Get the free U.S. TREAS Form treas-irs-5305-simple-2002

Show details

Establishes Savings Incentive Match Plan for Employees of Small Employers (SIMPLE) for use with a designated financial institution, including employee eligibility requirements, salary reduction agreements,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign us treas form treas-irs-5305-simple-2002

Edit your us treas form treas-irs-5305-simple-2002 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your us treas form treas-irs-5305-simple-2002 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

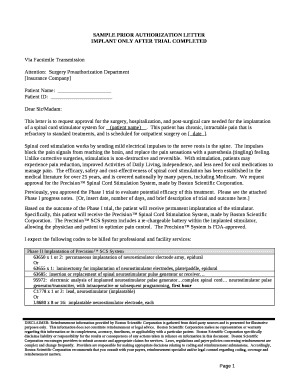

Editing us treas form treas-irs-5305-simple-2002 online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit us treas form treas-irs-5305-simple-2002. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

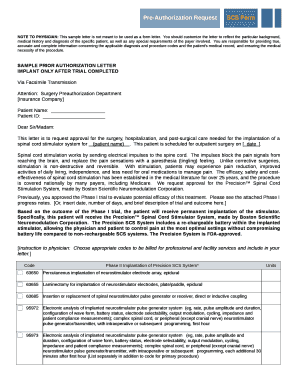

How to fill out us treas form treas-irs-5305-simple-2002

How to fill out U.S. TREAS Form treas-irs-5305-simple-2002

01

Obtain the U.S. TREAS Form 5305-SIMPLE from the IRS website or a trusted source.

02

Fill in the name of the plan sponsor at the top of the form.

03

Provide the address of the plan sponsor.

04

Enter the taxpayer identification number of the plan sponsor.

05

Specify the effective date of the SIMPLE IRA plan.

06

Indicate the type of contributions that will be made (employee salary reduction contributions and employer contributions).

07

Include a description of the eligibility requirements for employees.

08

State the method for notifying employees about the establishment of the SIMPLE IRA plan.

09

Sign and date the form at the bottom to certify it is completed.

Who needs U.S. TREAS Form treas-irs-5305-simple-2002?

01

Small employers with 100 or fewer employees who want to establish a SIMPLE IRA plan for their employees.

02

Employers who want to offer a retirement savings option that has lower administrative costs and is easier to manage than a traditional 401(k) plan.

03

Employers looking to attract and retain employees by providing a retirement savings vehicle.

Fill

form

: Try Risk Free

People Also Ask about

What are the rules for the SIMPLE IRA in 2025?

The SIMPLE IRA max contribution in 2025 allows an employee under age 50 to contribute up to $16,500. People aged 50 and older can make an added $3,500 catch-up contribution, for a total of $20,000, while those ages 60 to 63 have an additional $5,250 catch-up contribution, for a total of $21,750.

Do I need to report SIMPLE IRA contributions?

The IRS requires that contributions to a SIMPLE IRA be reported on the Form 5498 for the year they are actually deposited to the account, regardless of the year for which they're made.

Is a SIMPLE IRA the same as a simple Roth IRA?

A SIMPLE IRA cannot be a Roth IRA. Financial institutions authorized to hold and invest SIMPLE IRA plan contributions include banks, savings and loan associations, insurance companies, certain regulated investment companies, federally insured credit unions and brokerage firms.

What does "sep" mean?

Choose a SEP plan Simplified Employee Pension (SEP) plans can provide a significant source of income at retirement by allowing employers to set aside money in retirement accounts for themselves and their employees.

What is the 5305?

Traditional IRA for Nonworking Spouse - Form 5305-A may be used to establish the IRA custodial account for a nonworking spouse. Contributions to an IRA custodial account for a nonworking spouse must be made to a separate IRA custodial account established by the nonworking spouse.

What is a 5305?

Internal Revenue Service. “Form 5305-SIMPLE: Savings Incentive Match Plan for Employees of Small Employers (SIMPLE) for use with a Designated Financial Institution.” Internal Revenue Service. “Form 5306: Application for Approval of Prototype or Employer Sponsored Individual Retirement Arrangement (IRA).”

What is 5305 vs 5305A?

Unlike Form 5305-SEP, which allows employees to choose their financial institution, Form 5305A-SEP requires all contributions to be held in a single trust or custodial account designated by the employer. This centralizes administration and gives employers greater oversight.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is U.S. TREAS Form treas-irs-5305-simple-2002?

U.S. TREAS Form 5305-SIMPLE is a form used to establish a SIMPLE IRA plan, which is a retirement savings plan designed for small businesses with 100 or fewer employees.

Who is required to file U.S. TREAS Form treas-irs-5305-simple-2002?

Employers who wish to set up a SIMPLE IRA for their employees must file Form 5305-SIMPLE.

How to fill out U.S. TREAS Form treas-irs-5305-simple-2002?

To fill out Form 5305-SIMPLE, you will need to provide basic information about the employer, including the business name, address, and the plan's effective date, as well as indicate the selected contribution method.

What is the purpose of U.S. TREAS Form treas-irs-5305-simple-2002?

The purpose of Form 5305-SIMPLE is to formally establish a SIMPLE IRA plan and notify the IRS that the employer intends to offer this retirement plan to eligible employees.

What information must be reported on U.S. TREAS Form treas-irs-5305-simple-2002?

The form requires reporting of the employer's identification information, the plan's effective date, the type of contributions made, and current plan terms, including the rights of participants.

Fill out your us treas form treas-irs-5305-simple-2002 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Us Treas Form Treas-Irs-5305-Simple-2002 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.