Get the free COMPREHENSIVE PERSONAL LIABILITY APPLICATION

Show details

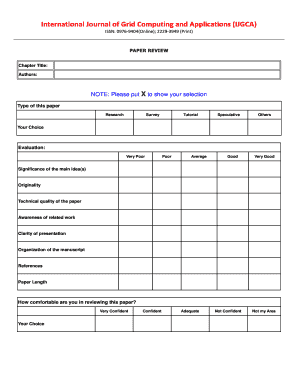

This document serves as an application for personal liability insurance, collecting applicant details, property information, and relevant coverage options.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign comprehensive personal liability application

Edit your comprehensive personal liability application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your comprehensive personal liability application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing comprehensive personal liability application online

To use the services of a skilled PDF editor, follow these steps:

1

Log into your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit comprehensive personal liability application. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out comprehensive personal liability application

How to fill out COMPREHENSIVE PERSONAL LIABILITY APPLICATION

01

Start with your personal information: Fill in your name, address, phone number, and email.

02

Provide your date of birth and social security number for identification.

03

List all household members: Include the names, relationships, and ages of all people residing in your home.

04

Describe your property: Include information about your home, any other properties, and their usage.

05

Detail your insurance history: Provide details on any previous comprehensive personal liability insurance you have held.

06

Answer questions regarding your activities: Disclose if you engage in activities that may increase risk, like owning pets or operating certain vehicles.

07

Select coverage amounts: Indicate the desired limits of liability coverage.

08

Review the application: Ensure all information is accurate and complete.

09

Submit the application: Send your completed application to the insurance provider.

Who needs COMPREHENSIVE PERSONAL LIABILITY APPLICATION?

01

Individuals who own a home or property.

02

People who have significant assets they want to protect.

03

Families with children or pets that could potentially cause harm.

04

Individuals who engage in activities that may increase their liability risk, such as hosting events or having a swimming pool.

05

Anyone seeking peace of mind from potential lawsuits or claims.

Fill

form

: Try Risk Free

People Also Ask about

What would be covered under personal liability?

Personal liability insurance is to cover your client's legal liability for accidental death, bodily injury, or illness of another person, or for accidental loss or damage to property belonging to another person.

What is an example of a comprehensive liability?

The other driver is injured, and their car is damaged. With comprehensive automobile liability insurance, the costs associated with the accident — such as medical bills for the injured driver and repairs to the damaged vehicle — will be covered by your insurance.

What is comprehensive personal liability?

Primary Comprehensive Personal Liability (CPL) is designed to provide coverage for primary and secondary residences, rentals, vacation homes, homes in course of construction, vacant homes and vacant land.

What does it mean to have personal liability?

Personal liability means that the individual's personal assets, such as their home, savings, and other possessions, may be at risk if the business is unable to meet its financial obligations. Choosing the right legal structure for the business is crucial for achieving personal liability protection.

What is excess comprehensive personal liability?

What is personal excess liability insurance? Personal excess liability insurance is a critical, yet sometimes overlooked, facet of personal risk management. This coverage acts as a safety net protecting you from major financial loss in the event of a costly liability claim or lawsuit.

What is the difference between personal umbrella and comprehensive personal liability insurance?

Comprehensive personal liability insurance is a standalone liability coverage for a variety of risks. Even if a person already has a primary policy protection program, an umbrella policy like CPL provides extra liability protection over and above the limit of the primary policy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is COMPREHENSIVE PERSONAL LIABILITY APPLICATION?

The Comprehensive Personal Liability Application is a form used to assess an individual's risk for personal liability coverage, including any potential risks or incidents that could lead to liability claims.

Who is required to file COMPREHENSIVE PERSONAL LIABILITY APPLICATION?

Individuals seeking personal liability insurance coverage, including homeowners and renters, are typically required to file a Comprehensive Personal Liability Application.

How to fill out COMPREHENSIVE PERSONAL LIABILITY APPLICATION?

To fill out the Comprehensive Personal Liability Application, applicants should provide accurate personal information, describe their property and activities, disclose any previous claims or incidents, and answer specific questions related to their liability risks.

What is the purpose of COMPREHENSIVE PERSONAL LIABILITY APPLICATION?

The purpose of the Comprehensive Personal Liability Application is to gather detailed information necessary to evaluate an individual's risk profile, determine eligibility for coverage, and set appropriate premiums for the insurance policy.

What information must be reported on COMPREHENSIVE PERSONAL LIABILITY APPLICATION?

The Comprehensive Personal Liability Application typically requires personal details such as the applicant's name, address, contact information, property details, a description of activities conducted on the property, and any history of claims or lawsuits.

Fill out your comprehensive personal liability application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Comprehensive Personal Liability Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.