Get the free 2012 MICHIGAN Corporate Income Tax Small Business Alternative Credit

Show details

Este formulario permite a los contribuyentes calcular el Crédito Alternativo para Pequeñas Empresas en Michigan. El crédito se calcula aquí y luego se lleva a la Declaración Anual del CIT (Formulario

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2012 michigan corporate income

Edit your 2012 michigan corporate income form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2012 michigan corporate income form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2012 michigan corporate income online

Follow the steps below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2012 michigan corporate income. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2012 michigan corporate income

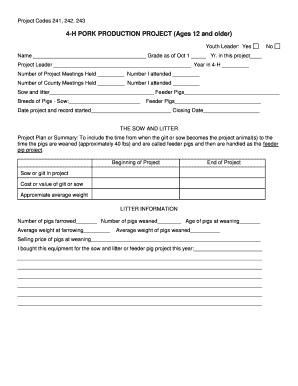

How to fill out 2012 MICHIGAN Corporate Income Tax Small Business Alternative Credit

01

Obtain the 2012 Michigan Corporate Income Tax form from the Michigan Department of Treasury website.

02

Complete the basic information sections, including your Business Name, Address, and Federal Employer Identification Number (FEIN).

03

Calculate your business's total gross receipts to determine if you qualify for the Small Business Alternative Credit.

04

Review the eligibility criteria for the Small Business Alternative Credit, ensuring your business qualifies.

05

Complete the Small Business Alternative Credit calculation section on the form, providing necessary financial data.

06

Attach any required documentation that supports your credit claim, such as tax returns or financial statements.

07

Review the entire form for accuracy and completeness.

08

Submit the completed form to the Michigan Department of Treasury by the due date.

Who needs 2012 MICHIGAN Corporate Income Tax Small Business Alternative Credit?

01

Businesses operating in Michigan with gross receipts below a certain threshold as defined by the 2012 Corporate Income Tax guidelines.

02

Small businesses that are structured as corporations or are subject to Michigan corporate regulations.

03

Entities looking to reduce their overall tax liability through available credits under the 2012 Corporate Income Tax legislation.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between CIT and MBT in Michigan?

Filing Requirements The CIT replaces the Michigan Business Tax; however, MBT taxpayers who have received or been assigned certain certificated credits may elect to continue to file under the MBT rather than the new CIT in order to claim such credits.

Who does the corporate alternative minimum tax apply to?

The CAMT applies to firms with an average of $1 billion or more in profits in any three-year period and to foreign-parented U.S. firms with profits of over $100 million if the aggregated foreign group has over $1 billion in profits.

What is the Michigan CIT payment?

Michigan Corporate Income Tax (CIT) The CIT imposes a 6% corporate income tax on C corporations and taxpayers taxed as corporations federally.

What is the corporate income tax small business alternative credit in Michigan?

Eligible businesses receive a lower tax rate under the Small Business Alternative Credit. Instead of paying the standard 6% Corporate Income Tax, qualified businesses pay a reduced rate of 1.8%. This significant reduction helps small businesses keep more of their earnings.

What is the corporate tax rate in Michigan?

Michigan Tax Rates, Collections, and Burdens Michigan has a 6.0 percent corporate income tax rate. Michigan also has a 6.00 percent state sales tax rate. Michigan has a 1.24 percent effective property tax rate on owner-occupied housing value.

What is the Michigan corporate income tax CIT?

Michigan Corporate Income Tax (CIT) The CIT imposes a 6% corporate income tax on C corporations and taxpayers taxed as corporations federally. The CIT has one credit, the small business alternative credit, which offers an alternate tax rate of 1.8% of adjusted business income.

Who must file a Michigan corporate tax return?

The Corporate Income Tax (CIT) has a flat rate of 6% and has to be filed by profit corporations in the state of Michigan. This is one of the important Michigan Corporation taxes and will not be applicable if the apportioned gross receipts are less than $350,000.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2012 MICHIGAN Corporate Income Tax Small Business Alternative Credit?

The 2012 Michigan Corporate Income Tax Small Business Alternative Credit is a tax credit designed to provide financial relief to small businesses by reducing their corporate income tax liabilities.

Who is required to file 2012 MICHIGAN Corporate Income Tax Small Business Alternative Credit?

Small businesses that qualify under the Michigan Corporate Income Tax regulations and have incurred eligible expenses or meet specific income thresholds are required to file for the 2012 Michigan Corporate Income Tax Small Business Alternative Credit.

How to fill out 2012 MICHIGAN Corporate Income Tax Small Business Alternative Credit?

To fill out the 2012 Michigan Corporate Income Tax Small Business Alternative Credit, businesses should gather necessary financial documents, accurately complete the prescribed forms including details of qualifying income and expenses, and submit the forms according to state guidelines.

What is the purpose of 2012 MICHIGAN Corporate Income Tax Small Business Alternative Credit?

The purpose of the 2012 Michigan Corporate Income Tax Small Business Alternative Credit is to encourage small business growth and economic development by providing tax relief and incentives for eligible small businesses within the state.

What information must be reported on 2012 MICHIGAN Corporate Income Tax Small Business Alternative Credit?

Businesses must report information including total corporate income, qualifying business expenses, details of employment and wages paid, and any other specific financial information required by the Michigan Department of Treasury to assess eligibility for the credit.

Fill out your 2012 michigan corporate income online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2012 Michigan Corporate Income is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.