Get the free SALE OF PARTNERSHIP TO CORPORATION

Show details

This Agreement outlines the terms for the sale of a partnership to a corporation, including the purchase price, warranties, and conditions precedent to the sale. It governs the rights and obligations

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sale of partnership to

Edit your sale of partnership to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sale of partnership to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sale of partnership to online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit sale of partnership to. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

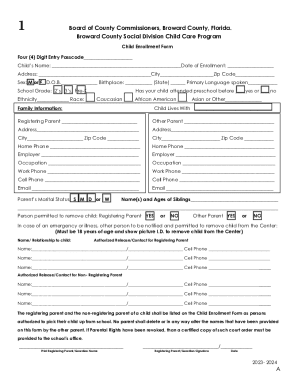

How to fill out sale of partnership to

How to fill out SALE OF PARTNERSHIP TO CORPORATION

01

Gather all necessary information about the partnership and the corporation.

02

Outline the terms of the sale, including the sale price and how it will be paid.

03

Draft a formal agreement that includes details such as the assets being sold, the liabilities being transferred, and any conditions required for the sale.

04

Have all partners review and sign the agreement.

05

File any necessary paperwork with relevant government agencies to officially record the sale.

06

Notify creditors and other stakeholders about the change in ownership.

Who needs SALE OF PARTNERSHIP TO CORPORATION?

01

Any partnership that is transitioning its business structure to a corporation.

02

Partners looking to formalize the sale of their ownership interest to a corporate entity.

03

Businesses valuing their tax benefits and liabilities in a corporate structure.

Fill

form

: Try Risk Free

People Also Ask about

What is the 7 year rule for partnerships?

If Sec. 704(c) property is distributed "by the partnership (other than to the contributing partner) within 7 years of being contributed," the contributing partner will recognize gain or loss equal to the amount of gain or loss the contributing partner would be allocated under Sec.

What happens when a partnership converts to a corporation?

The Partnership's assets are distributed by the Partnership to its partners in termination of the Partnership, followed by the contribution of assets by the partners to the corporation in exchange for the corporation's stock.

What happens when a partnership is sold?

In a transaction to purchase the units of a partnership, the buyer acquires the ownership shares of the company from the seller(s) and become the legal owners of the entity. The entity continues to operate as it has but under new ownership.

How is the sale of a partnership taxed?

If a partnership holds IRC 751(a) property at the time of the sale, the partner recognizes gain or loss from its share of IRC 751(a) assets. The ordinary gain or loss is subtracted from the total gain or loss. The result is the partner's capital gain or loss from the sale.

What happens when you sell a partnership?

If a partnership holds IRC 751(a) property at the time of the sale, the partner recognizes gain or loss from its share of IRC 751(a) assets. The ordinary gain or loss is subtracted from the total gain or loss. The result is the partner's capital gain or loss from the sale.

What is the sale of partnership firm to a company?

A partnership firm is sold to the purchasing company for a price known as "purchase Consideration". In other words, the term "Purchase Consideration" indicates the amount payable by the purchasing company to the vendor firm for taking over its assets and liabilities.

What is the 7 year rule for partnerships?

If Sec. 704(c) property is distributed "by the partnership (other than to the contributing partner) within 7 years of being contributed," the contributing partner will recognize gain or loss equal to the amount of gain or loss the contributing partner would be allocated under Sec.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SALE OF PARTNERSHIP TO CORPORATION?

The sale of a partnership to a corporation refers to the process where the assets and liabilities of a partnership are transferred to a corporation, effectively converting the partnership into a corporate structure.

Who is required to file SALE OF PARTNERSHIP TO CORPORATION?

The partners of the partnership who are transferring their interests to the corporation are required to file the necessary documentation for the sale of partnership to corporation.

How to fill out SALE OF PARTNERSHIP TO CORPORATION?

To fill out the sale of partnership to corporation form, the partners must provide detailed information about the partnership, including its assets and liabilities, any gains or losses incurred, and other pertinent details that reflect the transaction.

What is the purpose of SALE OF PARTNERSHIP TO CORPORATION?

The purpose of the sale of partnership to corporation is to facilitate the legal transition of partnership assets to a corporate entity, allowing for limited liability, easier capital raising, and potentially beneficial tax treatment.

What information must be reported on SALE OF PARTNERSHIP TO CORPORATION?

The information that must be reported includes the names of the partners, details of the partnership agreement, description of assets and liabilities being transferred, and the terms of the sale, including any consideration exchanged.

Fill out your sale of partnership to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sale Of Partnership To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.