Get the free LISTING APPLICATION NEW CLASS OF SECURITIES (FEDERAL FORMS)

Show details

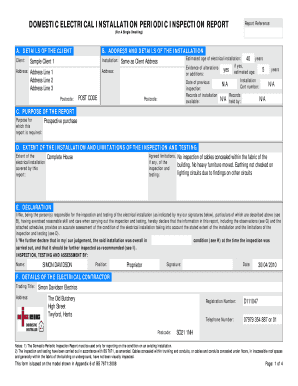

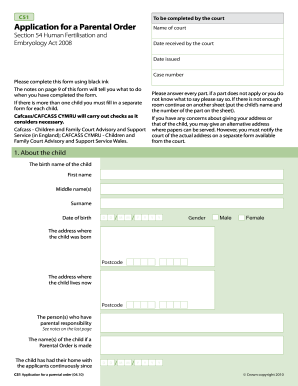

This document outlines the federal forms for additional listing applications in relation to new classes of securities on NASDAQ, providing details on filling out and submitting the forms.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign listing application new class

Edit your listing application new class form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your listing application new class form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing listing application new class online

Follow the steps down below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit listing application new class. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out listing application new class

How to fill out LISTING APPLICATION NEW CLASS OF SECURITIES (FEDERAL FORMS)

01

Download the Listing Application New Class of Securities from the official regulatory website.

02

Read the instructions provided with the form carefully to understand the requirements.

03

Fill in your company's name and details in the designated sections.

04

Specify the type of securities you are listing and provide all relevant details.

05

Include financial statements and any required supporting documents with the application.

06

Review the application for completeness and accuracy before submission.

07

Submit the application through the prescribed method (online or via mail) as indicated in the instructions.

08

Pay any applicable fees associated with the submission of the application.

Who needs LISTING APPLICATION NEW CLASS OF SECURITIES (FEDERAL FORMS)?

01

Public companies intending to list a new class of securities on a stock exchange.

02

Investment firms and financial institutions looking to issue new types of securities.

03

Companies looking to raise capital by offering new classes of stock to investors.

Fill

form

: Try Risk Free

People Also Ask about

What is the listing of securities section?

Conditions for listing. Where securities are listed on the application of any person in any recognised stock exchange, such person shall comply with the conditions of the listing agreement with that stock exchange.

What are the requirements for listing of securities?

Eligibility criteria for listing on NSE Emerge Platform The post issue paid up capital of the company (face value) shall not be more than Rs. 25 crore. iii. Proprietary / Partnership firm and subsequently converted into a Company (not in existence as a Company for three years) and approaches the Exchange for listing.

What happens if a company fails to meet Nasdaq continued listing requirements?

A company that fails to regain compliance with the bid price requirement following the expiration of the applicable compliance period will be issued a delisting letter and will have its securities suspended from trading on the Nasdaq Stock Market, effective on the 7th calendar day following receipt of Staff's delist

How does a company get listed on the stock exchange?

Each exchange sets its own requirements, which typically include minimum levels of cash flow and company assets. The company also must adhere to the exchange's standards of corporate governance. In order to be listed, a company must meet the qualifications set by one of the stock exchanges.

What are the requirements for securities listing?

Before a company's stock can begin trading on an exchange, the company must meet certain minimum financial and non-financial requirements, or "initial listing standards." Initial listing standards generally include a company's total market value and stock price, and the number of publicly traded shares and shareholders

What are the conditions for listing of securities?

The company should have annual revenue of not less than Rs. 10 crores and should have shown an annual growth of alteast 20% in the past one year. (Annual growth may in the form of number of users/revenue growth/customer base). The net-worth should be positive.

What are the requirements for listing in the securities Commission?

Profit Test. Uninterrupted profit of 3 to 5 full financial years (“FY”), with aggregate after-tax profit of at least RM20 million; Market Capitalisation Test. A total market capitalisation of at least RM500 million upon listing; and. Infrastructure Project Corporation Test.

What do the listing requirements of a security refer to?

Listing requirements for securities refer to the quantitative and qualitative characteristics needed for a company to be listed on a stock exchange. These criteria include financial performance metrics and corporate governance standards. Meeting these requirements ensures investor confidence and successful trading.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is LISTING APPLICATION NEW CLASS OF SECURITIES (FEDERAL FORMS)?

The Listing Application New Class of Securities (Federal Forms) is a regulatory document that companies must submit to seek approval to list a new class of securities on a national securities exchange.

Who is required to file LISTING APPLICATION NEW CLASS OF SECURITIES (FEDERAL FORMS)?

Companies that intend to offer a new class of securities on a national securities exchange are required to file the Listing Application New Class of Securities.

How to fill out LISTING APPLICATION NEW CLASS OF SECURITIES (FEDERAL FORMS)?

To fill out the Listing Application, companies must provide detailed information including the characteristics of the new securities, financial data, compliance with regulatory requirements, and any additional information required by the exchange.

What is the purpose of LISTING APPLICATION NEW CLASS OF SECURITIES (FEDERAL FORMS)?

The purpose of the Listing Application is to ensure that the new class of securities meets the exchange's listing standards and to provide adequate information for regulators to assess the application.

What information must be reported on LISTING APPLICATION NEW CLASS OF SECURITIES (FEDERAL FORMS)?

The information that must be reported includes the number and type of securities being listed, the terms of the offering, financial statements, compliance information, and disclosures relevant to the company's operations.

Fill out your listing application new class online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Listing Application New Class is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.