Get the free SALES FROM TEMPORARY STANDS OR VEHICLES

Show details

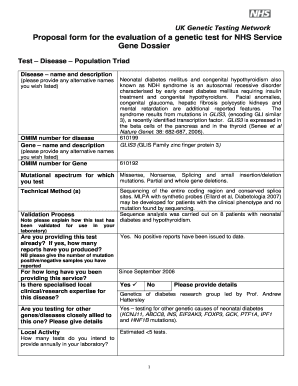

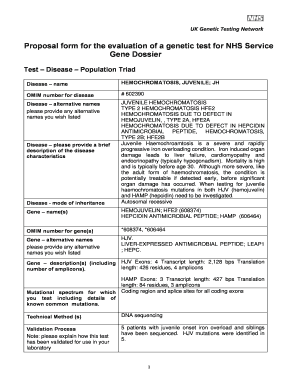

This document is used to apply for an occupational license tax and sales tax deposit for sales conducted from temporary stands or vehicles, outlining required information, obligations, and attachments.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sales from temporary stands

Edit your sales from temporary stands form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sales from temporary stands form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sales from temporary stands online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit sales from temporary stands. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sales from temporary stands

How to fill out SALES FROM TEMPORARY STANDS OR VEHICLES

01

Gather necessary documentation: Ensure you have the required permits and licenses for operating a temporary stand or vehicle in your area.

02

Determine your sales tax obligations: Check local regulations to understand how sales tax applies to your sales.

03

Record sales accurately: Keep detailed records of sales transactions, including receipts, to facilitate accurate reporting.

04

Prepare a sales report: Regularly compile sales data into a report summarizing total sales for the specified period.

05

File sales tax returns: Submit your sales tax returns along with any payment owed to the appropriate tax authority by the deadline.

06

Review compliance: Ensure that you are adhering to local health and safety regulations while operating your temporary stand or vehicle.

Who needs SALES FROM TEMPORARY STANDS OR VEHICLES?

01

Food vendors looking to sell products at fairs, festivals, or markets.

02

Entrepreneurs testing new product ideas in a low-risk environment.

03

Businesses promoting seasonal items, such as holiday decorations or summer beverages.

04

Nonprofits or community organizations fundraising through food or merchandise sales.

05

Local artisans and crafters wanting to showcase and sell their handmade goods.

Fill

form

: Try Risk Free

People Also Ask about

How long is a Texas temporary permit valid?

A One-Trip Permit is valid for a period of 15 calendar days from the effective date. A One-Trip Permit is valid for one trip only between the point of origin and the point of destination and the intermediate point as shown on the receipt. The point of origin or destination must be in Texas.

What is a temporary permit license in Texas?

A Temporary Permit allows the temporary operation of a vehicle without registration and must be purchased in person except for 72-Hour Permits and 144-Hour Permits. It cannot be used in place of regular registration. The Texas Department of Motor Vehicles offers 72-Hour, 144-Hour, 30-Day, One-Trip, and Transit Permits.

How to get temporary plates in VT?

You can apply for a 60-day temporary registration/plate that you can display on your vehicle until you are able to come into a DMV office to complete your full registration. Click the 'Apply for a Temporary Registration & Plate' link under the Vehicle Registration section.

What is a temporary permit in Texas?

TxDMV issues One-Trip Permits for the temporary movement of an unladen vehicle subject to Texas registration laws. A One-Trip Permit is valid for a period of 15 calendar days from the effective date.

What does it mean to have a permit in Texas?

A learner's permit is a provisional license that allows individuals to legally practice driving under the supervision of a licensed adult. It serves as a key first step toward earning a full driver's license, helping new drivers gain guided road experience.

What does a permit allow you to do in Texas?

Texas Learners License as a Teen Learner License - allows driving practice with a licensed adult. Provisional License - allows independent driving with some restrictions.

Does Massachusetts issue temporary plates?

If you need a temporary plate: Complete the application. Submit the application with the Master Registration and a $10.00 fee. A Temporary Plate can be issued, if needed.

How to get temporary plates in NH?

Temporary plates are available by calling 603-227-4000 or visiting the following New Hampshire Department of Motor Vehicle locations: Concord. Manchester. Milford. Nashua. Salem.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SALES FROM TEMPORARY STANDS OR VEHICLES?

SALES FROM TEMPORARY STANDS OR VEHICLES refers to the revenue generated from selling goods or services from a temporary location, such as a stand, booth, or vehicle, which is often set up for a limited period of time.

Who is required to file SALES FROM TEMPORARY STANDS OR VEHICLES?

Individuals or businesses that earn income from selling items at temporary stands or vehicles, such as food trucks, market stalls, or seasonal kiosks, are typically required to file for SALES FROM TEMPORARY STANDS OR VEHICLES.

How to fill out SALES FROM TEMPORARY STANDS OR VEHICLES?

To fill out SALES FROM TEMPORARY STANDS OR VEHICLES, report the total sales made during the specified period, provide details about the types of goods sold, and include relevant tax information as required by your jurisdiction.

What is the purpose of SALES FROM TEMPORARY STANDS OR VEHICLES?

The purpose of SALES FROM TEMPORARY STANDS OR VEHICLES is to ensure that businesses comply with tax regulations and provide transparency regarding income generated through temporary sales operations.

What information must be reported on SALES FROM TEMPORARY STANDS OR VEHICLES?

Information required to be reported includes total sales revenue, a description of the products sold, the period of sales activity, and any applicable taxes collected or owed.

Fill out your sales from temporary stands online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sales From Temporary Stands is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.