Get the free Health Savings Account – HSA Employer Payroll Funding Application

Show details

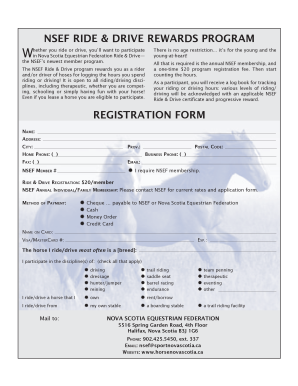

This guide provides a step-by-step manual for employers on using the Payroll On the Web system for Health Savings Accounts, including logging in, submitting payroll contributions, and managing account

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign health savings account hsa

Edit your health savings account hsa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your health savings account hsa form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing health savings account hsa online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit health savings account hsa. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out health savings account hsa

How to fill out Health Savings Account – HSA Employer Payroll Funding Application

01

Download the Health Savings Account (HSA) Employer Payroll Funding Application form from your provider's website.

02

Fill out the employer information section, including the company name, address, and contact details.

03

Provide the employee's information, including their name, Social Security number, and account number if applicable.

04

Indicate the type of funding method you will use (e.g., pre-tax payroll deduction, post-tax contributions).

05

Specify the contribution limits and frequency (e.g., weekly, bi-weekly, monthly).

06

Review the application for accuracy and completeness.

07

Sign and date the application where indicated.

08

Submit the completed application to your HSA provider as per their instructions.

Who needs Health Savings Account – HSA Employer Payroll Funding Application?

01

Employers who wish to offer Health Savings Accounts (HSAs) as part of their employee benefits package.

02

Employees looking to contribute to an HSA through payroll deductions.

03

HR departments managing employee benefits and payroll contributions.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between HSA 1099-SA and 5498-SA?

IRS form 1099-SA shows the amount of money you spent from your HSA during the tax year. IRS form 5498-SA shows the amount of money deposited into your HSA for the tax year. IRS form 8889 is the form you fill out and submit with your tax return.

How do I get my HSA form?

There are two sets of tax forms: Your annual tax Form 1099 will be mailed to the address on file by January 31 each year. Your annual tax Form 5498 will be mailed to the address on file by May 31 each year.

How much do most employers contribute to HSA?

In fact, the largest employers (1,000 employees or more) showed the lowest average contribution at $426. Similarly, for families, HSA contributions by smaller employers tended to be above the average $890 contribution, while large employers (1,000 employees or more) funded an average of $760.

Where can I find my HSA contributions?

But either way, your HSA custodian will have your back. They'll send you Form 5498-SA, showing how much you contributed to your HSA. And if you made any withdrawals, they'll also send you Form 1099-SA, showing the amount of the withdrawals. So there you have it.

What is the difference between HRA and HSA?

HSA: You can only use what you've saved. HRA: Because the employer owns these accounts, you can't directly withdraw funds to pay for qualified medical expenses or health coverage. You must incur the charge first and then file your claim for reimbursement.

What is an HSA employer?

An HSA is a savings account that lets your employees set aside money on a pre-tax basis to pay for qualified medical expenses. Further, if your employees choose to invest any of their funds in the account, interest earnings and investments are tax-free.

How do I get my HSA?

How to find an HSA financial institution Research HSA providers online. Check with your health insurance company to see if they partner with HSA financial institutions. Ask your bank if they offer an HSA option that meets your needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Health Savings Account – HSA Employer Payroll Funding Application?

The Health Savings Account – HSA Employer Payroll Funding Application is a form used by employers to facilitate the funding of health savings accounts for eligible employees through payroll deductions.

Who is required to file Health Savings Account – HSA Employer Payroll Funding Application?

Employers who wish to offer Health Savings Accounts to their employees and want to contribute or facilitate contributions through payroll deductions are required to file the Health Savings Account – HSA Employer Payroll Funding Application.

How to fill out Health Savings Account – HSA Employer Payroll Funding Application?

To fill out the Health Savings Account – HSA Employer Payroll Funding Application, employers need to provide information such as employee details, contribution amounts, and company information. Employers should ensure that they comply with IRS guidelines and include all necessary documentation.

What is the purpose of Health Savings Account – HSA Employer Payroll Funding Application?

The purpose of the Health Savings Account – HSA Employer Payroll Funding Application is to enable employers to set up a systematic way to fund employees' health savings accounts through payroll deductions, promoting the use of HSAs as a tax-advantaged way to save for medical expenses.

What information must be reported on Health Savings Account – HSA Employer Payroll Funding Application?

The Health Savings Account – HSA Employer Payroll Funding Application must report information such as employee names, Social Security numbers, contribution amounts, and the employer's information to ensure proper payroll processing and compliance with tax regulations.

Fill out your health savings account hsa online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Health Savings Account Hsa is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.