Get the free fixed and variable expenses worksheet pdf

Show details

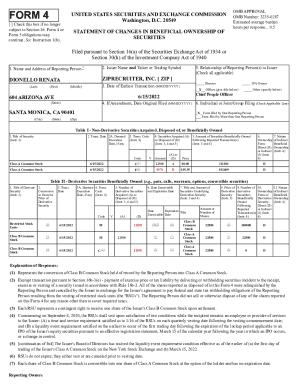

Name Date 24 Fixed and Variable Expenses Exercises 1. The fixed expenses for producing widgets are $947,900. The labor and materials required for each widget produced costs $16.44. Represent the total

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fixed and variable expenses

Edit your fixed and variable expenses form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fixed and variable expenses form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fixed and variable expenses online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit fixed and variable expenses. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fixed and variable expenses

How to fill out 2-4 fixed and variable:

01

Start by understanding the concept of fixed and variable expenses. Fixed expenses are those that remain constant month after month, such as rent or mortgage payments, while variable expenses fluctuate depending on factors like usage or consumption, such as grocery bills or utility costs.

02

Identify your fixed expenses. These are the regular expenses that you have to pay every month without fail. Examples include rent or mortgage payments, insurance premiums, subscription services, or loan payments. Make a list of these expenses along with the amount you need to pay for each.

03

Calculate your variable expenses. These are the expenses that can vary from month to month, so it's important to estimate an average amount. Examples include groceries, dining out, entertainment, transportation costs, and utility bills. Look at your past spending habits and create a budget based on your average expenses in these categories.

04

Prioritize your expenses. After listing both fixed and variable expenses, consider your financial situation and priorities. Determine which expenses are essential and must be paid first, such as rent or mortgage, utilities, and debt payments. Then, allocate the remaining funds towards your variable expenses based on importance and affordability.

Who needs 2-4 fixed and variable:

Anyone who wants to effectively manage their personal finances can benefit from understanding and filling out 2-4 fixed and variable expenses. This knowledge allows individuals or households to create a budget, track their spending, and make informed financial decisions. It is particularly useful for individuals looking to save money, pay off debts, or create a plan to achieve their financial goals. By categorizing expenses into fixed and variable, individuals can gain control over their financial situation and ensure that they are allocating their resources wisely.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify fixed and variable expenses without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like fixed and variable expenses, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

Can I create an electronic signature for signing my fixed and variable expenses in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your fixed and variable expenses and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I fill out fixed and variable expenses using my mobile device?

Use the pdfFiller mobile app to fill out and sign fixed and variable expenses. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is 2-4 fixed and variable?

2-4 fixed and variable refers to a specific type of tax form used for reporting certain financial information, including fixed and variable expenses.

Who is required to file 2-4 fixed and variable?

Individuals and businesses that have specific financial interactions related to fixed and variable costs are required to file the 2-4 fixed and variable form.

How to fill out 2-4 fixed and variable?

To fill out the 2-4 fixed and variable form, gather necessary financial data, follow the form instructions carefully, and ensure all required fields are completed accurately.

What is the purpose of 2-4 fixed and variable?

The purpose of the 2-4 fixed and variable form is to provide tax authorities with a clear overview of a taxpayer's fixed and variable expenses for accurate reporting and assessment.

What information must be reported on 2-4 fixed and variable?

The information that must be reported on the 2-4 fixed and variable form includes detailed breakdowns of both fixed and variable expenses, income sources, and any relevant deductions.

Fill out your fixed and variable expenses online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fixed And Variable Expenses is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.