USDA RD 3560-7 2005 free printable template

Show details

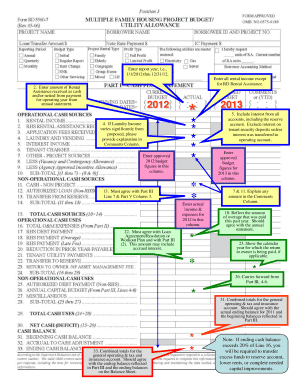

U.S. USDA Form usda-rd-3560-7 Position 3 BORROWER NAME Loan/Transfer Amount $ Reporting Period Annual Quarterly Monthly FORM APPROVED OMB NO.0575-0189 MULTIPLE FAMILY HOUSING PROJECT BUDGET/ UTILITY

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign USDA RD 3560-7

Edit your USDA RD 3560-7 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your USDA RD 3560-7 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit USDA RD 3560-7 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit USDA RD 3560-7. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

USDA RD 3560-7 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out USDA RD 3560-7

How to fill out USDA RD 3560-7

01

Begin by downloading the USDA RD 3560-7 form from the official USDA website.

02

Fill in the applicant's information in the designated sections, including name, address, and contact details.

03

Provide details regarding the project or property for which the funding is requested, including location and type.

04

Disclose all income sources and amounts in the financial section.

05

Indicate the intended use of the funds in the appropriate section.

06

Review the eligibility requirements and ensure all necessary documentation is attached.

07

Sign and date the form, certifying that all information provided is accurate.

08

Submit the form to the appropriate USDA office along with any required supplementary materials.

Who needs USDA RD 3560-7?

01

Individuals or organizations seeking funding for rural development projects.

02

Farmers or ranchers in need of financial assistance for agricultural purposes.

03

Non-profit organizations focused on housing and community developments in rural areas.

04

Local governments looking to improve infrastructure and services in rural communities.

Fill

form

: Try Risk Free

People Also Ask about

Is there a max on housing allowance?

IRS does not place any limits on how much you can designate. In fact, you can designate up to 100% of your salary if desired.

How does basic housing allowance work?

BAH is an allowance to offset the cost of housing when you do not receive government-provided housing. Your BAH depends upon your location, pay grade and whether you have dependents. BAH rates are set by surveying the cost of rental properties in each geographic location.

What is the dod housing allowance for 2023?

The 2023 Basic Allowance for Housing rates, as part of a robust military compensation package, continue the member cost-sharing element at five percent of the national average housing cost by pay grade. These amounts vary by grade and dependency status and range from $82 to $184 monthly for the 2023 rates.

How much can you take as a housing allowance?

As indicated above, up to 100 percent of compensation can be designated as housing allowance, but this does not necessarily mean that this is the amount which can be excluded from income taxes.

What are the IRS rules on housing allowance?

Housing allowance is excludable from gross income for federal and state income tax purposes but not for self-employment tax purposes. When a portion of compensation is received as housing allowance, federal and state taxes are directly reduced. SECA taxes are not directly reduced.

Will there be a BAH increase in 2023?

The 12.1% average increase from 2022 to 2023 represents another larger-than-normal increase. The 2022 increase of 5.1% was already up from 2.9% in 2021. The department bases BAH on a combination of local costs for rent and utilities for various housing types.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify USDA RD 3560-7 without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your USDA RD 3560-7 into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I execute USDA RD 3560-7 online?

Completing and signing USDA RD 3560-7 online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I fill out USDA RD 3560-7 on an Android device?

On an Android device, use the pdfFiller mobile app to finish your USDA RD 3560-7. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is USDA RD 3560-7?

USDA RD 3560-7 is a form used by the United States Department of Agriculture's Rural Development program to collect financial information from borrowers in their multi-family housing programs.

Who is required to file USDA RD 3560-7?

Borrowers who have received loans or assistance through USDA Rural Development for multi-family housing are required to file USDA RD 3560-7.

How to fill out USDA RD 3560-7?

To fill out USDA RD 3560-7, borrowers must complete the required sections regarding their financial information, including income, expenses, and other relevant financial data, following the instructions provided on the form.

What is the purpose of USDA RD 3560-7?

The purpose of USDA RD 3560-7 is to ensure that borrowers are accurately reporting their financial condition to the USDA for ongoing compliance and monitoring of loan agreements.

What information must be reported on USDA RD 3560-7?

Information that must be reported on USDA RD 3560-7 includes detailed financial statements, income and expense reports, and other pertinent data related to the management and operation of the multi-family housing project.

Fill out your USDA RD 3560-7 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

USDA RD 3560-7 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.