Get the free Form QBA

Show details

Este formulario se utiliza para solicitar la designación como un negocio calificado con el fin de emitir instrumentos de capital o deuda subordinada que califiquen para el crédito fiscal de inversiones

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form qba

Edit your form qba form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form qba form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form qba online

To use the services of a skilled PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form qba. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

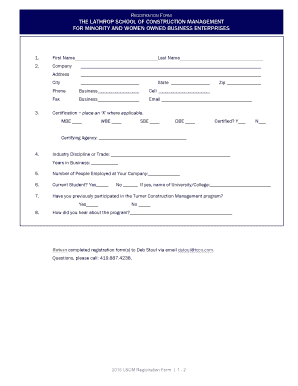

How to fill out form qba

How to fill out Form QBA

01

Obtain a copy of Form QBA from the relevant authority or download it from their website.

02

Read the instructions provided with the form carefully to understand its purpose.

03

Fill out your personal information in the designated fields, including your name, address, and contact details.

04

Provide details about the business-related activities that the form requires.

05

Attach any necessary supporting documents as specified in the instructions.

06

Review all the information entered to ensure accuracy and completeness.

07

Sign and date the form in the required section.

08

Submit the completed form either electronically or by mail as directed in the instructions.

Who needs Form QBA?

01

Individuals or businesses engaged in certain financial activities that must report income or expenses.

02

Taxpayers who are required to disclose specific information to the tax authorities.

03

Anyone who is applying for tax benefits related to business activities.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between a QBA and a BCBA?

BCBA certification covers a broader range of ABA applications, including organizational behavior management, education, and clinical behavior analysis, in addition to autism-focused practice. QBA certification is more focused on autism and developmental disabilities, which may lead to more specialization in this area.

What is a QBA degree?

The Qualified Applied Behavior Analysis Credentialing Board (QABA), Qualified Behavior Analyst (QBA) is an advanced credential that validates the competency of professionals working with individuals with autism and related disorders.

What are the requirements for QBA?

Must have completed 270 hours of approved coursework (18 semester credits), including 20 hours of supervision coursework (master's degree in ABA, Psychology, Special education, or a related field). 20 hrs. of coursework must be in ethics and 20 hours in autism core knowledge.

What is the full form of QBA?

Quantitative Business Analysis (QBA) Courses.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form QBA?

Form QBA is a tax form used to report Qualified Business Income (QBI) to the IRS. It is designed for taxpayers who qualify for the pass-through deduction on their business income.

Who is required to file Form QBA?

Individuals, partnerships, S corporations, estates, and trusts that have income from a qualified business and are eligible for the qualified business income deduction are required to file Form QBA.

How to fill out Form QBA?

To fill out Form QBA, gather your business income information, complete the required sections including income, expenses, and deductions, and ensure to calculate your qualified business income deduction accurately before submitting it to the IRS.

What is the purpose of Form QBA?

The purpose of Form QBA is to report the income, deductions, and expenses related to qualified business activities to determine eligibility for the qualified business income deduction under IRC Section 199A.

What information must be reported on Form QBA?

Form QBA must report the taxpayer's business income, deductible expenses, details about qualified trades or businesses, and the calculations used to determine the qualified business income deduction.

Fill out your form qba online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Qba is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.