Get the free Employer Health Reimbursement Arrangement (HRA) / Flexible Spending Account (FSA) Ap...

Show details

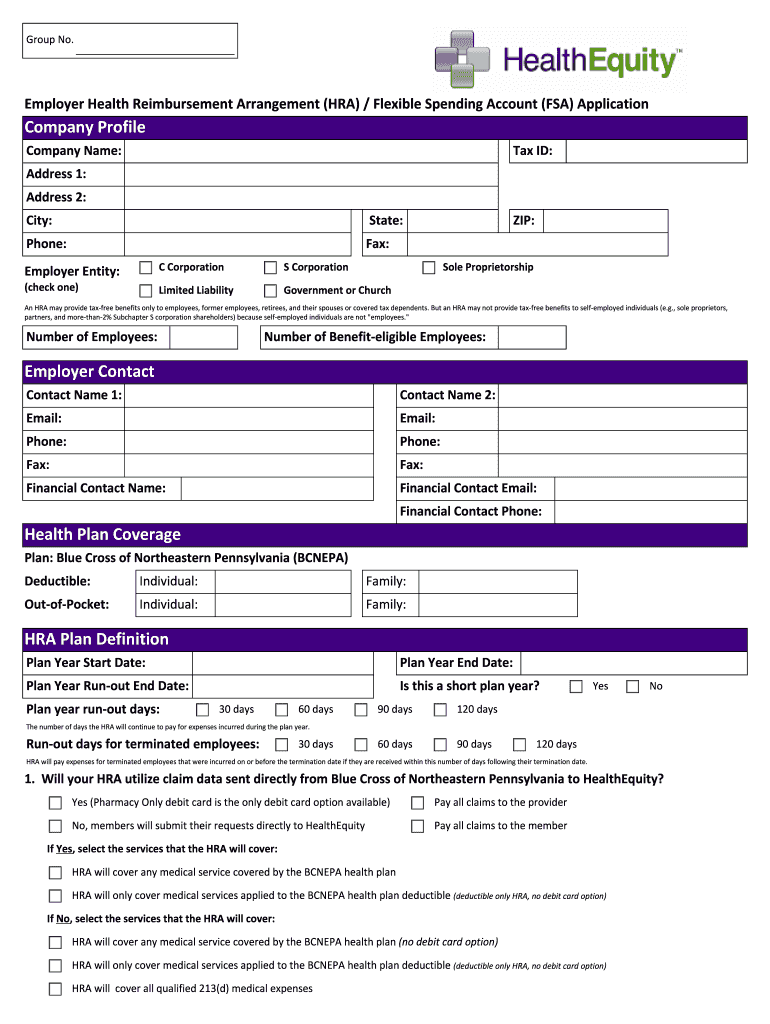

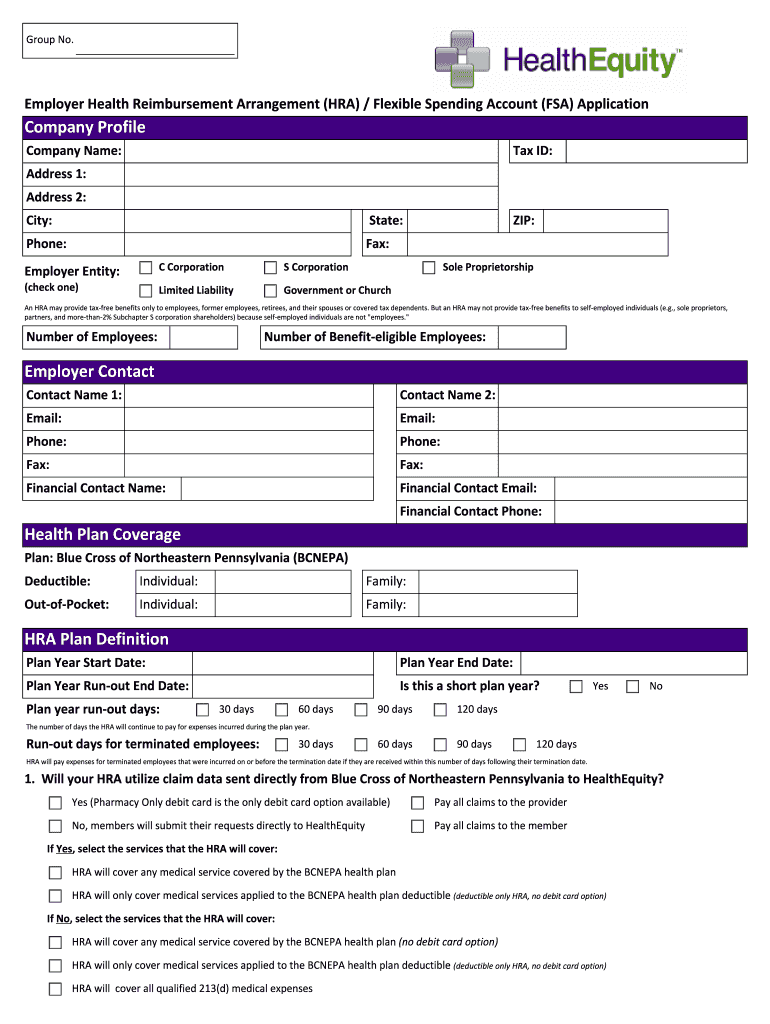

This document is an application form for employers to apply for Health Reimbursement Arrangements (HRA) and Flexible Spending Accounts (FSA) for their employees, detailing company information, health

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign employer health reimbursement arrangement

Edit your employer health reimbursement arrangement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employer health reimbursement arrangement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing employer health reimbursement arrangement online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit employer health reimbursement arrangement. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out employer health reimbursement arrangement

How to fill out Employer Health Reimbursement Arrangement (HRA) / Flexible Spending Account (FSA) Application

01

Obtain the Employer Health Reimbursement Arrangement (HRA) / Flexible Spending Account (FSA) Application form from your employer or HR department.

02

Read the instructions provided on the application to understand the requirements and eligibility.

03

Fill out your personal information including name, employee ID, and contact details.

04

Provide information about your healthcare expenses that you would like reimbursed or covered.

05

Attach any necessary documentation or receipts that support your claims, ensuring they meet the criteria specified in the application.

06

Review your application for accuracy and completeness.

07

Sign and date the application to affirm that the information provided is true and correct.

08

Submit the completed application to the designated department or online portal as instructed.

Who needs Employer Health Reimbursement Arrangement (HRA) / Flexible Spending Account (FSA) Application?

01

Employees who incur out-of-pocket medical expenses and wish to be reimbursed through their employer's health plan.

02

Individuals who want to utilize pre-tax dollars for healthcare expenses through a Flexible Spending Account.

03

Employees seeking to maximize their tax advantages related to healthcare costs.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between HSA and FSA?

The difference is that members do not keep their unused FSA money and funds may be forfeited back your employer. FSAs are generally paired with traditional health plans. An HSA lets you use pre-tax money to pay for qualified medical expenses.

What is the difference between HRA and LSA?

How is an LSA Different from a HRA? Unlike a lifestyle spending account, an HRA, or Health Reimbursement Arrangement, is only for healthcare expenses. They are employer-funded group health plans that allow employees to pay for qualifying medical bills.

What is the major disadvantage to employers of FSA plans?

Let's dive deeper into the details! Cons of Flexible Spending Accounts. “Use-It-or-Lose-It” Rule and Potential for Forfeiture. Administrative Burden and Compliance. Limited flexibility in changing contribution amounts mid-year. Complexity and Employee Understanding. Get Expert Guidance on FSAs. Related Articles.

What's the difference between a FSA and HSA?

Both HSAs and FSAs are tax-free savings accounts meant to cover healthcare costs. HSAs may provide a more flexible and portable option, but they're only available with a high-deductible health plan (HDHP). Meanwhile, FSAs have more restrictions and are typically offered as an employee benefit.

What is the difference between a health reimbursement account and a flexible spending account?

A health reimbursement account (HRA) is a fund of money in an account that your employer owns and contributes to. HRAs are only available to employees who receive health care coverage from an employer. A flexible spending account (FSA) is a spending account for different kinds of eligible expenses.

How do I know if I have an HRA?

An “HRA Letter” is sent to you by your employer and includes information you might need for individual coverage enrollment such as HRA type, dollar amount your employer will contribute, and how it can be used.

What is a disadvantage of a flexible spending account?

While flexible spending accounts can save you money, they come with some drawbacks: Use-It-Or-Lose-It Rule: Unused FSA funds are forfeited unless your employer offers a grace period or carryover option.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Employer Health Reimbursement Arrangement (HRA) / Flexible Spending Account (FSA) Application?

The Employer Health Reimbursement Arrangement (HRA) / Flexible Spending Account (FSA) Application is a form that employees use to apply for reimbursement of qualified medical expenses through employer-funded health benefit plans.

Who is required to file Employer Health Reimbursement Arrangement (HRA) / Flexible Spending Account (FSA) Application?

Employees who have incurred eligible medical expenses and wish to receive reimbursement from their employer's HRA or FSA need to file the application.

How to fill out Employer Health Reimbursement Arrangement (HRA) / Flexible Spending Account (FSA) Application?

To fill out the application, employees must provide personal information, detail the expenses being claimed, include supportive documentation such as receipts, and submit the application to the designated benefits administrator.

What is the purpose of Employer Health Reimbursement Arrangement (HRA) / Flexible Spending Account (FSA) Application?

The purpose of the application is to allow employees to request reimbursement for medical expenses that qualify under IRS guidelines, thereby helping them manage out-of-pocket healthcare costs.

What information must be reported on Employer Health Reimbursement Arrangement (HRA) / Flexible Spending Account (FSA) Application?

The information to be reported includes employee details, nature and amount of medical expenses, the date expenses were incurred, and any relevant documentation proving the expenses.

Fill out your employer health reimbursement arrangement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employer Health Reimbursement Arrangement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.