Get the free PERSONAL AUTO POLICY

Show details

This document outlines the terms and conditions of a personal auto insurance policy, detailing coverage options, exclusions, and duties of both the insurer and the insured.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign personal auto policy

Edit your personal auto policy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personal auto policy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing personal auto policy online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit personal auto policy. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

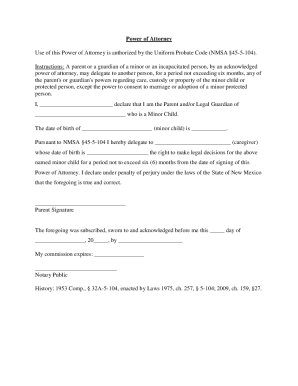

How to fill out personal auto policy

How to fill out PERSONAL AUTO POLICY

01

Gather necessary information: Collect your personal details, including your name, address, date of birth, and driver's license number.

02

Vehicle information: Provide details about the vehicle being insured, including make, model, year, VIN (Vehicle Identification Number), and current mileage.

03

Coverage selection: Choose the types of coverage you want, such as liability, collision, comprehensive, and personal injury protection.

04

Determine coverage limits: Decide on the limits for liability coverage and any optional coverages based on your needs.

05

Discounts: Inquire about and apply any available discounts (e.g., multi-policy, safe driver, good student).

06

Fill out the application: Complete the insurance application form provided by the insurer, ensuring all information is accurate.

07

Review your policy: Carefully read through the policy terms and conditions before signing to understand your rights and responsibilities.

08

Make the payment: Pay the premium to activate your policy.

Who needs PERSONAL AUTO POLICY?

01

Anyone who owns or leases a vehicle and drives it regularly needs a personal auto policy to protect against financial loss in case of accidents, theft, or damages.

02

New drivers who have recently obtained their driver's license and require insurance for their vehicles.

03

Individuals who use their vehicles for personal purposes rather than commercial activities.

Fill

form

: Try Risk Free

People Also Ask about

Who is the insured in a personal auto policy?

"Insured" as used in this Part means: 1. You or any "family member". 2. Any other person "occupying" "your covered auto".

What is a personal auto policy?

The numbers in the coverage refer to the maximum amount your insurer will pay out for each type of claim. So, in a 100/300/100 policy, you would have $100,000 coverage per person, $300,000 in bodily injury coverage per accident, and $100,000 in property damage coverage per accident.

What is not covered under a personal auto policy?

Your personal auto policy only covers personal driving, whether you're commuting to work, running errands or taking a trip. Your personal auto policy, however, will not provide coverage if you use your car for commercial purposes — for instance, if you deliver pizzas or operate a delivery service.

What is a personal automobile policy?

A personal auto policy is insurance on your personal vehicle. It may include liability, medical payment coverage, comprehensive, or collision coverage, depending on your policy. By Hearst Autos Research. FG TradeGetty Images. A personal auto policy is insurance on your personal vehicle.

What is the ABCD of the personal auto policy?

Unlike the personal auto policy (PAP), the SPAP does not provide the following: a 90-day extension of coverage for a nonresident spouse, liability coverage for a nonowned golf cart, rental coverage after theft of the covered auto, and the $1,000 of coverage contained in the PAP for aftermarket electronic equipment.

What does $100 k /$ 300k /$ 100k mean?

Part A — Liability coverage. Part B — Medical payments coverage. Part C — Uninsured motorists coverage. Part D — Coverage for damage to your auto.

What is personal vehicle insurance?

What is personal auto insurance? Personal auto insurance only covers accidents that occur while you're driving your vehicle for personal use. That includes commuting to and from work and travel unrelated to your job duties. Policies typically insure the owner of the vehicle and one or two immediate family members.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is PERSONAL AUTO POLICY?

A Personal Auto Policy (PAP) is a type of insurance policy that provides coverage for personal vehicles, protecting the policyholder against various risks such as accidents, theft, or damage.

Who is required to file PERSONAL AUTO POLICY?

Individuals who own personal vehicles and wish to protect against potential damages, liabilities, or losses related to their vehicle are required to file a Personal Auto Policy.

How to fill out PERSONAL AUTO POLICY?

To fill out a Personal Auto Policy, the policyholder must provide personal information, details about the vehicle, coverage selections, and any additional drivers or use cases.

What is the purpose of PERSONAL AUTO POLICY?

The purpose of a Personal Auto Policy is to provide financial protection against physical damage and bodily injury resulting from auto accidents, as well as coverage for theft and damage to the vehicle.

What information must be reported on PERSONAL AUTO POLICY?

Information that must be reported includes the insured's personal details, vehicle information (make, model, year, VIN), driving records, coverage limits, and any additional insured parties.

Fill out your personal auto policy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Personal Auto Policy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.