Get the free form 1051

Show details

U.S. GSA. PDF. (1) GSA.gov, (2) USA-Federal-Forms.com, (3) Fillable.com. T. T. T. T ... EQUIPMENT CONTROL REGISTER 9/1/1970 10/9/2003 DHS/NICE FORM.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 1051

Edit your form 1051 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 1051 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 1051 online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form 1051. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 1051

Point by point on how to fill out IRS form 1051:

01

Gather all the necessary information and documents required to complete the form, such as your personal information, income details, and any relevant deductions or credits.

02

Read the instructions provided with the form carefully to ensure you understand all the requirements and guidelines for filling it out correctly.

03

Start by entering your personal information accurately in the designated sections of the form, including your name, social security number, and address.

04

Proceed to report any income you have earned during the tax year in the appropriate sections, such as wages, self-employment income, or investment income.

05

If you have any deductions or credits that apply to your situation, make sure to claim them correctly on the form. This may include deductions for student loan interest, medical expenses, or education-related expenses.

06

Double-check all the information entered on the form to ensure accuracy and completeness. Inaccurate or missing information can lead to complications or delays in processing your tax return.

07

Sign and date the form before submitting it. If you are submitting the form electronically, follow the required authentication process.

08

Keep a copy of the completed form, along with any supporting documents, for your records.

Who needs IRS form 1051?

01

Form 1051 is typically needed by individuals or entities who are claiming deductions or credits related to certain education expenses. This form is specifically used to claim the American Opportunity Credit or the Lifetime Learning Credit, which are educational tax benefits provided by the IRS.

02

Students or their parents who have incurred qualifying education expenses and wish to claim these credits on their tax return must fill out form 1051.

03

The form may also be required by educational institutions that are responsible for providing the necessary information to their students or to the IRS for claiming these educational tax benefits.

Fill

form

: Try Risk Free

People Also Ask about

What is the IRS form for inheritance tax?

Form 706 is used by the executor of a decedent's estate to figure the estate tax imposed by Chapter 11 of the Internal Revenue Code.

What is the difference between a fiduciary tax return and an estate tax return?

While fiduciary income tax is the income taxation of a person's estate or trust assets, estate tax is a tax on the right to transfer property when a person passes away.

Do beneficiaries pay taxes on trust distributions?

Beneficiaries of a trust typically pay taxes on the distributions they receive from a trust's income rather than the trust paying the tax. However, beneficiaries aren't subject to taxes on distributions from the trust's principal, the original sum of money put into the trust.

What is the IRS form for a family trust?

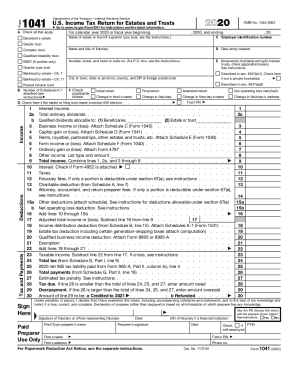

More In Forms and Instructions The fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files Form 1041 to report: The income, deductions, gains, losses, etc. of the estate or trust. The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries.

What is the form 8879 for trust?

A fiduciary and an ERO use Form 8879-F when the fiduciary wants to use a personal identification number (PIN) to electronically sign an estate's or trust's electronic income tax return and, if applicable, consent to electronic funds withdrawal.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 1051 directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your form 1051 and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I edit form 1051 from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including form 1051. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I get form 1051?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific form 1051 and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

What is form 1051?

Form 1051 is a tax form used for reporting certain tax-related information to the authorities, specifically concerning a specific type of financial transaction or entity.

Who is required to file form 1051?

Individuals or businesses that participate in the specific transactions covered by Form 1051 are required to file this form as part of their tax obligations.

How to fill out form 1051?

To fill out Form 1051, you need to provide the required personal or business information, specify the nature of the transactions, and report any relevant financial data as instructed in the form's guidelines.

What is the purpose of form 1051?

The purpose of Form 1051 is to collect information related to specific tax matters to ensure compliance with tax regulations and to assist the authorities in their oversight of financial transactions.

What information must be reported on form 1051?

Form 1051 requires reporting of details such as the names and addresses of the individuals or entities involved, the transaction amounts, dates, and any other pertinent information relevant to the regulatory requirements.

Fill out your form 1051 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 1051 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.