Get the free Maine Estate Tax Statement of Value for Lien Discharge

Show details

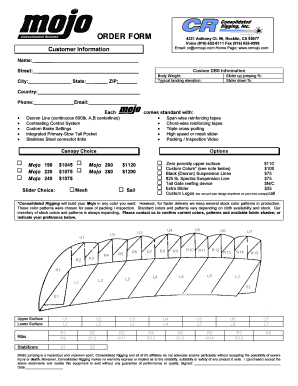

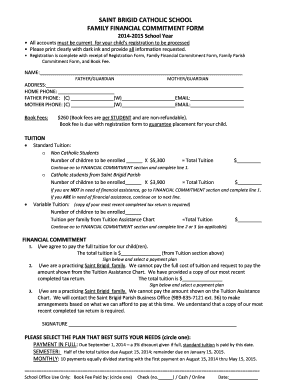

This document is designed for certain nontaxable estates to request a release of the automatic lien imposed on Maine property at the time of a person’s death, if the gross estate is $2 million or

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign maine estate tax statement

Edit your maine estate tax statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your maine estate tax statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing maine estate tax statement online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit maine estate tax statement. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out maine estate tax statement

How to fill out Maine Estate Tax Statement of Value for Lien Discharge

01

Obtain the Maine Estate Tax Statement of Value form from the Maine Revenue Services website or local office.

02

Fill in the decedent's name and date of death at the top of the form.

03

Provide the fiscal year and other identifying information as required.

04

List all assets of the estate in the provided sections, including real estate, bank accounts, stocks, and other properties.

05

Assign a fair market value to each asset on the date of death.

06

Include any deductions or liabilities that apply to the estate, such as debts and funeral expenses.

07

Complete the total value section, summing up all assets and deductions.

08

Sign and date the form, ensuring it is completed accurately.

09

Submit the form along with any required documents to the Maine Revenue Services to obtain the lien discharge.

Who needs Maine Estate Tax Statement of Value for Lien Discharge?

01

The executor or personal representative of the estate must file the Maine Estate Tax Statement of Value for Lien Discharge to clear any estate tax liens before property can be transferred or sold.

Fill

form

: Try Risk Free

People Also Ask about

What is the maximum you can inherit before paying taxes?

While state laws differ for inheritance taxes, an inheritance must exceed a certain threshold to be considered taxable. For federal estate taxes as of 2024, if the total estate is under $13.61 million for an individual or $27.22 million for a married couple, there's no need to worry about estate taxes.

What is the estate tax exemption in Maine?

Maine Estate Tax Exemption The estate tax threshold for Maine is $7 million in 2025. If your estate is worth less than that, Maine won't charge estate tax on it. If it is worth more than that, you'll owe a percentage of the estate to the government based on a series of progressive rates.

How much can you inherit without paying taxes in Maine?

Inheritance and Estate Taxes in Maine Heirs won't have to file a state estate tax return if the value of the estate is worth less than $7 million, because the 2025 estate tax threshold for Maine is $7 million. That means if you die and your total estate is worth less than $7 million, Maine won't collect any tax.

What is the estate tax lien in Maine?

The Maine estate tax lien applies to real estate that was formerly owned by the decedent, who during lifetime had granted the real estate and (1) retained up to death a life estate or other life interest, such as a lease, or (2) made such gift of an interest in real estate less than one year from date of death but does

What is the most you can inherit without paying taxes?

In the current tax year (2025/26), everyone has an Inheritance Tax-free allowance of £325,000, with 40% normally charged on any amount above that. However, this Inheritance Tax-free allowance increases to £500,000 for anyone who leaves their home to their 'direct descendants'.

Is there capital gains tax on inherited property in Maine?

Inheritance Tax: There are only a handful of states that impose an inheritance tax. Fortunately, Maine isn't one of them. Capital Gains Tax: If the inherited property increases in value between the date of death and the sale date, you will most likely owe capital gains taxes on the amount of appreciation.

Do I have to file a Maine estate tax return?

If you die while a resident of Maine, the personal representative or executor of your estate must file the Maine estate tax return if your "gross estate" plus all taxable gifts you made in the year before your death add up to more than $7 million. (Smaller estates won't need to file the return.)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Maine Estate Tax Statement of Value for Lien Discharge?

The Maine Estate Tax Statement of Value for Lien Discharge is a document used to report the value of an estate for the purpose of discharging a lien related to estate taxes.

Who is required to file Maine Estate Tax Statement of Value for Lien Discharge?

The personal representative of the estate or the individual responsible for settling the estate is required to file the Maine Estate Tax Statement of Value for Lien Discharge.

How to fill out Maine Estate Tax Statement of Value for Lien Discharge?

To fill out the Maine Estate Tax Statement of Value for Lien Discharge, one must provide information about the decedent, the value of the estate, and details regarding any tax liabilities, following the guidelines provided by the Maine Revenue Services.

What is the purpose of Maine Estate Tax Statement of Value for Lien Discharge?

The purpose of the Maine Estate Tax Statement of Value for Lien Discharge is to provide the state with necessary information to assess estate taxes owed and to officially discharge the lien placed on the estate assets.

What information must be reported on Maine Estate Tax Statement of Value for Lien Discharge?

The information that must be reported includes the decedent's name and date of death, the total value of the estate, details of assets and liabilities, tax identification numbers, and any previous estate tax returns filed.

Fill out your maine estate tax statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Maine Estate Tax Statement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.