Get the free Commercial Bond Application

Show details

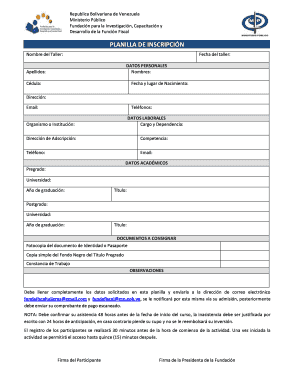

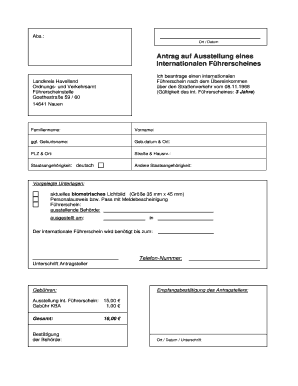

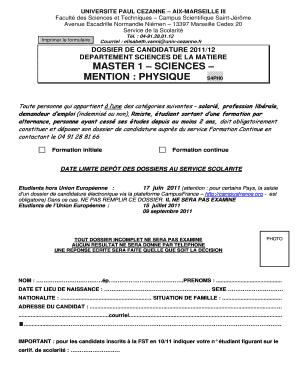

This document serves as an application for a commercial bond, detailing the information required from the applicant, including personal and business details, and confirming agreements related to indemnity

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign commercial bond application

Edit your commercial bond application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your commercial bond application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit commercial bond application online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit commercial bond application. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out commercial bond application

How to fill out Commercial Bond Application

01

Obtain the Commercial Bond Application form from the issuing authority or online.

02

Read the instructions carefully to understand the requirements.

03

Fill in your personal details including name, address, and contact information.

04

Provide business information such as business name, type, and registration details.

05

Indicate the bond amount required as specified for your particular bond type.

06

Complete any additional questions or sections related to your business and financial history.

07

Review the application for accuracy and completeness.

08

Sign and date the application where required.

09

Submit the application along with any necessary documentation and payment.

Who needs Commercial Bond Application?

01

Individuals or businesses that are required by law or regulation to post a bond for operating a specific type of business.

02

Contractors or service providers who need to guarantee their performance on projects.

03

Businesses seeking to comply with licensing requirements in certain industries.

Fill

form

: Try Risk Free

People Also Ask about

Who issues commercial bonds?

Corporate bonds are bonds issued by companies. Companies issue corporate bonds to raise money for a variety of purposes, such as building a new plant, purchasing equipment, or growing the business.

What is a commercial bond?

Also known as business bonds and commercial surety bonds, commercial bonds are agreements that protect businesses. They're generally required by state laws for various industries, and guarantee some aspect of a principal's occupation.

What is a bond application for?

A surety bond application is a form required by the surety carrier. It provides the basic information needed about the bond and the principal for the approval process. It also often serves as the legal contract between the surety carrier and the principal.

Which is an example of a corporate bond?

An example of a corporate bond would be if XYZ company wanted to raise $100 million by issuing bonds. The company's investment banker tells XYZ that it can issue 10-year bonds with an interest rate of 5%.

What is the application of English bond?

English Bond This traditional pattern is considered to be one of the strongest bonds and is commonly used for bridges and engineering projects. It requires more facing bricks than other patterns.

What is an example of a commercial bond?

Examples of commercial bonds include auto dealer bonds and mortgage broker bonds, while examples of contract bonds include performance bonds, bid bonds, and payment bonds. In essence, commercial bonds address regulatory compliance, while contract bonds address contractual performance.

What is an example of a commercial surety bond?

Lastly, there are numerous other commercial surety bonds that don't fit neatly into the categories above. These include a wide variety of bonds such as warehouse bonds, title bonds, utility bonds, and fuel tax bonds. Each of these bonds serves a unique purpose and caters to specific business requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Commercial Bond Application?

A Commercial Bond Application is a formal request for a surety bond, which acts as a guarantee that a business will fulfill its contractual obligations.

Who is required to file Commercial Bond Application?

Businesses or individuals who need a surety bond to comply with legal requirements, contracts, or licensing processes are required to file a Commercial Bond Application.

How to fill out Commercial Bond Application?

To fill out a Commercial Bond Application, gather necessary information about the business, complete the application form with accurate details, and submit it along with any required documentation.

What is the purpose of Commercial Bond Application?

The purpose of a Commercial Bond Application is to provide a pathway for obtaining a surety bond that ensures compliance with laws and contracts, thereby protecting clients and the public.

What information must be reported on Commercial Bond Application?

The information that must be reported includes the applicant's business details, type of bond required, financial statements, relevant licenses, and any past bond claims.

Fill out your commercial bond application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Commercial Bond Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.