Get the free PT 38A - APPLICATION FOR PROPERTY TAX REDUCTION FROM MUNICIPAL TAXES

Show details

Este formulario es una solicitud para la reducción del impuesto a la propiedad de los impuestos municipales para personas mayores y discapacitadas en Dakota del Sur.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pt 38a - application

Edit your pt 38a - application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pt 38a - application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pt 38a - application online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit pt 38a - application. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pt 38a - application

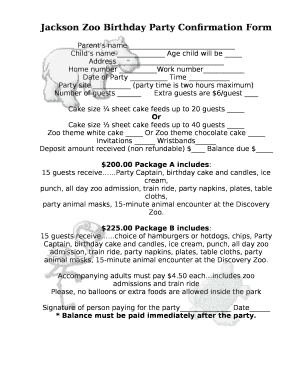

How to fill out PT 38A - APPLICATION FOR PROPERTY TAX REDUCTION FROM MUNICIPAL TAXES

01

Obtain the PT 38A form from your local municipality's website or office.

02

Fill in your personal information, including full name, address, and contact details.

03

Provide information about your property, including its location, type, and current assessed value.

04

Specify the reasons for requesting a property tax reduction, including any financial hardships or special circumstances.

05

Attach any required documentation, such as proof of income, tax returns, or other relevant financial records.

06

Review your application to ensure all information is accurate and complete.

07

Sign and date the application form.

08

Submit the completed PT 38A form and accompanying documents to your local municipality's tax office by the specified deadline.

Who needs PT 38A - APPLICATION FOR PROPERTY TAX REDUCTION FROM MUNICIPAL TAXES?

01

Homeowners or property owners experiencing financial hardship.

02

Individuals seeking to reduce their municipal property taxes.

03

People who believe their property's assessed value is higher than its market value.

04

Residents who qualify for specific exemptions or reductions under local tax laws.

Fill

form

: Try Risk Free

People Also Ask about

Who qualifies for tax exemption in California?

State Income Tax A “tax-exempt” entity is a corporation, unincorporated association, or trust that has applied for and received a determination letter from the Franchise Tax Board stating it is exempt from California franchise and income tax (California Revenue and Taxation Code Section 23701).

How do I get property tax exemption in California?

To claim the exemption, the homeowner must make a one-time filing with the county assessor where the property is located. The claim form, BOE-266, Claim for Homeowners' Property Tax Exemption, is available from the county assessor.

How can I reduce my property tax in California?

Lower My Property Taxes Decline In Value / Prop 8. Calamity / Property Destroyed. Disabled Veterans' Exemption. Homeowners' Exemption. Nonprofit Exemptions. Transfers Between Family Members. Transfer of Base Year Value to Replacement Dwelling. Assessment Appeal.

What is a $12000 property tax exemption in California?

Veterans who have a 100 percent disability rating or are deemed unemployable may qualify for a full property tax exemption on their primary residence. Veterans with a lower disability rating can exempt $5,000 to $12,000 of the appraised value on their home, depending on the disability rating.

How to apply for a property tax exemption in California?

Obtain the claim form from the County Assessor's office where the property is located. Submit the completed form to the same office. Once the exemption has been granted, it remains effective until a change in eligibility occurs, such as selling or moving out of the home. Annual filing is not required.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is PT 38A - APPLICATION FOR PROPERTY TAX REDUCTION FROM MUNICIPAL TAXES?

PT 38A is a form used by property owners to apply for a reduction in their municipal property taxes due to qualifying circumstances, such as financial hardship or other eligible criteria.

Who is required to file PT 38A - APPLICATION FOR PROPERTY TAX REDUCTION FROM MUNICIPAL TAXES?

Property owners who believe they qualify for a reduction in their municipal property taxes based on specific criteria must file PT 38A.

How to fill out PT 38A - APPLICATION FOR PROPERTY TAX REDUCTION FROM MUNICIPAL TAXES?

To fill out PT 38A, applicants should provide their personal information, property details, the reason for the reduction request, and any supporting documentation required by the municipality.

What is the purpose of PT 38A - APPLICATION FOR PROPERTY TAX REDUCTION FROM MUNICIPAL TAXES?

The purpose of PT 38A is to allow property owners to formally request a reduction in their property taxes based on financial needs or other qualifying factors recognized by local tax authorities.

What information must be reported on PT 38A - APPLICATION FOR PROPERTY TAX REDUCTION FROM MUNICIPAL TAXES?

The PT 38A form requires personal identification, property address, evidence supporting the request for tax reduction, and any financial information deemed necessary to evaluate the application.

Fill out your pt 38a - application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pt 38a - Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.