Get the free Tender Documents for Insurance Policies

Show details

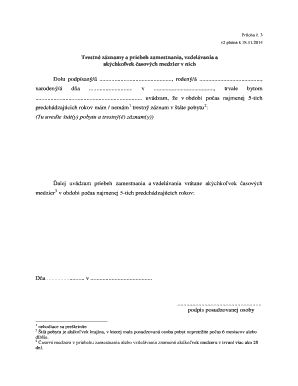

This document is a tender invitation for insurance policies by the Gujarat Mineral Development Corporation Ltd. for the year 2012-13, detailing requirements, types of insurance needed, submission

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tender documents for insurance

Edit your tender documents for insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tender documents for insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tender documents for insurance online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit tender documents for insurance. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tender documents for insurance

How to fill out Tender Documents for Insurance Policies

01

Gather all necessary information about the insurance policies needed.

02

Review the tender documents provided by the insurer for specific instructions.

03

Fill out the application section with accurate details about the organization and its insurance needs.

04

Provide information about previous insurance coverage and claims history.

05

Clearly outline the coverage limits, deductibles, and any specific endorsements required.

06

Attach supporting documents, such as financial statements or risk assessments, if needed.

07

Review the completed tender for accuracy and completeness.

08

Submit the tender documents by the specified deadline, ensuring all required signatures are included.

Who needs Tender Documents for Insurance Policies?

01

Organizations bidding for insurance policies require tender documents to formally request coverage from insurance providers.

02

Businesses looking to compare quotes from different insurers often need these documents to ensure comprehensive coverage.

03

Government entities or large corporations needing specialized insurance policies often utilize tender documents to outline specific coverage needs.

Fill

form

: Try Risk Free

People Also Ask about

What is a standard tender document?

Standard Bidding Documents, also known as tender documents or solicitation documents, are essential tools in the procurement process. These documents communicate the intent of the procurement entity to enter into contracts with suppliers, contractors, or consultants for the provision of goods, services, or works.

What to put in a tender?

The Tender Team have provided a list of documents that are often common asked for in many tenders; Occupational Health &Safety (OHS)/Work Health Safety (WHS) Policies. Insurance Certificates. CVs. Organisational Charts. Financial Information.

What documents are in a tender?

These documents usually contain the following: 1 Instructions to Tenderers (ITT) Show. 2 Specification Show. 3 Evaluation Criteria Show. 4 Terms and Conditions of the contract Show. 5 Policies Show. 6 Form of Tender Show. 7 Pricing/Costing Schedule Show. 8 Confidentiality Document Show.

What are the specifications of a tender document?

TENDER SPECIFICATIONS means the Scope of Work, Special Instructions / Conditions, Technical specifications/requirement , Appendices, Site Information and drawings pertaining to the work and any other relevant reference in the Tender Document for which the Bidder are required to submit their offer.

How to write a letter asking for a tender?

You can consider the following tips for creating and presenting a tender cover letter: Place it in the early pages of your tender. Maintain a one-page limit. Make sure you address the letter to the right person. Add a signature. Introduction. Win theme. Administrative note or guide note. Commitment note.

What is tender documentation?

In simple terms, a tender document outlines important information and instructions for participating in a procurement. The documents are provided by a buyer to potential suppliers. They outline the requirements, terms, and conditions for a specific project or contract.

How to write for a tender?

Tender loving: how to write a great tender submission Simple language. Keep it short. Answer the criteria. Transparent pricing. Stick to a template. Understand the process. Use examples. Outline your approach.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Tender Documents for Insurance Policies?

Tender Documents for Insurance Policies are formal documents that outline the terms, conditions, and requirements for selecting and procuring insurance coverage through a competitive bidding process.

Who is required to file Tender Documents for Insurance Policies?

Entities or organizations seeking to obtain insurance coverage—such as businesses, government agencies, or non-profits—are required to file Tender Documents for Insurance Policies.

How to fill out Tender Documents for Insurance Policies?

To fill out Tender Documents for Insurance Policies, one must provide accurate and complete information about the organization's insurance needs, the coverage required, and respond to each section of the tender form as specified by the issuer.

What is the purpose of Tender Documents for Insurance Policies?

The purpose of Tender Documents for Insurance Policies is to ensure a transparent and competitive process for selecting insurance providers, enabling organizations to make informed choices based on coverage, cost, and service.

What information must be reported on Tender Documents for Insurance Policies?

Tender Documents for Insurance Policies must report information such as the type of coverage needed, risk assessments, previous insurance history, budget constraints, and specific evaluation criteria for potential insurance providers.

Fill out your tender documents for insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tender Documents For Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.