. Residency Certification, you must submit a completed Form 8802, Application for United States Residency Certification. A user fee is charged to process all Forms 8802.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Request for Tax Residency Certificate?

A Request for Tax Residency Certificate is a formal application submitted by individuals or entities seeking to obtain a certificate that confirms their tax residency status in a specific country for tax purposes.

Who is required to file Request for Tax Residency Certificate?

Individuals or entities that need to provide proof of their tax residency status to foreign tax authorities or to claim benefits under a double taxation agreement are typically required to file a Request for Tax Residency Certificate.

How to fill out Request for Tax Residency Certificate?

To fill out a Request for Tax Residency Certificate, one must usually provide personal identifying information, tax identification numbers, details of residency, and sometimes the specific purpose for requesting the certificate, ensuring all required fields are accurately filled.

What is the purpose of Request for Tax Residency Certificate?

The purpose of a Request for Tax Residency Certificate is to formally document a person's or entity's residency status for tax purposes, often to avoid double taxation or to comply with international tax requirements.

What information must be reported on Request for Tax Residency Certificate?

The information that must typically be reported includes the applicant's name, tax identification number, address, details of residency, purpose for the request, and any other relevant identifiers required by the taxation authority.

Fill out your request for tax residency online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Request For Tax Residency is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.