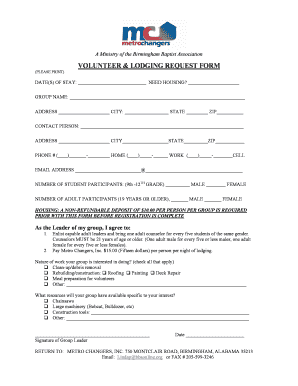

USDA RD 1944-3 1997-2025 free printable template

Show details

U.S. USDA Form usda-rd-1944-3 Form RD 1944-3 Rev. 6-97 FORM APPROVED OMB NO. 0575-0172 Position 3 USDA-RURAL HOUSING SERVICE FARM SERVICE AGENCY BUDGET AND/OR FINANCIAL STATEMENT 1. NAME OF APPLICANT/BORROWER 4. NAME OF CO-APPLICANT/CO-BORROWER 2. HOME PHONE NUMBER 3. AGES OF PERSONS IN HOUSEHOLD 5. WORK PHONE NUMBER 6. ADDRESS Applicant/Borrower Children Co-Applicant/Co-Borrower Others 7. PERIOD COVERED BY PLAN thru BUDGET PART 1 - PLANNED EXPENSES AND PAYMENTS A - CASH EXPENSES MONTHLY FOOD...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form rd 1944 3

Edit your usda form 1944 3 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your usda form 1944 3 statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit usda form rd 1944 3 online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 1944 3. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 1944 3 edit

How to fill out USDA RD 1944-3

01

Obtain the USDA RD 1944-3 form from the USDA website or your local USDA office.

02

Fill in the borrower’s name and address at the top of the form.

03

Provide the necessary details about the property, including the address and type of property.

04

Indicate the loan amount requested and the loan purpose.

05

Complete the personal and financial information sections, including income and employment details.

06

Attach any necessary documentation, such as proof of income and employment verification.

07

Review the completed form for accuracy and completeness.

08

Submit the form to your local USDA office for processing.

Who needs USDA RD 1944-3?

01

Individuals or families seeking financial assistance to purchase, build, or improve rural properties.

02

Homebuyers in eligible rural areas looking for low-interest loans.

03

Applicants who meet certain income requirements and seek government-backed financing.

Fill

fillable 1944 fillable

: Try Risk Free

People Also Ask about rd 1944 3 financial statement

What is the difference between form 940 and 941 and 944?

Form 940 tax returns are filed in respect of Federal Unemployment Tax and this tax is a non-Trust Fund tax liability. The 941 or 944 tax returns report the wages paid to one's employees and details the related tax liability.

Who needs to file form 944?

Form 944 is designed so the smallest employers (those whose annual liability for social security, Medicare, and withheld federal income taxes is $1,000 or less) will file and pay these taxes only once a year instead of every quarter.

Is form 944 required?

To ensure businesses pay the appropriate amount of income and FICA taxes each year, the IRS requires employers to file Form 944.

What are the requirements to file form 944?

Who Must File Form 944? Wages you have paid. Tips your employees reported to you. Federal income tax you withheld. Both the employer and the employee share of social security and Medicare taxes. Additional Medicare Tax withheld from employees.

What is the difference between 941 and 944?

Form 941 is very similar to Form 944, except that it's meant for businesses with annual payroll tax liabilities greater than $1,000. Businesses should generally file Form 941 unless the IRS tells you to use Form 944 or if you successfully request to use 944 forms because of your lower liability.

What is form 940 and 944?

However, Form 940 reports an employer's Federal Unemployment (FUTA) tax liability (an employer-only tax)—whereas Form 944 deals with employee income tax withholding and FICA taxes (which are shared by the employer and the employee).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my usda 1944 3 statement blank directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign form 1944 form and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I edit rd 1944 3 on an iOS device?

Create, modify, and share 1944 3 using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How do I edit USDA RD 1944-3 on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share USDA RD 1944-3 on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is USDA RD 1944-3?

USDA RD 1944-3 is a form used by the United States Department of Agriculture Rural Development to collect information from borrowers or applicants involved in the Rural Housing Service programs.

Who is required to file USDA RD 1944-3?

Applicants for USDA Rural Development housing or loan assistance programs are required to file USDA RD 1944-3.

How to fill out USDA RD 1944-3?

To fill out USDA RD 1944-3, applicants must provide detailed personal and financial information, including income, assets, liabilities, and other relevant details as outlined in the form's instructions.

What is the purpose of USDA RD 1944-3?

The purpose of USDA RD 1944-3 is to assess the eligibility and financial situation of applicants seeking assistance from USDA Rural Development housing programs.

What information must be reported on USDA RD 1944-3?

Information that must be reported on USDA RD 1944-3 includes personal information, income sources, assets, liabilities, family size, and other financial data as required by the form.

Fill out your USDA RD 1944-3 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

USDA RD 1944-3 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.