Get the free Debt Collection Terms and Conditions

Show details

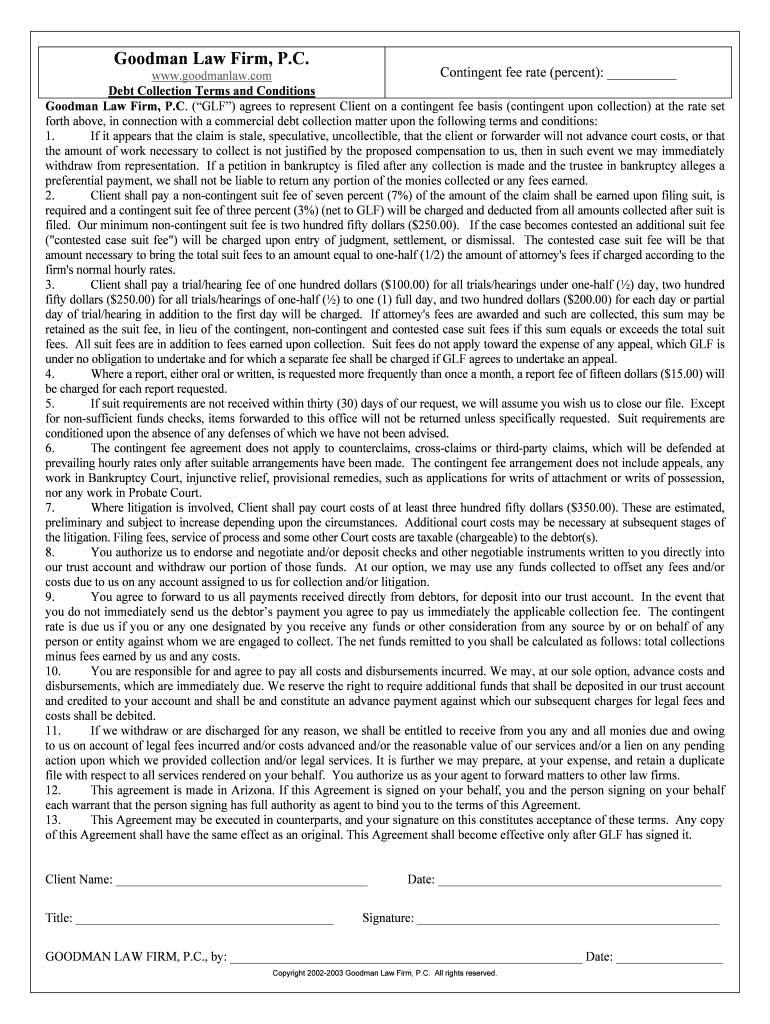

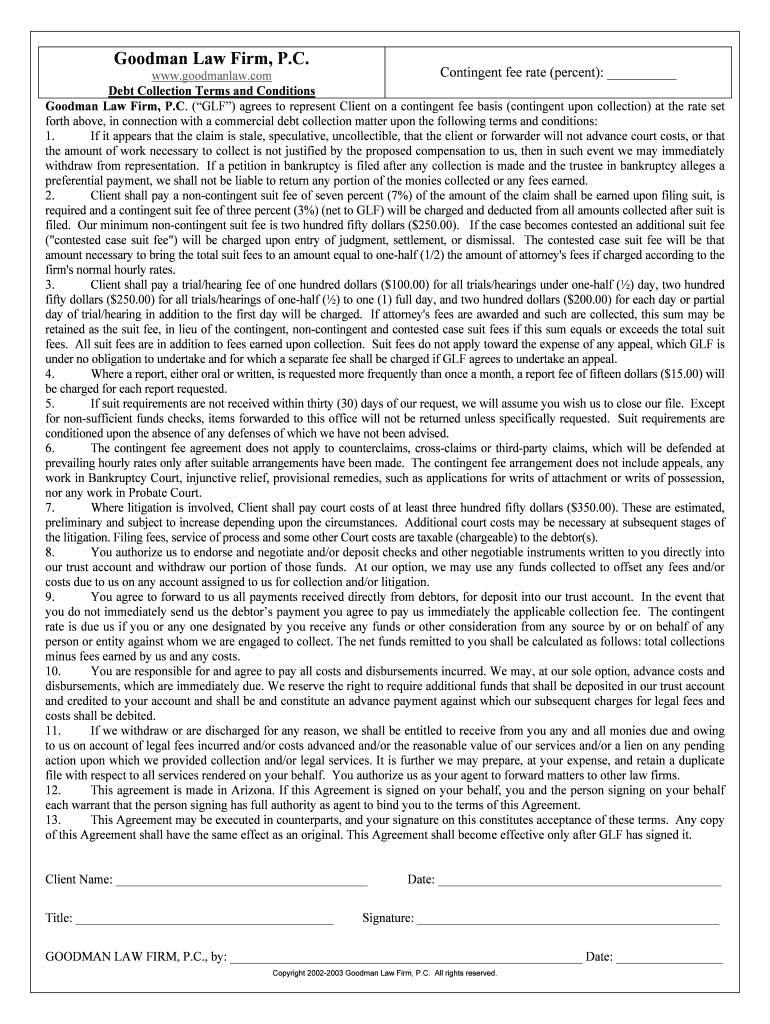

This document outlines the terms and conditions under which Goodman Law Firm, P.C. will represent clients in commercial debt collection matters on a contingent fee basis.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign debt collection terms and

Edit your debt collection terms and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your debt collection terms and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit debt collection terms and online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit debt collection terms and. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out debt collection terms and

How to fill out Debt Collection Terms and Conditions

01

Begin with the title 'Debt Collection Terms and Conditions'.

02

Introduce the purpose of the terms and conditions and define key terms.

03

Outline the scope of services provided by the debt collector.

04

Specify the fees and payment terms applicable to collections.

05

Include the rights and responsibilities of both parties involved.

06

Detail the procedures for debt disputes and resolution.

07

Mention compliance with relevant laws and regulations.

08

Include a contact information section for inquiries.

09

Provide the effective date and any conditions for amendments.

Who needs Debt Collection Terms and Conditions?

01

Businesses that provide credit or lend money.

02

Debt collection agencies and firms.

03

Freelancers and service providers offering payment plans.

04

Legal professionals advising on credit and collections.

05

Any organization managing accounts receivable.

Fill

form

: Try Risk Free

People Also Ask about

Can debt be forgiven after 7 years?

In general, most debt will fall off your credit report after seven years, but some types of debt can stay for up to 10 years or even indefinitely. Certain types of debt or derogatory marks, such as tax liens and paid medical debt collections, will not typically show up on your credit report.

What is the 7 7 7 rule for debt collectors?

Specifically, the rule states that a debt collector cannot: Make more than seven calls within a seven-day period to a consumer regarding a specific debt. Call a consumer within seven days after having a telephone conversation about that debt.

What are the 11 words to stop a debt collector?

If you want to stop debt collectors from calling you, the phrase to use is: "Please cease and desist all communication with me about this debt." This simple phrase, when sent in writing to a debt collector, legally requires the debt collector to stop contacting you except to notify you of specific actions, such as

What are the 11 words to say to a debt collector?

As soon as you use the 11-word phrase “please cease and desist all calls and contact with me immediately” to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.

What are collection terms?

Accounts Receivable — Money that is owed to a person or organization for products or services provided on credit, in advance of payment. Aging Report or Schedule — A list of accounts receivable broken down by number of days until due or number of days past due.

How many times can a debt collector call you in 7 days?

The 7-in-7 rule, established by the Consumer Financial Protection Bureau (CFPB) in 2021, limits how often debt collectors can contact you by phone. Specifically, the rule states that a debt collector cannot: Make more than seven calls within a seven-day period to a consumer regarding a specific debt.

What is the term for collecting debt?

Debt collection or cash collection is the process of pursuing payments of money or other agreed-upon value owed to a creditor. The debtors may be individuals or businesses. An organization that specializes in debt collection is known as a collection agency or debt collector.

What is the 7x7 collection rule?

This rule states that a creditor must not contact the person who owes them money more than seven times within a 7-day period. Also, they must not contact the individual within seven days after engaging in a phone conversation about a particular debt.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Debt Collection Terms and Conditions?

Debt Collection Terms and Conditions refer to the specific rules and guidelines that govern the process of collecting outstanding debts, detailing the rights and responsibilities of both creditors and debtors.

Who is required to file Debt Collection Terms and Conditions?

Businesses and individuals engaged in debt collection practices are typically required to file Debt Collection Terms and Conditions to ensure compliance with relevant laws and regulations.

How to fill out Debt Collection Terms and Conditions?

To fill out Debt Collection Terms and Conditions, one must provide necessary information including the creditor's name, details of the debt, collection procedures, and compliance acknowledgments, ensuring clarity and legality.

What is the purpose of Debt Collection Terms and Conditions?

The purpose of Debt Collection Terms and Conditions is to establish clear guidelines for debt collection activities, protect the rights of both parties involved, and ensure adherence to legal standards.

What information must be reported on Debt Collection Terms and Conditions?

Information that must be reported includes the identity of the debt collector, details about the debt, communication practices, payment terms, and the rights of the debtor under applicable laws.

Fill out your debt collection terms and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Debt Collection Terms And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.