Get the free LISTING APPLICATION EXCHANGE TRADED FUNDS ETF (FEDERAL FORMS)

Show details

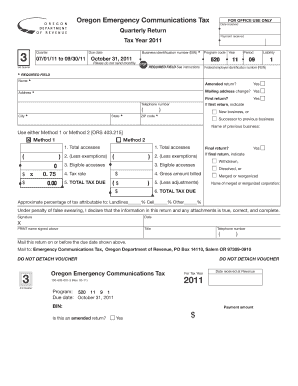

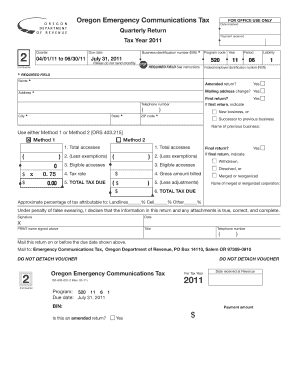

This document serves as the listing application for Exchange Traded Funds (ETFs) within the federal framework, specifically for additional listing applications on NASDAQ.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign listing application exchange traded

Edit your listing application exchange traded form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your listing application exchange traded form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit listing application exchange traded online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit listing application exchange traded. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out listing application exchange traded

How to fill out LISTING APPLICATION EXCHANGE TRADED FUNDS ETF (FEDERAL FORMS)

01

Download the LISTING APPLICATION EXCHANGE TRADED FUNDS ETF form from the official website.

02

Carefully read the instructions provided with the form.

03

Fill out the basic information section, including the name of the ETF and the sponsor's details.

04

Provide a detailed description of the ETF's investment objectives and strategies.

05

Complete the section on the financial information of the ETF, including its assets and liabilities.

06

Include the required supporting documents, such as the prospectus and any relevant agreements.

07

Review the form for completeness and accuracy.

08

Sign and date the application form.

09

Submit the application to the relevant regulatory body, following their submission guidelines.

Who needs LISTING APPLICATION EXCHANGE TRADED FUNDS ETF (FEDERAL FORMS)?

01

Investment firms planning to launch an exchange-traded fund.

02

Financial institutions seeking to list their ETFs on a stock exchange.

03

Asset managers who want to offer ETF products to investors.

04

Regulatory authorities to assess compliance with securities law.

Fill

form

: Try Risk Free

People Also Ask about

What is a US listed ETF?

U.S. listed ETFs offer direct exposure to the largest and most liquid market in the world, providing access to a broader range of sectors and companies, including those not easily available through Canadian listed ETFs.

What is the meaning of ETF listing?

An exchange-traded fund (ETF) is a pooled investment vehicle with shares that trade intraday on stock exchanges at a market-determined price. Investors may buy or sell ETF shares through a broker or in a brokerage account, just as they would the shares of any publicly traded company.

What is the best ETF to invest $1000 in?

The Vanguard 500 ETF is a solid core holding nearly any investor should own. The Vanguard Growth ETF and Invesco QQQ Trust are two great growth ETFs. The Schwab U.S. Dividend Equity ETF is great for those seeking a solid yield.

What is an ETF document?

An exchange-traded fund (ETF) is a pooled investment vehicle with shares that trade intraday on stock exchanges at a market-determined price. Investors may buy or sell ETF shares through a broker or in a brokerage account, just as they would the shares of any publicly traded company.

What does ETF select list mean?

Developed by the experts at The Schwab Center for Financial Research, a division of Charles Schwab & Co., Inc., the ETF Select List is a tool to help you narrow your choices and make confident investing decisions. Click on the fund symbol for quarterly standardized returns and detailed fund expenses.

What does ETF mean?

An exchange-traded fund (ETF) is a type of investment fund that is also an exchange-traded product; i.e., it is traded on stock exchanges. ETFs own financial assets such as stocks, bonds, currencies, debts, futures contracts, and/or commodities such as gold bars.

What is an ETF listing?

Exchange-traded products (ETPs) — including exchange-traded funds (ETFs), exchange-traded notes (ETNs) and some other similar product types — are investment vehicles that are listed on an exchange and can be bought and sold throughout the trading day like a stock.

What are ETF applications?

ETFs are used for core asset class exposure, multi-asset, dynamic, and tactical strategies based on investment views or changing market conditions; for factor or smart beta strategies with a goal to improve return or modify portfolio risk; and for portfolio efficiency applications, such as rebalancing, liquidity

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is LISTING APPLICATION EXCHANGE TRADED FUNDS ETF (FEDERAL FORMS)?

The Listing Application Exchange Traded Funds ETF (Federal Forms) is a regulatory document that issuers must submit to request the listing of an Exchange Traded Fund on a stock exchange. It provides essential details regarding the ETF's structure, investment objectives, and compliance with federal regulations.

Who is required to file LISTING APPLICATION EXCHANGE TRADED FUNDS ETF (FEDERAL FORMS)?

Issuers of Exchange Traded Funds (ETFs) that wish to have their funds listed on national stock exchanges are required to file the Listing Application Federal Forms.

How to fill out LISTING APPLICATION EXCHANGE TRADED FUNDS ETF (FEDERAL FORMS)?

To fill out the Listing Application Federal Forms for ETFs, the issuer must provide specific information including the ETF's name, investment strategy, risk factors, management details, financial statements, compliance with SEC regulations, and any additional disclosures required by the exchange.

What is the purpose of LISTING APPLICATION EXCHANGE TRADED FUNDS ETF (FEDERAL FORMS)?

The purpose of the Listing Application Exchange Traded Funds ETF (Federal Forms) is to outline the necessary details that allow regulators and stock exchanges to review, approve, and facilitate the listing of the ETF on the market, ensuring transparency and adherence to legal requirements.

What information must be reported on LISTING APPLICATION EXCHANGE TRADED FUNDS ETF (FEDERAL FORMS)?

The information to be reported includes the ETF's investment objectives, asset allocation, performance history, regulatory compliance, management structure, expenses, and any other pertinent details that contribute to an investor's understanding of the ETF.

Fill out your listing application exchange traded online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Listing Application Exchange Traded is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.