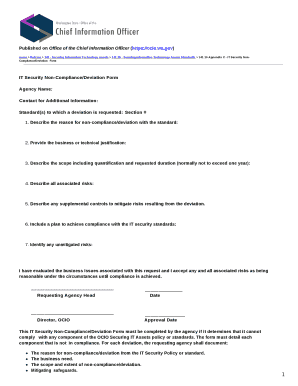

Get the free Georgia Nonresident Composite Tax Return

Show details

This document serves as a tax return form for nonresident partners and shareholders in Georgia, intended for reporting income and calculating taxes for the tax year 2012.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign georgia nonresident composite tax

Edit your georgia nonresident composite tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your georgia nonresident composite tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing georgia nonresident composite tax online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit georgia nonresident composite tax. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out georgia nonresident composite tax

How to fill out Georgia Nonresident Composite Tax Return

01

Gather necessary documents, including income statements and other relevant financial information for all members of the composite return.

02

Obtain Form 500-CR, which is the Georgia Nonresident Composite Tax Return.

03

Complete the identification section, including the name and address of the entity filing the return.

04

List all participating nonresident members of the entity, including their IDs and share of income.

05

Calculate the Georgia taxable income by determining the proportion of income sourced from Georgia.

06

Apply the appropriate tax rates to the Georgia taxable income to compute the total tax owed.

07

Complete the payment details, including any prepayments or credits that may reduce the tax owed.

08

Review and verify all information for accuracy before submitting.

09

Sign and date the return, and send it to the Georgia Department of Revenue.

Who needs Georgia Nonresident Composite Tax Return?

01

Entities that have nonresident members earning income from Georgia sources.

02

Partnerships, S corporations, and LLCs with nonresident owners who opt to file as a composite group.

03

Nonresident individuals who earn income in Georgia and prefer to have the entity handle their tax obligations collectively.

Fill

form

: Try Risk Free

People Also Ask about

Does Georgia not tax resident individuals on their foreign source income?

Residents are taxed on their worldwide income. Non-residents are taxed only on their Georgian- sourced income. The income tax rate is 20 percent.

Do I need to file a nonresident Georgia tax return?

Nonresidents, who work in Georgia or receive income from Georgia sources and are required to file a federal income tax return, are required to file a Georgia income tax return.

Does Georgia allow nol carryback?

Yes, Georgia allows a state net operating loss (NOL) deduction. The deduction is for NOL carryovers and allowed federal carrybacks after adjustments to federal taxable income and to the extent the loss is attributable to operations in Georgia.

Who gets the $250 Georgia refund?

Here's who's eligible An individual filer's refund amount will depend on their tax liability from the 2023 tax year and is capped at: $250 for single filers and married individuals filing separately. $375 for head of household filers. $500 for married individuals filing jointly.

Does Georgia allow composite returns?

As an alternative to withholding on nonresident partners, shareholders or members, the Partnership, S Corporation or Limited Liability Company may file a composite return. Permission is not required.

Who must file GA Form 700?

Form 700 Partnership Tax Return applies to: Businesses are required to file a Georgia Income Tax Return Form 700 if your business is required to file a Federal Income Tax Form 1065 and your business: Owns property or does business in Georgia. Has income from Georgia sources; or. Has members domiciled in Georgia.

Does Georgia have a 183 day rule?

A Georgian resident for the entire current tax year shall be a natural person who has actually stayed in the territory of Georgia for 183 or more days in any continuous 12-calendar-month period ending in that tax year, or a natural person who was in a foreign country in the public service of Georgia during that tax

Does Georgia have a state return?

You must file a Georgia tax return if your income exceeds the standard deduction listed below: Married Filing Jointly, $24,000. Single, $12,000. Married Filing Separately, $12,000.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Georgia Nonresident Composite Tax Return?

The Georgia Nonresident Composite Tax Return is a tax return that allows certain pass-through entities, like partnerships or S corporations, to file a composite income tax return on behalf of their nonresident members or shareholders who have income sourced from Georgia.

Who is required to file Georgia Nonresident Composite Tax Return?

Entities that have nonresident members or shareholders earning income from Georgia sources are required to file the Georgia Nonresident Composite Tax Return on behalf of those individuals, unless the individual chooses to file their own Georgia tax return.

How to fill out Georgia Nonresident Composite Tax Return?

To fill out the Georgia Nonresident Composite Tax Return, entities should gather all income, deductions, and tax credits related to the nonresident members, complete the proper forms including the Composite Tax Return Form 600, and provide the necessary details regarding income allocations and tax calculations.

What is the purpose of Georgia Nonresident Composite Tax Return?

The purpose of the Georgia Nonresident Composite Tax Return is to simplify tax compliance for nonresident individuals by allowing the entity to remit taxes on their behalf, ensuring that Georgia tax obligations are met efficiently.

What information must be reported on Georgia Nonresident Composite Tax Return?

The Georgia Nonresident Composite Tax Return must report the nonresident members’ income sourced from Georgia, deductions, tax credits, and any other relevant financial information that applies to the entity's operations in Georgia for the tax year.

Fill out your georgia nonresident composite tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Georgia Nonresident Composite Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.