Get the free U.S. TREAS Form treas-irs-1099-oid-1996

Show details

This document provides information regarding the U.S. TREAS Form 1099-OID for informational purposes, detailing printing requirements and references to IRS publications for proper usage.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign us treas form treas-irs-1099-oid-1996

Edit your us treas form treas-irs-1099-oid-1996 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your us treas form treas-irs-1099-oid-1996 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing us treas form treas-irs-1099-oid-1996 online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit us treas form treas-irs-1099-oid-1996. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

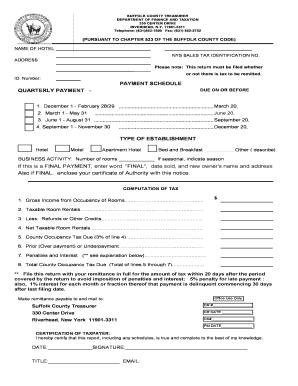

How to fill out us treas form treas-irs-1099-oid-1996

How to fill out U.S. TREAS Form treas-irs-1099-oid-1996

01

Obtain the U.S. TREAS Form 1099-OID (Original Issue Discount).

02

Complete the payer's information in Box 1 (your name, address, and taxpayer identification number).

03

Fill in the recipient's information in Box 2 (recipient's name, address, and taxpayer identification number).

04

Report the total OID for the tax year in Box 3.

05

Fill in any federal income tax withheld in Box 4, if applicable.

06

Provide any other required information, such as relevant interest rates or terms, in the additional boxes provided.

07

Review the completed form for accuracy.

08

File the form with the IRS and send a copy to the recipient by the required deadline.

Who needs U.S. TREAS Form treas-irs-1099-oid-1996?

01

Individuals or entities that have received interest income from bonds or other debt instruments issued at a discount.

02

Financial institutions that are in possession of debt securities with original issue discounts.

03

Investors who need to report OID income for tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

What is the purpose of the 1099-OID form?

Form 1099-OID, Original Issue Discount, exists to report income when bonds, notes, or certificates of deposit (CDs) are sold at a discount from their maturity value.

What does OID mean in IRS?

Original issue discount (OID) is a form of interest. It usually occurs when companies issue bonds at a price less than their redemption value at maturity. The difference between these two amounts is the OID. For bonds issued after 1984, the OID is treated as interest.

What is OID for tax purposes?

Original issue discount (OID) is a form of interest. It usually occurs when companies issue bonds at a price less than their redemption value at maturity. The difference between these two amounts is the OID. For bonds issued after 1984, the OID is treated as interest.

What does a 1099-OID do?

Form 1099-OID is used to report original issue discount interest as part of your income. How the OID on a long-term debt instrument is calculated depends on the date it was issued as well as on the type of debt instrument.

What is the penalty for 1099-OID?

The penalties for failing to file or for filing an incorrect form are as follows: For each Form 1099-OID that is filed late or with incomplete information, the penalty ranges from $60 to $330 per form, depending on how long past the due date the form is filed.

What is the difference between a 1099-INT and a 1099-OID?

Form 1099-INT is issued to a taxpayer who receives $10 or more in interest income from a bank during the year. Form 1099-OID reports "original issue discount" and the list goes on. Get this report to learn more about these specific 1099 forms.

What is the purpose of the OID?

The OID is the amount of discount or the difference between the original face value and the price paid for the bond. Original issue discounts are used by bond issuers to attract buyers to purchase their bonds so that the issuers can raise funds for their business.

What is an OID used for?

The OID is the amount of discount or the difference between the original face value and the price paid for the bond. Original issue discounts are used by bond issuers to attract buyers to purchase their bonds so that the issuers can raise funds for their business.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is U.S. TREAS Form treas-irs-1099-oid-1996?

U.S. TREAS Form treas-irs-1099-oid-1996 is a tax form used to report original issue discount (OID) on certain debt instruments. It is issued by the issuer of the security to report the amount of OID that must be included in the income of the bondholder.

Who is required to file U.S. TREAS Form treas-irs-1099-oid-1996?

The issuer of a debt instrument is required to file U.S. TREAS Form treas-irs-1099-oid-1996 if they have issued a bond or other debt instrument that has an original issue discount. This typically includes corporations, government entities, and certain financial institutions.

How to fill out U.S. TREAS Form treas-irs-1099-oid-1996?

To fill out U.S. TREAS Form treas-irs-1099-oid-1996, the issuer must provide information such as the payee's name, address, taxpayer identification number, the amount of OID, and other required details about the debt instrument, including interest paid for the year.

What is the purpose of U.S. TREAS Form treas-irs-1099-oid-1996?

The purpose of U.S. TREAS Form treas-irs-1099-oid-1996 is to report and inform the IRS and the taxpayer about any original issue discount income that needs to be reported on the tax return. It ensures compliance with tax regulations regarding income from OID.

What information must be reported on U.S. TREAS Form treas-irs-1099-oid-1996?

The information that must be reported on U.S. TREAS Form treas-irs-1099-oid-1996 includes the recipient’s name, address, taxpayer identification number, the amount of OID, the associated bond or debt instrument details, and any interest payments made during the year.

Fill out your us treas form treas-irs-1099-oid-1996 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Us Treas Form Treas-Irs-1099-Oid-1996 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.