Get the free ADPE Disposition and Control Request

Show details

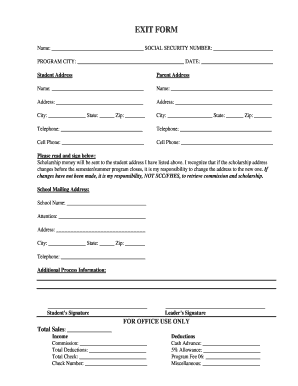

This form is used for the request of turn-in, transfer, or relocation of equipment, ensuring that proper procedures are followed regarding classified materials and the disposition of unclassified

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign adpe disposition and control

Edit your adpe disposition and control form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your adpe disposition and control form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing adpe disposition and control online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit adpe disposition and control. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out adpe disposition and control

How to fill out ADPE Disposition and Control Request

01

Locate the ADPE Disposition and Control Request form.

02

Fill in the requester’s information, including name, department, and contact details.

03

Specify the type of ADPE (Automated Data Processing Equipment) in the designated section.

04

Provide the serial number and model of the ADPE.

05

Indicate the reason for disposition such as repair, surplus, or disposal.

06

Attach any supporting documents if required, such as previous repair logs or compliance mandates.

07

Review all entries for accuracy and completeness.

08

Submit the completed form to the appropriate authority for approval.

Who needs ADPE Disposition and Control Request?

01

Departments handling IT equipment.

02

Administrative personnel managing asset disposal.

03

Anyone involved in the procurement or management of ADPE.

04

Organizations needing to comply with data security and environmental standards.

Fill

form

: Try Risk Free

People Also Ask about

What is a deemed disposition of taxable Canadian property?

Deemed dispositions. If you ceased to be a resident of Canada in the year, you were deemed to have disposed of certain types of property at their fair market value (FMV) when you left Canada and to have immediately reacquired them for the same amount. This is called a deemed disposition. This applies to most properties

What is Section 116 of taxable Canadian property?

Section 116 is designed to ensure that non-resident taxpayers who dispose of taxable Canadian property (“TCP”) report the disposition to the Canada Revenue Agency (the “CRA”) and pay any applicable Canadian income tax.

How are you taxed if you are deemed a non-resident of Canada?

As a non-resident of Canada, you pay tax on income you receive from sources in Canada. The type of tax you pay and the requirement to file an income tax return depend on the type of income you receive.

What is the request by a non-resident of Canada for a certificate of compliance related to the disposition of taxable Canadian property?

Non-residents must file Form T2062 if they are disposing of taxable Canadian property and want to ensure they are not held liable for unpaid taxes in Canada. This form must be submitted within 10 days after the disposition of the property, and it applies to both individuals and entities.

What is a Canadian certificate of compliance?

This is a document issued by the Director under the Canada Business Corporations Act (CBCA) as evidence that a corporation is in existence and not dissolved as a corporate entity. Under the Ontario Business Corporations Act, the equivalent document is a certificate of status.

What is a certificate of compliance related to the disposition of taxable Canadian property?

If you're a non-resident of Canada and you're selling taxable Canadian property, you may need to file a T2062 Request for a Certificate of Compliance with the Canada Revenue Agency (CRA). This certificate ensures that any taxes owed on the disposition of the property are paid before the transaction is completed.

What is the withholding tax on non-resident selling property in Canada?

Understanding Withholding Taxes and Certificates of Compliance. The CRA requires purchasers of Canadian real estate from non-residents to withhold 25% of the gross sale proceeds.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ADPE Disposition and Control Request?

ADPE Disposition and Control Request is a formal document used to request approval for the disposition and control of Automatic Data Processing Equipment (ADPE). This includes the transfer, disposal, or reuse of such equipment within government or organizational settings.

Who is required to file ADPE Disposition and Control Request?

Any government agency or organization that manages or disposes of ADPE must file the ADPE Disposition and Control Request. This includes departments that handle surplus or outdated technological equipment.

How to fill out ADPE Disposition and Control Request?

To fill out the ADPE Disposition and Control Request, complete all required fields including the description of the ADPE, the reason for disposition, the proposed method of disposal, and necessary signatures from authorized personnel.

What is the purpose of ADPE Disposition and Control Request?

The purpose of the ADPE Disposition and Control Request is to ensure proper tracking, accountability, and compliance with regulations regarding the disposal and control of government-owned data processing equipment.

What information must be reported on ADPE Disposition and Control Request?

The information that must be reported includes the serial number, asset tag number, description of the equipment, its condition, disposal reason, proposed method of disposition, and approval signatures from responsible individuals.

Fill out your adpe disposition and control online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Adpe Disposition And Control is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.