Get the free U.S. TREAS Form treas-irs-23-2002

Show details

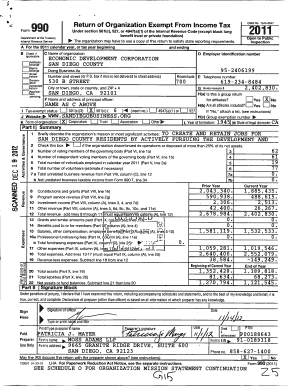

This document serves as an application form for individuals seeking to enroll and practice before the Internal Revenue Service, detailing personal information, eligibility criteria, and instructions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign us treas form treas-irs-23-2002

Edit your us treas form treas-irs-23-2002 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your us treas form treas-irs-23-2002 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing us treas form treas-irs-23-2002 online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit us treas form treas-irs-23-2002. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out us treas form treas-irs-23-2002

How to fill out U.S. TREAS Form treas-irs-23-2002

01

Obtain a copy of the U.S. TREAS Form treas-irs-23-2002 from the official IRS website or a trusted source.

02

Fill in Part I with the name of the applicant and their social security number or taxpayer identification number.

03

Complete Part II by providing the details of the entity or person that is applying for the request.

04

In Part III, indicate the type of request being made and provide the necessary descriptions or justifications.

05

Sign and date the form at the bottom, certifying the accuracy of the provided information.

06

Submit the completed form to the appropriate IRS office as instructed in the form's guidelines.

Who needs U.S. TREAS Form treas-irs-23-2002?

01

Individuals or entities who need to request a determination or ruling from the IRS regarding specific tax issues.

02

Taxpayers seeking clarification on complex tax situations or exemptions.

03

Organizations applying for tax-exempt status or seeking to resolve tax-related matters with the IRS.

Fill

form

: Try Risk Free

People Also Ask about

What is the IRS USA tax payment on my bank statement?

"IRS USA Tax Payment," "IRS USA Tax Pymt" or something similar will be shown on your bank statement as proof of payment. If the payment date requested is a weekend or bank holiday, the payment will be withdrawn on the next business day.

What is the IRS USA tax?

The Internal Revenue Service (IRS) administers and enforces U.S. federal tax laws.

What is the full form of IRS in US payroll?

The Internal Revenue Service (IRS) is the revenue service for the United States federal government, which is responsible for collecting U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax law.

How to write a check to the US treasury?

If you mail your tax payment: Make your check, money order or cashier's check payable to U.S. Treasury. Enter the amount using all numbers ($###.##). Do not use staples or paper clips to affix your payment to your voucher or return. Make sure your check or money order includes the following information:

What is the IRS USA tax payment on my bank statement online?

"IRS USA Tax Payment," "IRS USA Tax Pymt" or something similar will be shown on your bank statement as proof of payment. If the payment date requested is a weekend or bank holiday, the payment will be withdrawn on the next business day.

What does IRS stand for in banking?

In finance, an interest rate swap (IRS) is an interest rate derivative (IRD). It involves exchange of interest rates between two parties. In particular it is a "linear" IRD and one of the most liquid, benchmark products. It has associations with forward rate agreements (FRAs), and with zero coupon swaps (ZCSs).

Is pay USA tax legitimate?

payUSAtax is a service of Link2Gov under agreement with the IRS and is certified as an IRS payment processor which allows taxpayers to make a payment by credit card for taxes due to the IRS.

What is the IRS form for non resident?

About Form 1040-NR, U.S. Nonresident Alien Income Tax Return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is U.S. TREAS Form treas-irs-23-2002?

U.S. TREAS Form treas-irs-23-2002 is a form used to report certain information to the U.S. Department of the Treasury and the Internal Revenue Service regarding foreign bank and financial accounts and other related information as part of the U.S. financial reporting obligations.

Who is required to file U.S. TREAS Form treas-irs-23-2002?

Individuals and entities that have foreign financial accounts exceeding certain thresholds are required to file U.S. TREAS Form treas-irs-23-2002. This includes U.S. citizens, residents, and domestic entities with foreign bank accounts or financial interest in foreign accounts.

How to fill out U.S. TREAS Form treas-irs-23-2002?

To fill out U.S. TREAS Form treas-irs-23-2002, you must provide your personal information, details of your foreign accounts, including account numbers, names of financial institutions, and maximum account balances during the reporting period. Follow the instructions provided with the form carefully to ensure all necessary information is completed.

What is the purpose of U.S. TREAS Form treas-irs-23-2002?

The purpose of U.S. TREAS Form treas-irs-23-2002 is to comply with the Bank Secrecy Act by reporting foreign financial accounts to prevent money laundering and tax evasion. It ensures transparency in foreign financial activities of U.S. citizens and residents.

What information must be reported on U.S. TREAS Form treas-irs-23-2002?

The information that must be reported on U.S. TREAS Form treas-irs-23-2002 includes the names and addresses of foreign banks, account numbers, types of accounts, maximum account balances during the reporting period, and any other relevant details concerning the foreign financial accounts.

Fill out your us treas form treas-irs-23-2002 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Us Treas Form Treas-Irs-23-2002 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.