Get the free BUSINESS/COMMERCIAL SALE OR LEASE

Show details

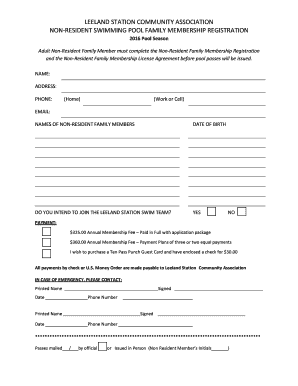

This document provides a comprehensive listing template for business or commercial properties available for sale or lease, including details on pricing, property features, and agent information.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign businesscommercial sale or lease

Edit your businesscommercial sale or lease form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your businesscommercial sale or lease form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit businesscommercial sale or lease online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit businesscommercial sale or lease. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out businesscommercial sale or lease

How to fill out BUSINESS/COMMERCIAL SALE OR LEASE

01

Begin by gathering all necessary documents related to the business or commercial property.

02

Clearly identify the parties involved in the sale or lease (buyer/lessee and seller/lessor).

03

Provide a detailed description of the property, including location, size, and any relevant features.

04

Specify the terms of the transaction, including sale price or lease amount, duration, and payment terms.

05

Include any contingencies or special conditions that may apply to the sale or lease.

06

Add any required disclosures or representations related to the property condition or legal compliance.

07

Review all information for accuracy and completeness.

08

Sign and date the document, ensuring both parties receive a copy.

Who needs BUSINESS/COMMERCIAL SALE OR LEASE?

01

Business owners looking to sell or lease their property.

02

Investors seeking to acquire commercial real estate.

03

Real estate agents representing sellers or lessors.

04

Lessees looking to secure a commercial space for business operations.

05

Legal professionals involved in real estate transactions.

Fill

form

: Try Risk Free

People Also Ask about

What is a commercial lease in the UK?

A commercial lease is a form of legally binding contract made between a business tenant - your company - and a landlord. The lease gives you the right to use the property for business or commercial activity for a set period of time. In return for this, you will pay money to the landlord.

What does TMi mean in a commercial lease?

TMI is a commercial lease agreement term meaning “taxes, maintenance, and insurance”. It's commonly found on agreements where the lessee is responsible for paying some or all of the incidental expenses (i.e. net, double net, and triple net lease agreements).

What is the difference between NNN and TMI?

The TMI includes property tax, maintenance and insurance. In a NNN (triplet net) lease, the landlord is only responsible for the structural repair and the general maintenance is the responsibility of the tenants. The tenants also pay for the property tax and property insurance.

What are the three main types of leases?

The three most common types of leases are gross leases, net leases, and modified gross leases. The Gross Lease. The gross lease tends to favor the tenant. The Net Lease. The net lease, however, tends to favor the landlord. The Modified Gross Lease.

What is TMi for?

"TMI" stands for "too much information," according to Merriam-Webster. The term is used when someone gives out private or personal information that was previously kept secret. "TMI" is also associated with the disclosure of intimate, embarrassing or inappropriate information.

What is the difference between NNN and absolute NNN?

On top of what is included in a NNN lease, an absolute net lease will also often make the tenant responsible for repairs to roofs, parking lots, lighting, etc. Absolute net leases are often long-term — many times 15 years or more – with users that want to be in the space for a long time.

What is the meaning of commercial lease in English?

Meaning of commercial lease in English a formal agreement to rent a building, vehicle, land, or property that will be used for business purposes: Almost all commercial leases contain provisions for the landlord to enter the premises for various reasons.

What are the risks of nnn?

One of the most significant risks of NNN investments is relying on a single tenant for income. In other words, the property's cash flow depends on the tenant's ability to meet lease obligations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is BUSINESS/COMMERCIAL SALE OR LEASE?

BUSINESS/COMMERCIAL SALE OR LEASE refers to the transaction involving the sale or leasing of commercial real estate properties or business assets, which may include buildings, land, equipment, or businesses themselves, typically for profit purposes.

Who is required to file BUSINESS/COMMERCIAL SALE OR LEASE?

Individuals or entities involved in the sale or leasing of business or commercial property, including property owners, businesses, or real estate professionals, are generally required to file BUSINESS/COMMERCIAL SALE OR LEASE forms with the appropriate government authority.

How to fill out BUSINESS/COMMERCIAL SALE OR LEASE?

To fill out the BUSINESS/COMMERCIAL SALE OR LEASE form, one must provide detailed information about the transaction, including property details, buyer and seller information, terms of sale or lease, and any associated financial data. The form should be completed accurately to ensure compliance with local regulations and tax requirements.

What is the purpose of BUSINESS/COMMERCIAL SALE OR LEASE?

The purpose of BUSINESS/COMMERCIAL SALE OR LEASE is to record and report transactions involving the sale or leasing of business or commercial properties, ensuring transparency, compliance with tax laws, and the proper assessment of property values for tax purposes.

What information must be reported on BUSINESS/COMMERCIAL SALE OR LEASE?

The information that must be reported on BUSINESS/COMMERCIAL SALE OR LEASE includes the property address, transaction date, sale price or lease terms, buyer and seller identification details, property description, and any relevant financial information necessary for tax assessment and regulatory compliance.

Fill out your businesscommercial sale or lease online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Businesscommercial Sale Or Lease is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.