Get the free ST-121.3

Show details

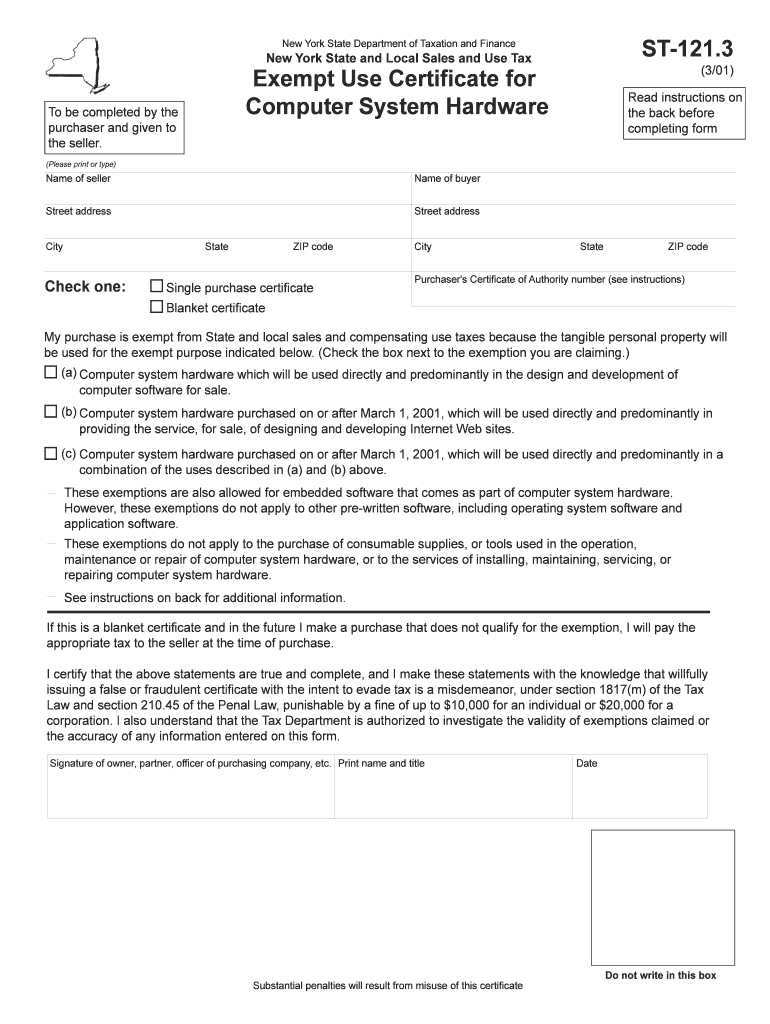

This form is used to certify the exempt status of purchases of computer system hardware from New York State sales and use tax, specifically for purchases that will be used for certain exempt purposes

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign st-1213

Edit your st-1213 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your st-1213 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing st-1213 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit st-1213. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out st-1213

How to fill out ST-121.3

01

Obtain the ST-121.3 form from the appropriate tax authority's website or office.

02

Enter your business name and address in the designated fields.

03

Fill in the date on which the certificate is completed.

04

Provide your seller's permit number or any other identification number as required.

05

Indicate the reason for using the ST-121.3, such as a purchase for resale.

06

List the items or types of products covered under this exemption.

07

Sign the form and date it to certify the information is true.

Who needs ST-121.3?

01

Retailers and wholesalers who make purchases for resale.

02

Businesses that require exemption from sales tax on items intended for resale.

03

Entities participating in transactions that qualify for tax exemptions.

Fill

form

: Try Risk Free

People Also Ask about

How do I avoid sales tax on my car in NY?

If you paid sales tax in the state where you purchased the vehicle, you do not have to pay sales tax in New York State. Complete the Sales Tax Exemption {Sales Tax Form} (PDF) (DTF-803). You must provide military ID or other documentation of military service and attach proof of tax paid to another state.

What is the tax exempt form for rental cars in NY?

Tax Exemption Certificate (AC946) This form can be used to show your tax exempt status for car rentals or anything else, except for hotels. It should be printed and given to the company if needed.

What form is the tax exempt form?

About Form 1023, Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code. Internal Revenue Service.

How do I get a tax exemption certificate?

Generally, to obtain a sales tax exemption certificate, an exempt institution must first have a valid sales tax account. That account number is put on a form certificate issued by that state and the certificate can be used to purchase goods tax-free.

What is the tax exempt form for car rental in NY?

Tax Exemption Certificate (AC946) This form can be used to show your tax exempt status for car rentals or anything else, except for hotels. It should be printed and given to the company if needed.

What is NY St 121?

Manufacturers, certain service providers, and other types of businesses may use Form ST-121, Exempt Use Certificate, to purchase, rent, or lease certain tangible personal property or services exempt from sales tax.

What is a blanket certificate for sales tax exemption?

A blanket certificate is one that can be kept on file for multiple transactions between a specific Buyer and specific Seller. Who determines whether this resale certificate will be accepted? The Seller will determine whether it will accept the certificate from the Buyer.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ST-121.3?

ST-121.3 is a sales tax exemption certificate used in New York State, allowing exempt organizations to purchase goods and services without paying sales tax.

Who is required to file ST-121.3?

Organizations that are exempt from sales tax, including certain nonprofit organizations, government entities, and other specified exempt groups, are required to file ST-121.3.

How to fill out ST-121.3?

To fill out ST-121.3, the organization must provide its name, address, the reason for the exemption, and a signature from an authorized representative, ensuring all required fields are accurately completed.

What is the purpose of ST-121.3?

The purpose of ST-121.3 is to allow qualifying organizations to obtain goods and services free from sales tax, thereby supporting their exempt status and reducing operational costs.

What information must be reported on ST-121.3?

The information that must be reported on ST-121.3 includes the organization's name, address, exempt status type, and the signature of an authorized representative indicating the validity of the claim.

Fill out your st-1213 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

St-1213 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.