Get the free PEZA EDD Form No. 019-A

Show details

This document is an application form for registering a company as an Ecozone Service Enterprise under the Philippine Economic Zone Authority.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign peza edd form no

Edit your peza edd form no form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your peza edd form no form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit peza edd form no online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit peza edd form no. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out peza edd form no

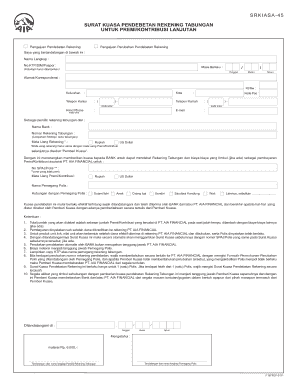

How to fill out PEZA EDD Form No. 019-A

01

Obtain a copy of PEZA EDD Form No. 019-A from the PEZA website or office.

02

Fill in the company's information at the top of the form, including the company name, address, and contact details.

03

Indicate the date of submission in the designated section.

04

Provide details regarding the activities of the registered enterprise by selecting appropriate options.

05

Complete the sections on employment, investment, and production data as required.

06

Sign the form in the designated area and include the printed name and designation of the signatory.

07

Review the form for accuracy and ensure all required fields are filled.

08

Submit the completed form to the designated PEZA office and keep a copy for your records.

Who needs PEZA EDD Form No. 019-A?

01

Entities operating within the PEZA jurisdiction that are engaged in economic activities.

02

Companies applying for registration or renewal with PEZA.

03

Businesses seeking incentives or benefits under the PEZA program.

Fill

form

: Try Risk Free

People Also Ask about

Are foreigners allowed to invest in the Philippines?

Although direct land ownership in the Philippines is restricted to Filipino nationals, there are legal avenues for acquisitions by foreign nationals, such as through long-term leases, inheritance, corporate ownership, and condominium ownership. Long-Term Leases.

Who is qualified to pay income tax in the Philippines?

The Philippines taxes its resident citizens on their worldwide income. Non-resident citizens and aliens, whether or not resident in the Philippines, are taxed only on income from sources within the Philippines.

What is the meaning of PEZA in the Philippines?

Philippine Economic Zone Authority (PEZA) promotes the establishment of economic zones in the Philippines for foreign investments.

What is PEZA ptops?

PTOPS is one of PEZA's digital processes that serves as a one-stop shop to streamline operations and support the agency's digitalization efforts across the ecozones.

Why do foreign investors invest in the Philippines?

Noteworthy advantages of the Philippine investment landscape include free trade zones, including special economic zones, and a large, educated, English-speaking, and relatively low-cost workforce.

Who is qualified to invest in the Philippines under PEZA?

PEZA Eligibility Enterprises that are 100% foreign owned and engaged in preferred areas of investment may be entitled to incentives from the Board of Investments (BOI) and the Philippine Economic Zone Authority (PEZA).

Who can avail an income tax holiday in the Philippines?

Income tax holiday (ITH) and exemptions Additional three years ITH shall be granted to projects or activities of registered entities prior to the effectivity of CREATE, or under the incentive system when such entities relocate from the National Capital Region (NCR).

How to apply PEZA?

What is the 7-step Registration Process of PEZA? Submit application documents for pre-screening. Pay application fee of ₱3,600 and secure official receipt. Submit the duly accomplished application form along with other required documents. Wait for receipt of Board Resolution.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

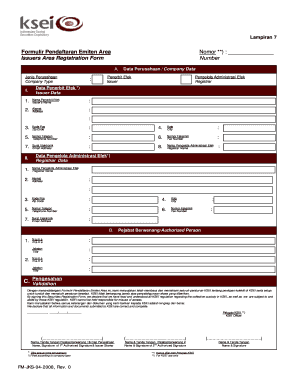

What is PEZA EDD Form No. 019-A?

PEZA EDD Form No. 019-A is a document used by entities registered with the Philippine Economic Zone Authority (PEZA) to report specific details regarding their export activities and production outputs.

Who is required to file PEZA EDD Form No. 019-A?

Entities registered with PEZA that engage in export activities and are involved in economic zone operations are required to file PEZA EDD Form No. 019-A.

How to fill out PEZA EDD Form No. 019-A?

To fill out PEZA EDD Form No. 019-A, entities must provide accurate details regarding their export activities, including production outputs, export values, and other necessary information as prescribed by PEZA guidelines.

What is the purpose of PEZA EDD Form No. 019-A?

The purpose of PEZA EDD Form No. 019-A is to monitor and gather data on the export performance of registered enterprises, which helps in policy formulation and economic planning.

What information must be reported on PEZA EDD Form No. 019-A?

The information that must be reported on PEZA EDD Form No. 019-A includes total production output, export value, details of goods exported, and other relevant operational data related to export activities.

Fill out your peza edd form no online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Peza Edd Form No is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.